NN IP: Currencies are giving US earnings an extra boost

Q2 earnings are stronger in the US than in the Eurozone. Currencies are crucial to the relative earnings momentum and are currently a tailwind for US companies.

03.08.2017 | 13:32 Uhr

Earnings update

The past week was busy with respect to corporate earnings announcements. We have now a clearer picture of what these look like and can draw a number of conclusions.

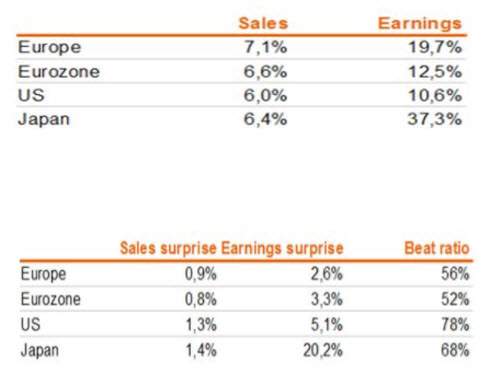

First, absolute sales and earnings growth is positive, especially outside the US. This makes perfect sense as both Japan as Europe are more leveraged towards the global recovery. The rise in operating margins is bigger than in the US, although it is coming from a cyclically depressed level.

Secondly, the US and Japan are strong relative to expectations whereas Europe is only in line. Also the breadth in companies beating estimates is larger in the US (78%) than in the Eurozone (52%).

From a sector point of view, technology was strong both in the US and in the Eurozone. Consumer sectors were on the weak side, especially US retail.

One of the possible explanations of the relatively modest figures for Eurozone companies is the strength of the euro which means that sales realized abroad translate into fewer euros. At the same time, we should not over-emphasize this impact as the domestic economy is growing faster than originally expected. This should buffer the negative impact of the strong euro. In addition, at this stage the currency effect is mainly a translation effect. Only in a second phase it will hurt the relative competitive positions through the transaction effect.

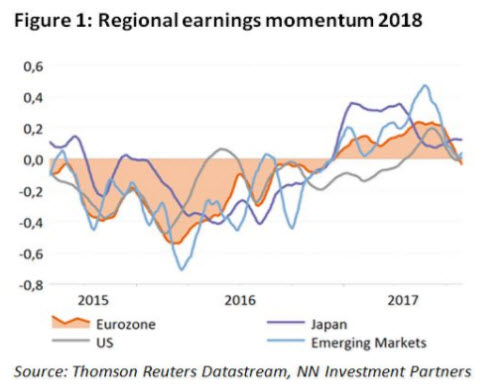

This is already visible in the changes in the regional earnings momentum as illustrated in Figure 1. Eurozone momentum has turned negative and has fallen below US momentum for the first time in a year. Japan remains strong although also here we see the currency risk rising as the USD no longer appreciates against the JPY.

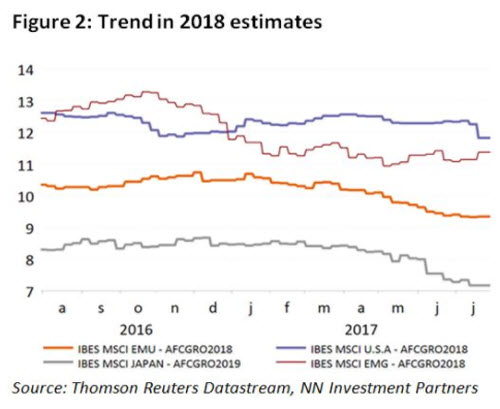

The absolute consensus estimates for next year indicate better growth for US earnings (11.8%) than for Eurozone (9.3%) or Japanese earnings (+7.2% for FY 03/19). The gap has increased over the past months most likely reflecting currency moves. Emerging market earnings are expected to grow 11.4% in 2018.

Looking at earnings momentum for sector groups we notice a convergence between defensive and cyclical sectors. Convergence in this sense means there is a rising trend in defensive sectors versus a declining trend in cyclical sectors. Financials remain positive.

To conclude, the second quarter earnings season is good but does not provide the power to drive market higher as it was the case in the first quarter. It also makes clear that currency movements will become an important variable going forward in the relative earnings performance between regions. Other variables that will play an important role are the trend in the oil price and the level of interest rates/shape of the yield curve. The former is not only crucial for the earnings in the energy sector but it has also an impact on the materials sector through the chemical sector and on the industrial sector through the capital goods sector. The level of interest rates and the shape of the yield curve are important for the profitability of the financial sector as they determines the net interest margin.

Diesen Beitrag teilen: