Robeco: US-Dollar-Aufwertung nicht in Sicht

Die Chancen, dass der US-Dollar nach der FED-Entscheidung aufwertet, stehen schlecht, sagt Jeroen Blokland.

16.03.2016 | 14:12 Uhr

The Federal Reserve is the only major central bank that has shown a real ambition to raise rates. While the spike in volatility and market turmoil at the beginning of this year made the Fed more cautious, its aim remains clear. In the absence of major economic disruptions, rates will go up gradually. During the last couple of weeks markets have (again) started to anticipate higher rates, as they acknowledged that recession fears were (massively) overdone. More on the likelihood of a U.S. recession can be found in this earlier post.

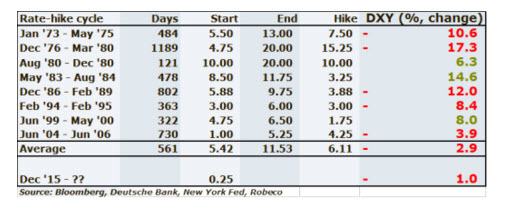

For some investors, the ‘renewed’ belief that the Fed target rate will go up from here is reason to expect that the U.S. Dollar will also start to appreciate again. But a look at history suggests this is not likely to happen. Just take a look at the table below, which shows the changes in the trade weighted U.S. dollar (last column) during rate-hike cycles, from 1972 onwards. As the table reveals, only in three out of the eight hiking-cycles since 1972, did the trade weighted dollar go up. Equally important, on average the U.S. dollar depreciated during those eight hiking cycles. Hence, when betting on a stronger U.S. Dollar, especially if that bet is based on the Fed hiking-cycle, remember that the odds are against you.

Diesen Beitrag teilen: