Janus Henderson: The sell-off culprit - real rates

Global Head of Asset Allocation, Dr Ash Alankar, explains why real rates are behind recent bond and stock market volatility.

23.10.2018 | 09:47 Uhr

The early-month sell-off in global bonds spread to equity markets this week. While speculation has identified potential culprits ranging from trade concerns to rich valuations, our eye is squarely on real interest rates. We have long emphasised the important role that real rates would play during the Fed’s normalisation programme as they are what ultimately determine investment decisions across the economy. While this week’s equity move caught investors’ attention, we believe the epicenter of the market’s current rebalancing remains the bond market.

All about real rates

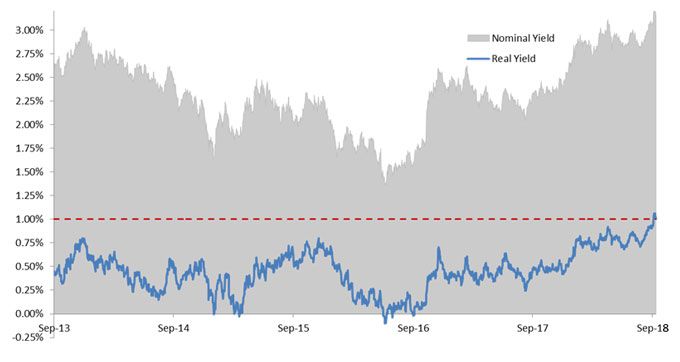

Using our proprietary options market-based model, we believe that calmer heads are prevailing as we see non-US equities showing average to above-average levels of expected upside versus downside. This suggests to us that what we are dealing with today is more of a US-centric event. Why? Because US 10-year real rates are moving up toward ‘tight’ levels – rising 30 basis points (bp) in just over a month to 1.04% today. While higher, we wouldn’t consider that real rates are approaching dangerous levels until they exceeded real GDP expectations in possibly the 1.5% to 2.0% range. Such a scenario would pose a headwind to both risky and real assets, with many already becoming more expensive. This possibility differs considerably from conditions in Japan and Europe, where real rates still sit at very accommodative – and in some instances, negative – levels.

The good news is that options prices do not suggest an imminent inflationary shock. Such an event would be a catalyst that could cause the Fed to tighten more aggressively, withdrawing substantial liquidity from the economy. That could cause real rates to move higher faster, which would transform a Category 1 ‘headwind’ to a Category 4 ‘storm’.

Chart 1: Real yield on 10-year US Treasury note

Recent rise in nominal Treasury yields driven by real yields as investors gain confidence in US economic growth.

Recent rise in nominal Treasury yields driven by real yields as investors gain confidence in US economic growth.

Source: Bloomberg, 2018

The end of easy money

For these reasons, while this week’s equity volatility has grabbed headlines, we believe that the bond market’s recent moves are likely to have more meaningful long-term consequences. In a simple world, if real rates are below real GDP, monetary conditions can be considered accommodative, and money becomes ‘cheap’. We can assume normalised real US GDP to currently be in a range between 1.5% to 2.0%. In contrast, for roughly the past decade, real rates have been well below 1.5% and have even fallen to negative levels. This, of course, was the result of the Fed’s highly accommodative monetary policy. Now, however, real rates – at 1.0% – are finally approaching normalised real GDP and its impact will be meaningful as risk premiums will have to reprice in the new era of non-cheap money. The consequences of rates held well below normalised GDP over the last 10 years were easy to see as the value of risky assets soared. The reverse will likely be true as real rates move toward more normal levels.

Rising for the right reasons

We believe that real rates are one of the most important determinants of future economic growth, as an increase would reset the cost of capital across the entire economy. Longer-duration assets, such as growth stocks, are likely to be most negatively impacted by higher real rates, as would real assets such as real estate and gold. Indeed, the numbers have borne this out, with growth stocks far underperforming value since the end of September.

While choppy markets merit vigilance, we believe the forces behind this week’s volatility may herald some good news. Driving the uptick in real rates is the market gaining faith in the sustainability of US economic strength. The current convergence of real yields toward higher real GDP growth rates indicate that bond market expectations are finally catching up with what the economy has been delivering for several quarters. But it also means that the easy money conditions that borrowers became used to might be a thing of the past.

Ahead of the curve?

With real yields leading the charge, another ingredient of bond prices – inflation – noticeably isn’t. Recent wage gains may have spooked investors into believing that a breakout in inflation was on the horizon, but our options model shows no such risk. Historically, the Fed has been criticised for being consistently behind the curve when managing inflation. We believe this time is different. Ever since the Fed started to back away from the highly accommodative policy followed during former Chairwoman Yellen’s tenure, we have believed that the central bank might actually be ahead of the game. After all, when the Fed initially increased rates in December 2015, core inflation, as measured by the Fed’s favored gauge, was a paltry 1.3%.

Due to this proactive ‘tightening’ campaign, inflation risk at present appears contained. This gives the Fed the very valuable luxury of increasing rates in a disciplined and calm fashion. Such a measured pace provides the economy – and allocators of capital more specifically – sufficient time to adjust to higher real rates. As we have long stated, it is not the destination of interest rates but the pace at which they travel that is most important.

Signals from options markets

Yes, we interpret higher real rates as the result of investors expressing a more sanguine view on the US economy, but our options-market signals have identified further factors that bear monitoring. Unlike February’s short-lived volatility, options investors expect that this turbulence may be longer lasting. This, too, is not necessarily alarming; as higher real rates impact the cost of capital across the economy, economic outcomes should become more dispersed. We see this as forming part of the policy normalisation process.

Expectations of more normalised economic and market conditions – accompanied by more volatility brought on partly by higher costs of capital – can be seen in options signalling potential weakness in small-cap stocks, strength in the ‘safe-haven’ Japanese yen and upside to volatility indices that infer elevated equity risk. In aggregate, however, there is no pronounced downside evident in options price signals. Indeed, some areas – among them emerging markets – show greater potential upside than downside. Normalisation, painful or not, is ultimately good for the mechanisms underpinning the economy. Fortunately, we do not foresee any level of pain commensurate with a recession, and for this we give credit to the proactive stance taken by the Fed. Unfortunately, however, our same models see risk resetting at higher levels across many asset classes.

Note: Our Adaptive Multi-Asset Solutions Team arrives at its outlook using options market prices to infer expected tail gains (ETG) and expected tail losses (ETL) for each asset class. The ratio of these two (ETG/ETL) provides signals about the risk-adjusted attractiveness of each asset class.

Diesen Beitrag teilen: