Janus Henderson: UK MPC on course for risky rate hike

UK labour market statistics confirm stronger wage cost pressures and suggest that the MPC will press ahead with another interest rate increase next month. The view here remains that the Committee should hold fire because of worryingly weak monetary trends.

24.04.2018 | 12:59 Uhr

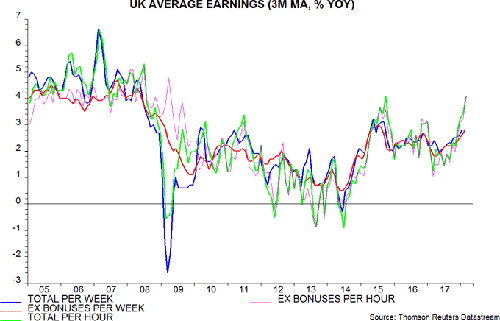

Annual growth of average weekly earnings, smoothed over three months, was unchanged at 2.8% in February and below a consensus forecast of 3.0%. The undershoot, however, reflected lower growth of bonus payments – the ex. bonuses measure moved up to 2.8%, the highest since 2015.

Annual growth of average weekly earnings, smoothed over three months, was unchanged at 2.8% in February and below a consensus forecast of 3.0%. The undershoot, however, reflected lower growth of bonus payments – the ex. bonuses measure moved up to 2.8%, the highest since 2015.

Hourly pay, moreover, is rising considerably faster because of a fall in average weekly hours worked over the last year. Hourly earnings growth, including or excluding bonuses, is estimated to have increased further to 4.0% in February, with the ex. bonuses measure the highest since 2009 – see first chart.

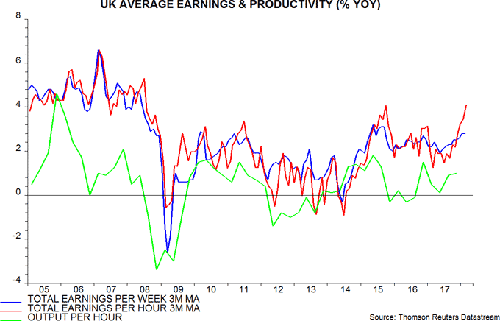

The recent acceleration of hourly earnings has outpaced a modest improvement in growth of productivity (i.e. output per hour), implying stronger unit wage cost expansion – second chart. Annual productivity growth rose to 1.0% in the fourth quarter of 2017 and may have increased slightly further in the first quarter, reflecting the dropping-out of a quarterly decline a year earlier. With hourly earnings growth at 4.0%, however, annual unit wage cost expansion may have moved up towards 3% last quarter, after 2.4% in the fourth quarter.

MPC concern about labour market overheating will be heightened by a further fall in the unemployment rate to 4.2% in the three months to February and 4.0% in February alone – below a forecast of 4.3% for the first quarter in the February Inflation Report.

Increased labour cost pressures support the view here that consumer price inflation will be slower to return to the 2% target than the MPC projected. As previously discussed, however, these pressures reflect past monetary and economic strength – current weak monetary trends suggest diminishing medium-term inflation risks, with narrow and broad money growing at annualised rates of only 1.6% and 1.1% respectively in the three months to February. A May rate hike would risk exacerbating this weakness.

Diesen Beitrag teilen: