Janus Henderson: Is the global economy facing "slowflation"?

Some expressed concern that a global economic slowdown during 2018 would be accompanied by a rise in inflationary pressures, constraining central banks’ ability to provide policy support for weakening markets. Recent inflation news provides some support for this view.

02.05.2018 | 11:02 Uhr

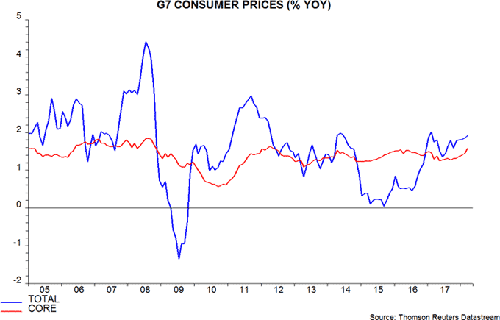

G7 headline and core (i.e. ex. food and energy) consumer price inflation rose in March, with the core rate reaching the top of its post-GFC range, matching highs in 2012 and 2016 – see first chart.

G7 headline and core (i.e. ex. food and energy) consumer price inflation rose in March, with the core rate reaching the top of its post-GFC range, matching highs in 2012 and 2016 – see first chart.

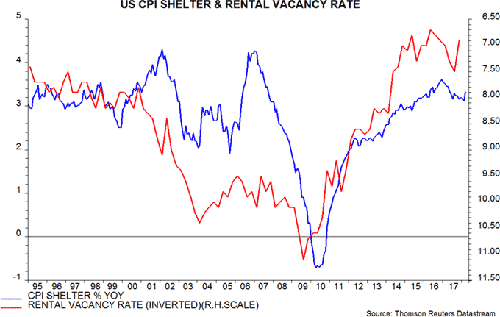

The recent core rise has been driven by the US and Japan. The US increase partly reflects the dropping-out of last year’s large cut in mobile data charges. In addition, shelter inflation, which was also a drag in 2017, recovered to a seven-month high in March – shelter has a 41% weight in the core basket and is dominated by actual and imputed rents.

Upward pressure on rents is suggested by the low level of the rental vacancy rate, which fell in the fourth quarter of 2017, with a first-quarter figure to be released tomorrow – second chart.

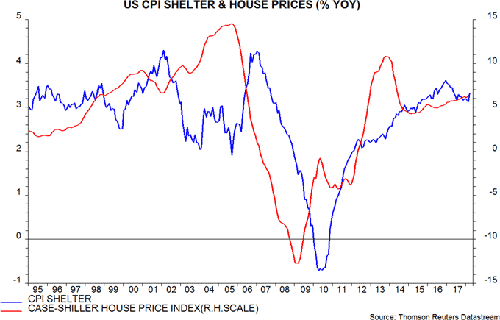

Shelter inflation has also displayed a lagged relationship historically with house price inflation, which has continued to pick up – third chart.

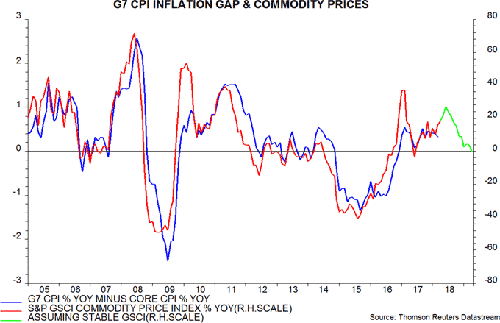

Our start-of-year commentary suggested that Chinese monetary policy would be eased during the first half of 2018, a development that “could give a further short-term boost to commodity prices, which would add to global inflation concerns”. Evidence continues to build of a policy reversal, with newswires yesterday reporting that an “informed source” expects a further cut in banks’ reserve requirement ratios, following last week’s surprise reduction.

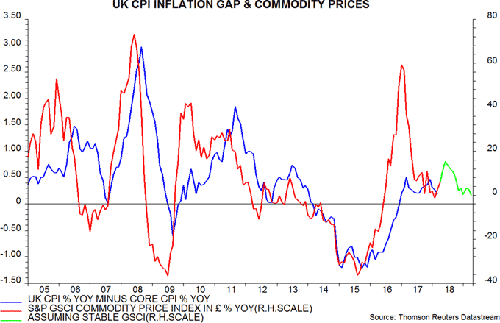

The fourth chart below shows the gap between G7 headline and core inflation along with the annual rate of change of the S&P GSCI commodity price index, with this rate of change projected forward assuming that the GSCI is stable at its current level. The relationship implies a widening of the gap near term, in turn suggesting that headline inflation will move above its February 2017 high, assuming stable core inflation.

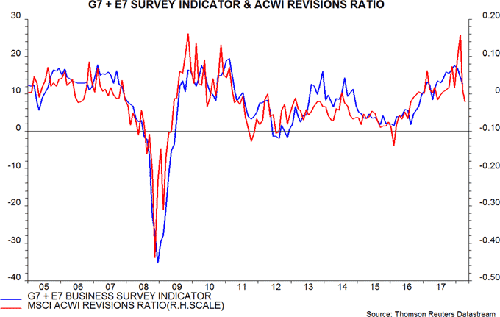

Business surveys and equity analysts’ earnings revisions are consistent with a peak in economic growth – fifth chart – but consumer confidence measures remain elevated, giving rise to hopes that a slowdown will be modest and temporary. Higher inflation could contribute to a decline in consumer optimism.

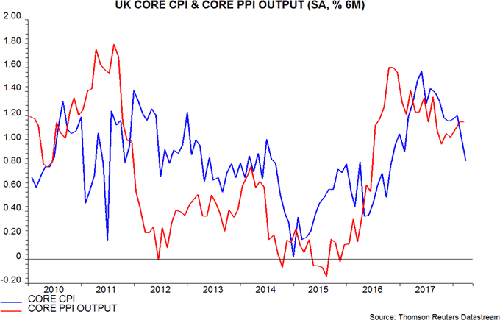

UK inflation numbers have surprised on the downside in the last two releases but, as elsewhere, recent commodity price strength may lift the headline rate near term – sixth chart. As previously discussed, annual unit wage cost growth may have moved up to about 2.75% in the first quarter, while producer output price trends suggest a near-term reacceleration of core consumer prices – seventh chart.

Diesen Beitrag teilen: