Morgan Stanley IM: Digital (De)Dollarization?

The U.S. dollar's dominance as the cornerstone of the international financial system is now being reconsidered in the face of evolving geopolitical shifts and the growing U.S. twin deficits.

16.01.2024 | 06:53 Uhr

Notably, the recent growth in interest of digital assets such as Bitcoin, growth of stablecoin volumes and the promise of Central Bank Digital Currencies (CBDCs), have potential to significantly alter the currency landscape. These innovations, while still in their nascent stages, hold opportunities to both erode and reinforce the dollar’s hegemony in global finance. Macro investors should consider how these digital assets, with their unique characteristics and growing adoption, could reshape the future dynamics of the dollar, including their implications for aspects such as global financial stability and monetary policy.

Nation States Target Dollar Diversification

Despite the U.S. contributing approximately 25% to global GDP, the

U.S. dollar currently makes up nearly 60% of global foreign exchange

reserves, a significant lead over its closest competitor, the euro.

However, this dominance is being increasingly scrutinized. Recent U.S.

monetary policies, combined with the strategic use of economic

sanctions, have prompted some nations to consider alternatives to the

greenback.

In parallel, the European Union is actively working to bolster the euro’s role in international trade, aiming to provide a viable alternative to the dollar, especially in energy transactions and other key commodities. This effort is part of a broader strategy to enhance the euro’s global standing, which could further diversify currency dependencies in international markets.

Moreover, China is advancing the yuan in international trade, particularly through its Cross-Border Interbank Payment System (CIPS), challenging the dollar-centric Clearing House Interbank Payments System (CHIPS). This initiative has seen success, with a notable increase in the yuan’s share in global FX turnover and its use in commodity trade settlements, however global foreign exchange reserve balances of yuan remain small around 2.5% at time of publishing.

Inter-governmental organizations such as BRICS (comprising Brazil, Russia, India, China and South Africa), the Association of Southeast Asian Nations (ASEAN), the Shanghai Cooperation Organization (SCO), and the Eurasian Economic Union, which collectively represent a significant portion of global GDP, are also expressing interest in using local currencies for trade invoicing and settlements. Some members have shown a willingness to trade in yuan, further indicating a shift in global currency dynamics.

Structural reforms and new settlement systems are essential for currencies like the yuan and euro to challenge the global dominance of the dollar. However, a clear shift towards reducing dollar-dependency is evident, simultaneously fueling interest in digital currencies such as Bitcoin, stablecoins, and CBDCs.

Bitcoin: From an Internet Forum Idea to a Sovereign Reserve Asset

Bitcoin, now 15 years old, kickstarted the digital asset movement.

Its appeal lies in its capped supply, algorithmic governance, and a

decentralized ledger, or blockchain, independent of central banks’

influence. Despite regulatory challenges, Bitcoin’s adoption has been

remarkable. As of 2023, it is estimated that there are 106 million

Bitcoin owners worldwide. Corporations like Tesla have incorporated

Bitcoin into their balance sheet holdings, while El Salvador’s adoption

of Bitcoin as legal tender and a reserve currency marks a significant

step in national level acceptance. The presence of Bitcoin ATMs in 84

countries further demonstrates its growing international reach. In terms

of global scale, Bitcoin’smarket capitalization is currently

around the value of Switzerland’s GDP and, at its peak in 2021,

surpassed that of Saudi Arabia.

The adoption of Bitcoin beyond speculative purposes continues to evolve. U.S. regulators in January gave the green light to BlackRock and 10 other asset managers to offer spot Bitcoin exchange-traded funds (ETF), a potential paradigm shift in the global perception and use of digital assets.

Stablecoins: Crypto's Killer App?

Stablecoins, particularly those pegged to the U.S. dollar, have

risen as a critical component to facilitate trading digital assets like

Bitcoin. Designed initially for cryptocurrency traders, these

stablecoins facilitate 24/7 trading and near-instant settlement on

blockchain networks, offering a more efficient alternative to

traditional financial systems. Their utility extends beyond trading,

serving as reliable value storage and a bridge between crypto and

traditional banking, while offering benefits in cost, security, utility

and efficiency in comparison to physical cash.

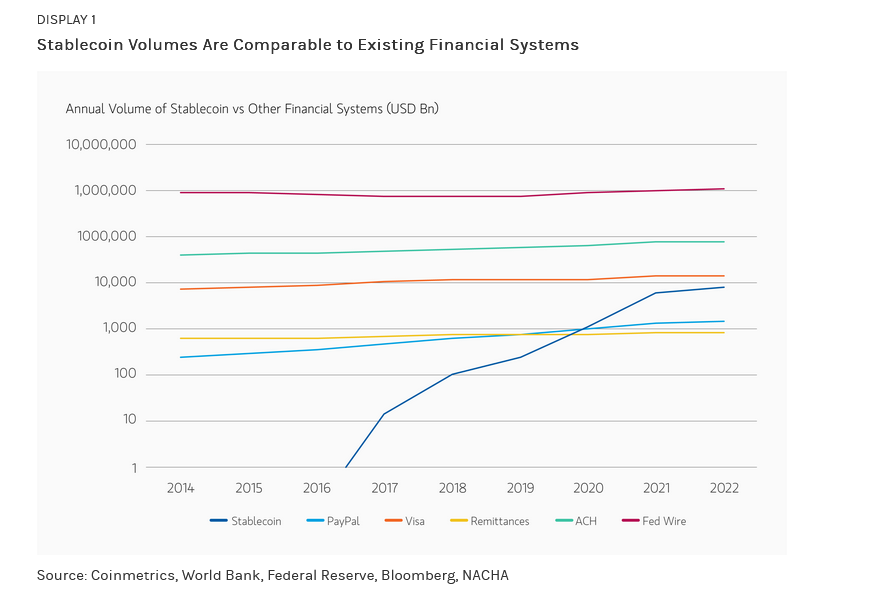

The global adoption of dollar-linked stablecoins has seen exponential growth. In 2022, they processed transactions close to $10 trillion on public blockchains, rivaling traditional payment giants like PayPal and even Visa. This has prompted major financial service companies to adapt. For instance, Visa’s integration of Circle’s USD stablecoin (USDC) on Solana and PayPal’s introduction of its PayPal USD (PYUSD) illustrate the shift towards embracing blockchain efficiency in payments and cross-border transactions (Display 1).

With their increasing importance, dollar backed stablecoins are set to have a profound impact on the financial sector, potentially reshaping how money is moved across borders. Rather than challenge the dollar’s dominance, their continued evolution and growing acceptance by mainstream financial entities underscore their potential to significantly alter the landscape of global finance and in fact reinforce the dollar as the dominant global currency.

CBDCs: Nationalization and Centralization of Stablecoins

The rapid adoption of stablecoins has spurred global interest in

Central Bank Digital Currencies (CBDCs). By mid-2023, 111 countries,

representing over 95% of global GDP, are actively exploring CBDCs,

marking a significant increase from just a few years prior. Unlike

decentralized cryptocurrencies and stablecoins, CBDCs centralize control

over the underlying infrastructure and convert their nation’s currency

into a purely digital form, equivalent to traditional fiat currency.

Issued and regulated by central banks, CBDCs aim to modernize financial

systems by leveraging the efficiency, transactional savings, and the

benefits of distributed ledger technology (DLT), a permissioned version

of blockchain technology, while ensuring oversight and control. Various

studies have also highlighted an opportunity to leverage CBDCs to extend

financial access to unbanked populations.

Countries like the Bahamas and Nigeria have already launched digital currencies, though uptake has been limited. China’s introduction of the digital yuan (e-CNY) in 2020 marked a significant step forward, with transactions using e-CNY reaching 1.8 trillion yuan by July. Although this represents just 0.16% of China’s cash in circulation, a notable milestone was the first international crude oil transaction settled in e-CNY by PetroChina International Corp Ltd at the Shanghai Petroleum and Natural Gas Exchange. Brazil is also advancing in this space, planning to launch a pilot for its digital currency, DREX. This initiative which will use DLT for wholesale interbank transactions, follows the success of the countries popular PIX network. PIX offers instant, free electronic fund transfers using QR codes and easily remembered IDs. The DREX initiative is poised to facilitate transactions based on tokenized bank deposits, highlighting the evolving role of digital currencies in central banking.

As CBDCs become more widely adopted and technologically advanced, they hold the potential to establish a unified standard for cross-border payments, which could diminish the reliance on traditional intermediaries like SWIFT and the use of dominant currencies such as the dollar. Furthermore, CBDCs can enable significant innovation in financial services, such as the use of smart contracts for automating payments, making the concept of programmable money a practical reality. The mBridge project, led by the Bank for International Settlements and involving central banks from China, Hong Kong, Thailand, and the UAE, exemplifies the potential of smart contracts in facilitating efficient and secure cross-border settlements. The ongoing development and increasing adoption of CBDCs promise to reshape the global financial system, potentially influencing not just monetary transactions but also broader economic and geopolitical dynamics.

Navigating the Evolving Global Currency Landscape

As the search by nation states for alternatives to the dollar

continues, emerging digital currencies and stablecoins are fast

developing into viable alternatives to traditional cash and in some

cases, fiat currencies. This shift, influenced by U.S. foreign and

monetary policies and global competition, is driving the move away from

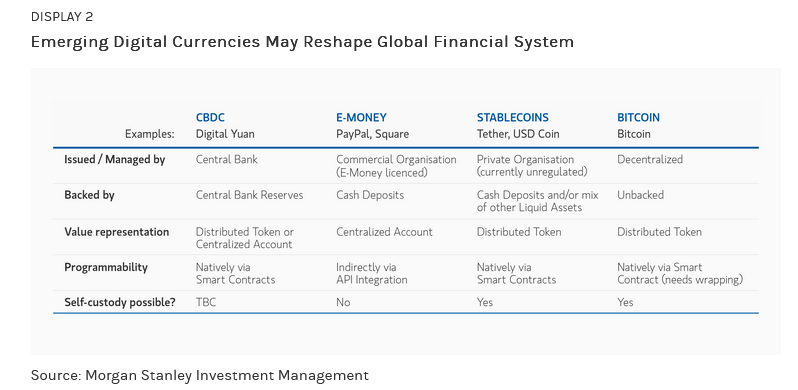

the dollar in cross-border transactions and central bank reserves (Display 2).

Countries and major institutions are increasingly recognizing the need to embrace these technological advancements for their core business processes. This integration not only validates the technology and business use cases but also marks a transition towards more efficient, faster, and cost-effective international transactions.

While changes in global trade and currency usage are likely to be gradual during the early adoption stages of these digital solutions, they are expected to gain mainstream acceptance over time. It is imperative for global investors to closely monitor these developments, adapting their strategies to leverage opportunities in global markets and transformative financial technologies.

As the world adjusts to these technological advancements, understanding the interplay and nuances between traditional fiat currencies, Bitcoin, E-Money, and stablecoins becomes crucial. This dynamic is set to significantly influence the future of international trade and finance, potentially reshaping the global economic and financial landscape. Investors and policymakers alike must pay attention and keep informed with the rapidly changing digital asset ecosystem, considering wide-ranging implications on global businesses and nation-states, as well as the macro investor landscape.

Diesen Beitrag teilen: