Henderson: Chinese money trends signalling ongoing reflation

Chinese monetary growth remained strong in September, supporting expectations that the economy will continue to reflate despite administrative attempts to cool an overheating housing market.

19.10.2016 | 14:01 Uhr

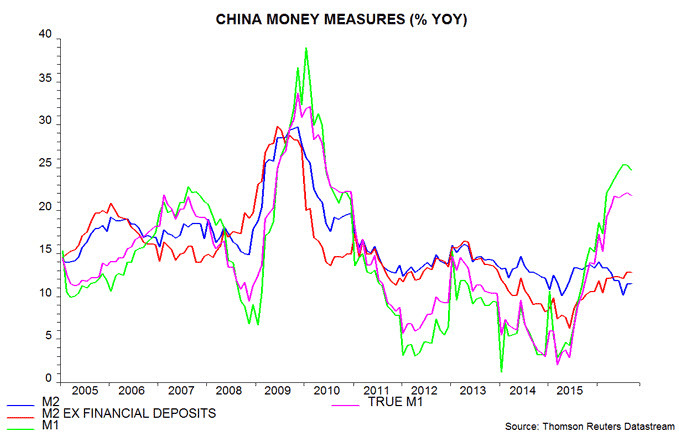

The preferred broad money aggregate here is M2 excluding financial deposits – the latter have fluctuated widely in recent years but have little connection to money spending. Annual growth of this measure was stable at 12.8% in September, more than double a low of 6.3% in June 2015 and the fastest since 2013 – see chart.

Total M2 growth was lower at 11.5%, reflecting a fall in financial deposits over the past 12 months. M2 ex financial deposits has been a superior economic gauge in recent years, signalling the 2014-15 downturn as well as this year’s recovery. M2 was misleadingly strong in 2014-15 as financial deposits surged.

Annual M1 growth, meanwhile, remained buoyant at 24.7% in September versus 25.3% in August. As previously discussed, the Chinese M1 definition omits household demand deposits, which are added back here to create “true” M1. Such deposits grew by an annual 16.0% in September, while demand deposits of non-financial enterprises and government organisations rose 28.3%. Annual true M1 growth was 21.7% in September versus 22.1% in August.

Die Wertentwicklung in der Vergangenheit ist kein zuverlässiger Indikator für die künftige Wertentwicklung. Alle Performance-Angaben beinhalten Erträge und Kapitalgewinne bzw. -verluste, aber keine wiederkehrenden Gebühren oder sonstigen Ausgaben des Fond.

Die Informationen in diesem Artikel stellen keine Anlageberatung dar.

Diesen Beitrag teilen: