Janus Henderson: There’s a new yield curve to predict recessions

Ashwin Alankar is Global Head of Asset Allocation and Risk Management at Janus Henderson. He explains why high-yield credit markets now look to be a better barometer of economic conditions than US Treasuries.

29.09.2017 | 11:21 Uhr

There have been plenty of warnings in recent months that a reduction in the amount of extra yield earned by holders of long-maturity US Treasuries compared with owners of shorter-dated debt is a signal of an impending economic slowdown. The spreads between two-, five- and 10-year Treasury yields are well below average. Should short-term rates move higher than longer-term rates, it’s a sure sign of a recession.

Or so the conventional wisdom goes.

The Treasury yield curve has inverted ahead of the past six downturns going back to the 1960s, including prior to the last two recessions in 2000 and 2006. But that was before the era of central bank quantitative easing. Years of unconventional monetary accommodation have led to many market distortions, one of which has been the disappearing term premium, which measures the extra compensation investors need to own long-term bonds instead of continuously rolling over short-term debt. By guaranteeing unprecedented levels of liquidity through its asset purchases, the so-called ‘Fed put’ has taken risk out of the system and the term premium along with it.

In combination with former Federal Reserve (Fed) Chairman Ben Bernanke’s Operation Twist, under which the central bank bought longer-dated debt and sold bonds of shorter maturities, the policies had exactly the desired effect: 10-year rates plummeted, flattening the curve.

Despite the Fed now moving to unwind liquidity, there may be further flattening pressure in the US, or at least a lack of steepening, as ever more accommodative foreign central banks drive yield-hungry overseas investors to US benchmark debt, because there is little to no yield available in developed markets outside the US.

But this should not be a reason for concern, because all the above distortions mean the shape of the Treasury yield curve is no longer a reliable indicator of an impending recession. We believe a much truer assessment of the threat of a slowdown can be gleaned from the high yield credit curve, where the impact of central bank policy is much less pronounced.

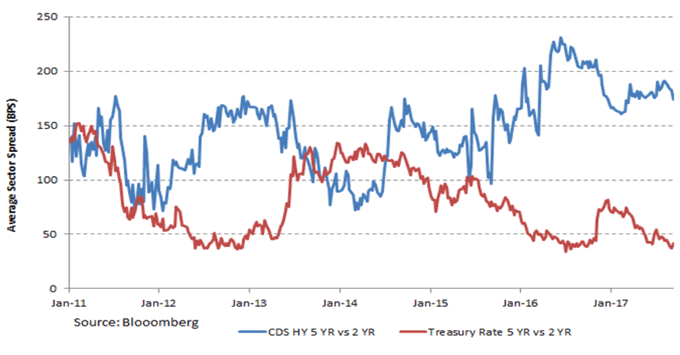

The spread between two- and five-year Treasuries is less than half the average since the end of the global financial crisis, at 41 basis points (bps) versus a mean of 90bps. By contrast, the extra yield enjoyed by sellers of five-year high yield credit default swaps versus two-year high yield credit default swaps stands 30bps higher than the average.

Five-year versus two-year comparisons in the Treasury and HY credit curves

Source: Janus Henderson Investors, Bloomberg, as at 21 September 2017. HY = high yield

In other words, yield curves are steep in credit markets and showing no signs of flattening or inverting. On that measure, there’s no hint of a correction.

The imbalances created by global central banks will not disappear overnight, because stimulus measures will only be unwound gradually. For a more accurate barometer of the possibility of recession, credit curves win out over potentially miscalibrated rate curves.

Glossary:

Yield curve = a graph that plots the yields of similar quality bonds against their maturities. In a normal/upward sloping yield curve, longer maturity bond yields are higher than short-term bond yields. A yield curve can signal market expectations about a country’s economic direction.

Credit spread = the difference in yield between securities with similar maturities but different credit quality.Basis point (bp) = 1/100 of a percentage point: 1bp = 0.01%; 100bps = 1%.

First published on Bloomberg View on 21 September 2017.

Republished here with permission.

Diesen Beitrag teilen: