NN IP: EM domestic demand growth recovery continues

Better emerging market domestic demand growth prospects explain most of the outperformance of EM equities. The global IT sector poses the main short-term risk.

11.04.2018 | 14:17 Uhr

The trend of emerging market (EM) equity outperformance, which started in January 2016, is still intact. Year-to-date, EM equities have returned one percentage point more than developed market (DM) equities, despite the sharp rise in Fed rate expectations since last September, despite the more concrete risk of an escalating global trade conflict, despite the recent weakening of global cyclical indicators, despite the pressure on global IT stocks and despite the resulting underperformance of China, the largest EM equity market.

All these negative factors have been neutralised by the positive growth dynamics in EM domestic demand outside of China, and by the still easy financial conditions in EM that bode well for the sustainability of the EM domestic demand growth recovery for the coming quarters and years. In other words, while the evidence of the pick-up in consumption and investment growth in most countries outside of China is mounting, we are seeing strong-enough capital flows to EM for credit growth to be sustained. The credit growth recovery, which began about a year ago, has strengthened in recent months. As a result, EM ex-China credit growth is back in double-digit territory, for the first time in three years. This has clearly helped consumption and fixed-investment growth to gain traction and has helped to produce a pick-up in EM earnings growth expectations in recent months (see graph).

With concerns about the prospects for global trade growth increasing due to weaker global cyclical indicators and the protectionist agenda of the Trump administration, it has become even more important than before that EM domestic demand growth strengthens. Already for several months, we have been seeing domestic demand related indicators strengthening while global trade related indicators weakened. Also, in the last round of PMIs, the sharpest declines were experienced by the export economies in Asia, while the more closed economies in EMEA and Latin America showed improvements. This is the environment we are currently in. As long as the more forward-looking indicators for domestic demand growth keep strengthening, this environment should remain consistent with improving EM earnings growth and an EM-DM outperformance trend.

Key to this is the outlook for EM credit growth. We remain confident that the credit recovery is sustainable, despite the gradual exit from super-loose DM monetary policy and the likely intensifying pressure on the EM-DM carry trade. The main reasons are the benign EM inflation outlook, the narrowed EM external and fiscal imbalances and the weakening US dollar trend. These factors are sustaining capital flows to the emerging world and thereby help EM central banks to keep their easy monetary policy stance. In the past weeks, Russia, Brazil and South Africa cut their policy rate. As long as more EM central banks cut rates than hike rates, we are not too worried about the prospects for EM credit growth.

Main short-term risk comes from the global IT sector

For now, the main risk to EM growth and EM equity market performance lies in the outlook for global trade and more specifically in what happens in global IT. Financial markets have been affected by Trump’s protectionist measures and China’s reaction. Remarkably, emerging equity markets have not been hit hard, or at least not harder than developed markets. We continue to believe that the US and China will eventually aim for a deal that should not affect mutual trade too much. Meanwhile, however, protectionist noise is likely to weigh on markets. In the end, we believe that Mexico will be hurt more than the Asian countries.

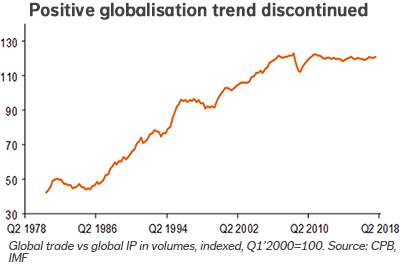

To put the theme of protectionism a bit in perspective, we like to look at the graph above. Since the Global Financial Crisis, the share of international trade in the global economy has moved sideways – after more than twenty years of increasing globalisation. It is not strange that the developing trade conflict between the US and China has made investors nervous in recent months. At the same time, one could question why markets have not been more worried in the past years about the secular trend of global trade.

For now, EM equity markets are more sensitive to the correction in global IT than to the less concrete worries about protectionism. The Chinese market has been a clear underperformer recently for this reason. So far, it has not broken the EM outperformance trend, thanks to the favourable growth dynamics elsewhere. But where IT was a key positive driver for EM last year, it has turned into the main drag this year.

Diesen Beitrag teilen: