UBS: Bearing the market

When the Fed raised rates in December, who would have expected equity markets to enter virtual freefall? After all, the hike was no surprise. So, are there other forces behind the equity bear market that has prevailed since last summer? Might it be that the increase in real rates since the Fed tapering, combined with fears about global growth and the plummeting oil price have been the real drivers of financial markets?

16.02.2016 | 10:48 Uhr

Never has monetary policy looked so powerful. One month the Federal Reserve hikes rates by just 25 basis points in order to tighten financial conditions slightly, and the next month equity markets are in freefall. The MSCI world index has fallen by almost 11% year-to-date. Monetary policy is meant to take a lot longer to have much impact, and never to have that much impact. Especially when it has been so well signalled in advance. The Fed must feel as if it lit a small firecracker but got an explosion like a bomb.

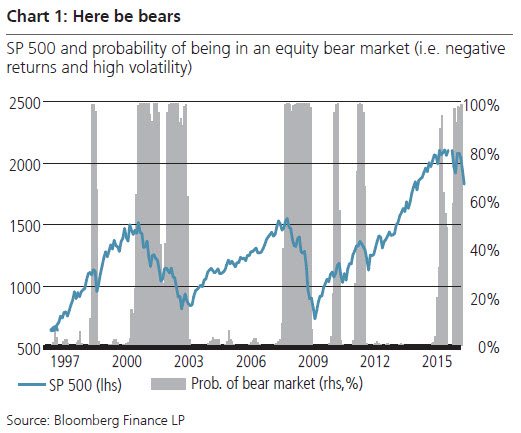

But is this really the result of Fed tightening? Periodically the equity market gets into a self-perpetuating negative mood, returning nothing or looking for excuses to break lower. The equity market actually entered such a bear market last summer and has pretty much been in one ever since (chart 1). The imminent start of the rate hiking cycle may have contributed, but a combination of weakness in China and other emerging markets, plus the sharp fall in oil prices with an inventory correction in the US were probably more important.

In this environment of fear, the market was looking for some reassurance from Fed Chair Janet Yellen during her semi-annual testimony to Congress. While she did sound some dovish notes, it is always a good idea to apply the counterfactual test. What else could she have said? For example, if she had not mentioned the market turmoil the market would have interpreted this as extremely hawkish, signalling that the Fed did not care about the messages from the market. What she did say was the bare minimum, effectively saying that as long as things did not worsen the Fed would continue hiking this year.

Diesen Beitrag teilen: