Janus Henderson: Are global money trends stabilising?

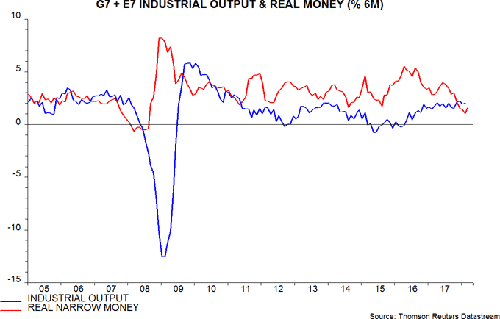

A further fall in global real narrow money expansion in early 2018 suggests that a recent slowdown in economic activity will be sustained until late in the year.

24.04.2018 | 10:40 Uhr

A further fall in global real narrow money expansion in early 2018 suggests that a recent slowdown in economic activity will be sustained until late in the year, allowing for the typical nine-month lead. Previous posts (e.g. here) discussed reasons for thinking that real narrow money trends would stabilise or recover from the first quarter, a development that would provide some reassurance about economic prospects for end-2018 / early 2019. Partial monetary data for March are consistent with this scenario.

A further fall in global real narrow money expansion in early 2018 suggests that a recent slowdown in economic activity will be sustained until late in the year, allowing for the typical nine-month lead. Previous posts (e.g. here) discussed reasons for thinking that real narrow money trends would stabilise or recover from the first quarter, a development that would provide some reassurance about economic prospects for end-2018 / early 2019. Partial monetary data for March are consistent with this scenario.

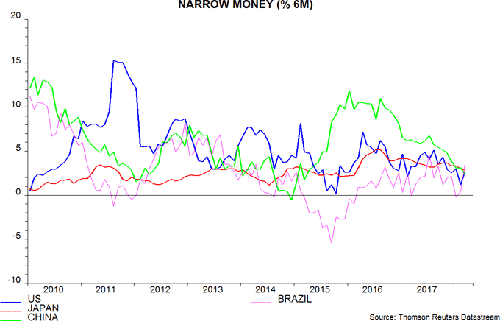

March monetary figures are available for the US, China, Japan and Brazil, together accounting for 60% of the G7 plus E7 aggregate tracked here. Assuming unchanged nominal money growth in the other economies, and taking into account March inflation data / forecasts, G7 plus E7 six-month real narrow money expansion is estimated to have returned to its December level, following February’s nine-year low. This would, however, still leave it below its range between September 2008 and November 2017 – see first chart.

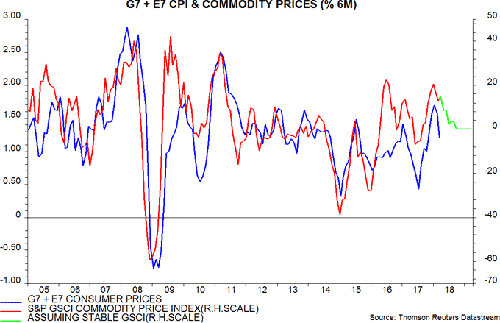

The estimated March recovery reflects two factors: a rebound in US six-month nominal narrow money growth and a fall in the six-month rate of change of global consumer prices (seasonally adjusted).

As previously discussed, a rise in US narrow money growth into the third quarter of 2018 would fit the pattern after three previous large tax cuts. The Fed, as now, was raising interest rates as these tax cuts were enacted; the additional tightening implied by current and planned balance sheet contraction, however, could undermine the comparison. The weekly narrow money data fell back during March and will need to rebound in April to maintain alignment with the historical pattern.

Brazilian six-month narrow money growth also strengthened in March but Chinese and Japanese data were weak – second chart.

A fall in six-month global consumer price inflation had been suggested by recent commodity price trends – third chart. The March decline, however, was larger than expected – a further fall seems unlikely and a rebound is possible, unless commodity prices weaken significantly from current levels.

The estimated March recovery in global real narrow money expansion, therefore, is tentative and requires confirmation from April / May readings before concluding that nine-month-ahead economic prospects are improving. Such confirmation, of course, would not alter the forecast of a further economic slowdown through late 2018.

A firm March reading will be available in early May and will depend importantly on Euroland monetary data to be released on 30 April.

Diesen Beitrag teilen: