Janus Henderson: Global money trends still downbeat

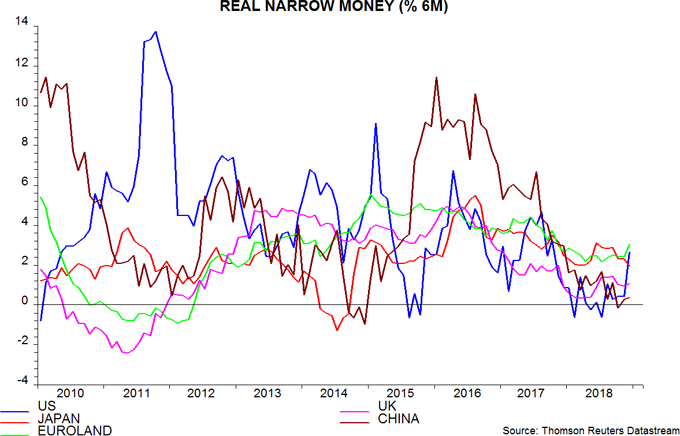

Additional monetary data released last week confirm that global six-month real narrow money growth ticked higher in November / December.

11.02.2019 | 13:49 Uhr

Growth, however, remains below its range over 2009-17 – a sustained further increase is needed to warrant a shift away from economic pessimism. January global manufacturing PMI results, meanwhile, are consistent with the forecast here of a joint downturn in the stockbuilding and business investment cycles.

Global (i.e. G7 plus E7) real money growth may have bottomed in October, suggesting that six-month industrial output momentum will slide further to a low around July, allowing for a typical nine-month lead.

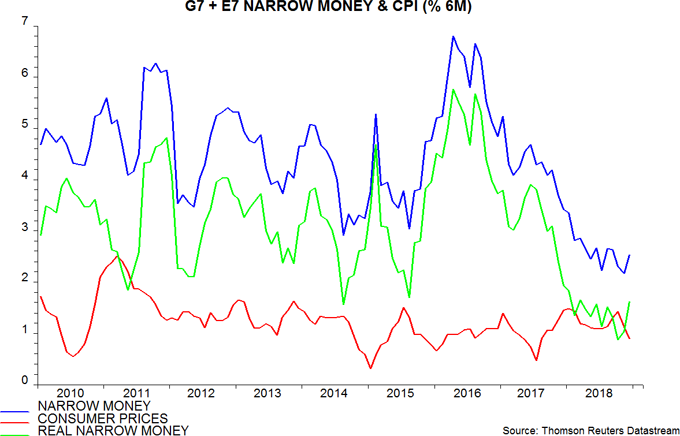

Two-thirds of the recovery in global real money growth in November / December reflected a slowdown in inflation, due to weakness in oil and other commodity prices. Nominal money trends have yet to show much improvement – first chart.

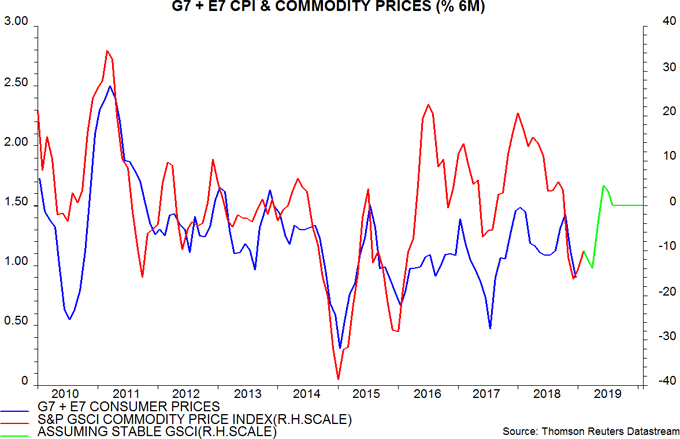

The inflation boost could fade towards mid-year, assuming that commodity prices now stabilise – second chart. With economic weakness expected to intensify, however, a further decline in prices is plausible.

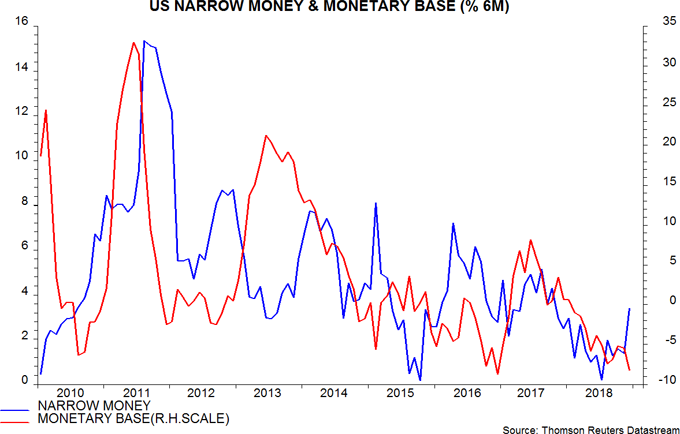

Stronger US money growth at year-end may prove temporary. Although the Fed capitulated last week, QT is likely to continue at least through mid-year, implying a further contraction in the monetary base (ignoring possible short-term volatility due to changes in the Treasury’s balance at the Fed) – fifth chart.

The expectation here remains that the current global economic downswing will be more severe than the slowdowns in 2011-12 and 2015-16. Global real money trends are weaker now, while cycle analysis suggests that business investment will exert a larger negative influence, adding to a drag from stockbuilding.

Global manufacturing PMI results are moving in line with the forecast. The new orders index fell below the 2016 low in January, with weakness led by investment goods demand – sixth chart.

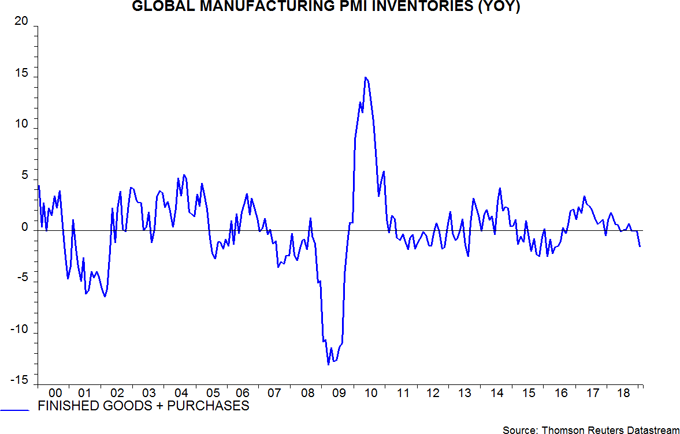

The survey, meanwhile, confirms a downswing in the stockbuilding cycle: the annual change in the sum of the inventory indices for finished goods and purchased inputs turned significantly negative in January – seventh chart.

Diesen Beitrag teilen: