Janus Henderson: Chinese money trends suggesting resilience

A softening of Chinese economic activity data in July probably reflects pay-back for strong June results, as well as disruption from high temperatures / drought in parts of the country. Monetary trends suggest that economic growth will remain respectable during the second half.

23.08.2017 | 12:40 Uhr

(Foto: Simon Ward)

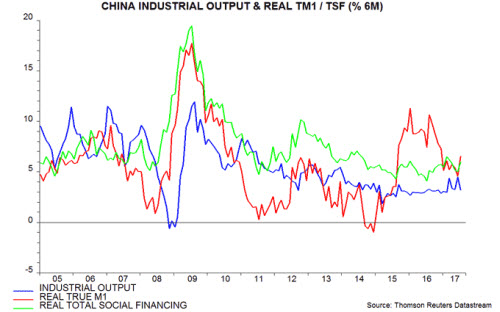

Six-month growth of industrial output* reached a three-year high in June before falling back in July.

The July reading, however, was close to the average since 2014 – see first chart.

The preferred monetary aggregate for forecasting purposes here is “true” M1, comprising currency in circulation and demand deposits of corporations and households. (The official M1 measure excludes household deposits.) Six-month growth of real (i.e. consumer price inflation-adjusted) true M1 fell significantly between August 2016 and early 2017, suggesting softer economic momentum from the spring, allowing for an average nine-month lead. Growth, however, has remained above levels associated with economic weakness historically and rebounded in July – first chart.

Credit trends, meanwhile, appear consistent with the official aim of clamping down on speculative lending while maintaining "real economy" funding. Six-month growth of real total social financing of households and non-financial enterprises has fluctuated in a narrow range and was slightly above the average since 2014 in July – first chart. There has, however, been a significant slowdown in bank lending to financial institutions and government.

The rebound in six-month real true M1 growth in July reflected both a recovery in nominal expansion and a sharp decline in six-month consumer price inflation.

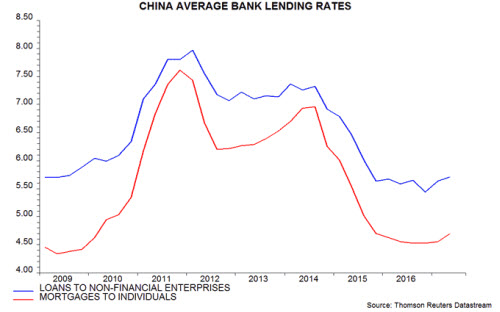

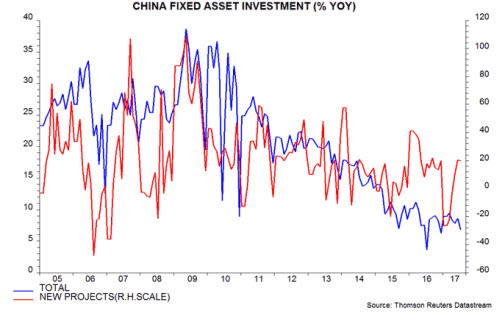

Pessimists argue that first-half policy tightening will exert an increasing drag on the economy during the second half. The rise in money market interest rates, however, has yet to feed through to a significant increase in bank lending rates – second chart. On the fiscal side, the central government deficit has been stable while annual growth in fixed asset investment in newly-started projects rebounded strongly in June / July – third chart.

Money rates have subsided since June, with easing inflation and currency stability giving the PBoC scope to engineer a further decline, if necessary.

A constructive economic view will be maintained here barring a further slowdown in real true M1 growth.

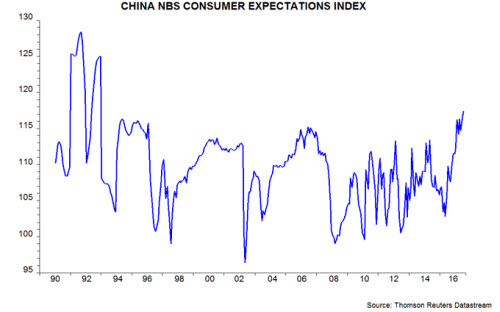

Commentary on China is biased towards negativity, playing down or ignoring positive surprises. A recent rise in the NBS consumer expectations index to its highest level since 1993, for example, has received little attention – fourth chart.

*Seasonally adjusted series sourced from World Bank.

Diesen Beitrag teilen: