UBS: SNB to stay on hold, growth still moderate

Following fairly disappointing average quarterly growth rates of 0.1% in H2 2016, Swiss growth has gained some momentum in early 2017. Swiss real GDP rose to 0.3% q/q in Q1 after 0.2% in Q4, but Swiss sentiment indicators and also solid Eurozone growth had signalled a stronger outcome.

02.06.2017 | 12:28 Uhr

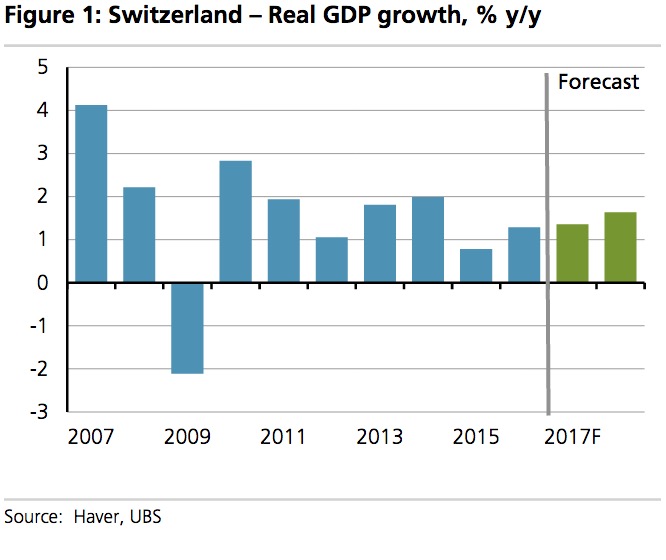

Weakness was driven by slowing private consumption growth and a large negative contribution from stocks, which offset a marked rise in exports. Going forward, we project a further increase in growth given the continued strength in business confidence and spillovers from very solid growth in the Eurozone. For 2017 as a whole we project growth of 1.4% y/y, in line with the Swiss National Bank's expectation of growth of "around 1.5%", but with some downside risks after the weaker than expected Q1 outcome.

2018 GDP growth to rise above the Eurozone for the first time since 2014

We continue to expect growth to rise to 1.6% in 2018, which would be the first time since 2014 that growth outperforms the Eurozone (which we expect to grow by 1.4%). Switzerland used to outgrow the Eurozone in every year in the decade prior to 2014, but then suffered a setback following the steep franc appreciation in early 2015. In part, the prior outperformance (and our expectation of stronger growth ahead) is because potential growth in Switzerland is projected to be 1.6% - higher than in the Eurozone (where we believe potential growth is only slightly above 1%).

FX interventions have declined; Swiss franc to depreciate further

The latest Sight Deposits data from the SNB indicate limited FX intervention since the second round of the French elections. In the past limited FX intervention has coincided with CHF weakness; we expect this trend to extend. Following the reduction in Eurozone political risk, "safe-haven" flows (a key factor behind CHF strength) are likely to gradually reverse. In addition, the CHF remains overvalued and we expect the ECB to start normalising policy soon. We expect further CHF weakness and have recently adjusted our EUR/CHF year-end target higher to 1.13 (from 1.11 previously).

SNB expected to be patient and follow ECB – first rate hike in spring of 2018

Low inflation, an overvalued currency and growth gaining speed only moderately should lead the Swiss National Bank to remain on hold, in our view, at its next meeting on 15 June. The central bank still keeps policy interest rates at -0.75% (charged on sight deposits that exceed an exemption threshold of 20 times required minimum reserves). All eyes are now on the ECB and the timing of its start to scale back its stimulus as this is expected to take appreciation pressure off the franc, thereby contributing to a recovery in inflation (we project Swiss inflation to rise to 0.9% in 2018 from 0.3% currently).

ECB meetings will be watched with keen interest in Zurich

The 8 June ECB meeting will be watched with keen interest in Zurich for any hints that the ECB is preparing markets for an exit from QE. We expect a tapering decision by the ECB in September and the first rate hike only thereafter (see ECB: What to expect next week). Under this scenario, we envisage the SNB to hike interest rates by 25bp in Q2 2018. This would still leave Swiss policy rates below the ECB's deposit rate of -0.4% and we would expect a second step by the SNB at around the time when the ECB starts to hike its deposit rate – possibly only in early 2019. Should the ECB start to increase interest rates earlier than we assume, this would open up further degrees of freedom for the SNB to raise its policy rate as well. Meanwhile, the SNB has made it clear that they are far from considering any measures to shrink the balance sheet.

Diesen Beitrag teilen: