Janus Henderson: Global leading indicator confirming monetary warning signal

Incoming evidence is consistent with the view here that the global economy will slow significantly later in 2018, so Simon Ward, Chief Economist at Janus Henderson.

09.02.2018 | 10:06 Uhr

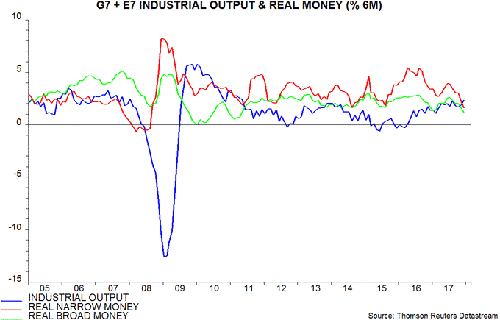

As suggested by earlier partial data, six-month growth of real narrow money in the G7 and seven large emerging economies fell to its lowest level since 2009 in December. Real broad money growth also weakened further. The most recent peak in real money growth occurred in June / July 2017, suggesting a decline in six-month industrial output growth starting around March / April 2018, allowing for the average nine-month historical lead – see first chart.

As suggested by earlier partial data, six-month growth of real narrow money in the G7 and seven large emerging economies fell to its lowest level since 2009 in December. Real broad money growth also weakened further. The most recent peak in real money growth occurred in June / July 2017, suggesting a decline in six-month industrial output growth starting around March / April 2018, allowing for the average nine-month historical lead – see first chart.

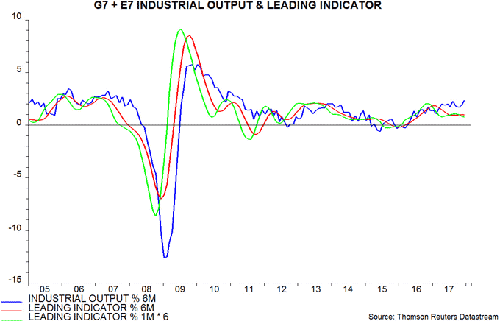

A peak in economic momentum around the end of the first quarter is now also being signalled by a shorter-term G7 plus E7 leading indicator based on the OECD’s country composite leading indicators (which do not generally include money measures). This indicator usually leads by between three and five months and its six-month growth edged down in December. One-month growth has fallen for three consecutive months – second chart.

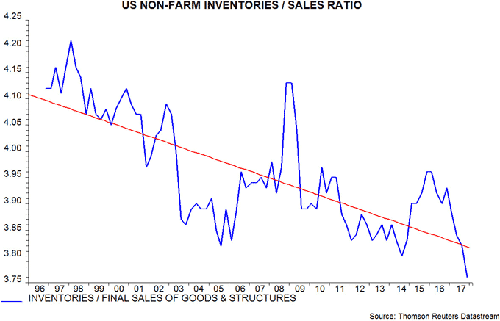

The assessment here is that economic strength in early 2018 partly reflects the final stage of the upswing in the US / global stockbuilding cycle, which is judged to have bottomed in early 2016 and usually tops out after about two years. The US ratio of inventories to final sales of goods and buildings continued to fall sharply in the fourth quarter of 2017, with demand boosted by recovery spending in hurricane-affected areas – third chart. This suggests a high level of stockbuilding in early 2018 as firms seek to restore the ratio to a normal level. The level of GDP growth depends on the change in stockbuilding, so a moderation of the latter later in 2018 would imply a drag on economic momentum.

Consistent with this interpretation, the ISM manufacturing inventories index rose sharply in January, while the Atlanta Fed’s GDPNow model currently projects that an increase in stockbuilding will boost first-quarter GDP growth by 1.25% at an annualised rate.

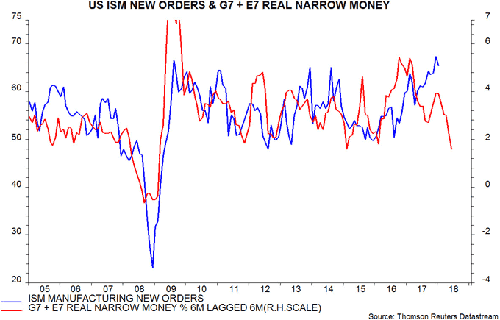

If the scenario of a second-quarter slowdown is correct, global business surveys should be at or near a peak. The US ISM manufacturing new orders index fell slightly in January, as did new orders components of manufacturing PMI surveys in China (NBS and Markit) and Euroland / the UK (Markit). The lagged relationship with global real narrow money growth suggests a significant decline in the ISM measure by mid-2018 – fourth chart.

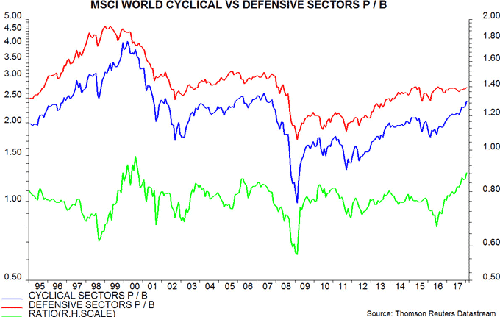

Slowing economic momentum would be expected to be associated with a reversal of recent outperformance of cyclical equity market sectors, defined by MSCI to include materials, industrials, consumer discretionary, financials and IT. Cyclical sectors are historically expensive relative to defensive sectors, defined as energy, consumer staples, health care, telecommunications and utilities: the ratio of the price to book of the MSCI World cyclical sectors index to that of the defensive sectors index is at its highest level since 2000 – fifth chart.

Diesen Beitrag teilen: