NN IP: US mid-terms will likely have little impact on markets

The US mid-term elections delivered the expected result and therefore shouldn’t have much impact on markets; we neutralize government bonds and commodities.

09.11.2018 | 12:20 Uhr

Today we were reminded that ‘fortunately’ not all elections have to end in a surprise. The US mid-terms yesterday delivered the result that was widely anticipated: the Democrats took back the House while the Republicans increased their majority in the Senate. The outcome brought something positive for both sides. The Democrats won the popular vote by more than 3 million votes and managed to bring home the majority in the House of Representatives by securing some nice wins, including in districts that had voted for Trump in 2016. On the other hand, there was no sign of a blue wave as the Democrats lost the highly contested Senate races in Texas and Georgia and Trump won important governor races in swing states like Ohio and Florida. This will be a big help for him in the 2020 presidential race.

The outcome of the elections should not be a surprise for investors and should therefore not have a big impact on markets. Treasury yields could fall back a bit as a Democratic-dominated House will be less likely to approve additional tax cuts and further increases in the deficit, against a background of significant underweight positions among US fixed income investors. Ahead of the mid-terms we had adjusted our stance to a fully neutral positioning by upgrading treasuries from a small underweight and downgrading commodities from a small overweight. Recent changes to our scorecards in both the fundamental and market dynamics components no longer justify the previous positions. And, as we could not identify a clear bias in investor sentiment ahead of the elections, we deemed it appropriate to stay neutral and not anticipate any outcome.

Last week was good for risky assets, particularly equities. US equity markets recovered by roughly 3%. European markets performed slightly less well, up 2%, and Asian markets did best with a more than 4% return over the last five trading days for the Hang Seng. Government bond yields moved slightly higher while spread levels came down a bit. All in all a pretty nice rebound from the equity sell-off in October. The question is whether this rebound is the start of a continuing year-end rally or more a short-term bounce after a period of very negative market sentiment. Our quantitative inputs suggest that significant uncertainty continues to surround financial markets in the near term. Signals for all risky assets point to underweights. This negative dynamic in our toolkit must be balanced with the overall constructive level of economic indicators and a constructive qualitative economic outlook. Now that the mid-term elections are over, we will reassess our current neutral top-down allocation and act accordingly.

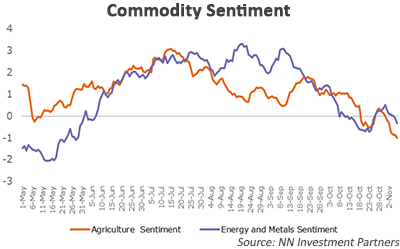

Our downgrade of commodities is primarily driven by behavioural factors, momentum and sentiment in particular. Fundamental drivers are weakening as well and the US waiver for eight countries on Iranian oil imports has been an important factor for a lower oil price.

The weak cyclical picture in our scorecard translates to a better picture for euro government bonds. With yields slightly above the middle of their old trading range, it made sense to neutralize. Additionally, ongoing Italian political uncertainty still has the potential to drive investors into safe government bonds likes Bunds.

Diesen Beitrag teilen: