NN IP: Italian budget poses two-sided risk

Italy’s budget proposals took their toll on directly related assets but contagion to other regions and classes has been limited so far.

04.10.2018 | 09:31 Uhr

Most equity indices are up over the week with the exception of some European markets. The weakest performer is clearly Italy, where the MIB lost close to 4%. One of the best-performing equity markets was Japan, the only market where we have an overweight position. The Bund yield was down a few basis points over the week, which is not too much, considering the market response to the Italian budget announcement and the impact it had on other assets, especially Italian government bonds (BTPs).

The fundamental news flow was mixed over the week. Chinese data was slightly weaker, but trade fears faded somewhat after the US and Canada made a deal to replace NAFTA. The most-watched news was Italy’s budget announcement. The M5-Lega coalition government agreed on a budget deficit equal to 2.4% of GDP. The announcement was not well-received by other European politicians and investors. The deficit would be in breach of EU rules, risking renewed Eurozone market stress and political upheaval. While the market impact on the directly related assets like BTPs and Italian/European financials is already sizeable, contagion to the rest of Eurozone periphery and other assets has been limited so far. To us, this means that the market risk is basically two-sided, and we don’t want to act on it yet.

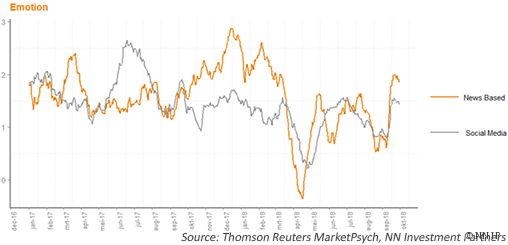

Market sentiment is not providing much direction at the moment. The bull-bear ratio is close to neutral and our TRMI emotion signal is moving up but not at extreme levels.

The overall scores of the quantitative signals we use have weakened somewhat for equity, government bonds and real estate, but we take some caution in responding to them too quickly. Our global cyclical indicator has an important weight in the scorecards and recently the one-month signal has been improving. With most US data to be updated this week, our fundamental signal could turn more positive.

This week we downgraded core government bonds to a small underweight after our top-down quant signal turned more negative. German 10y Bund yields broke out of the 30-50 bp trading range last week, and although they fell back a bit after the Italian budget news came out, we believe the upward trends remains in place. It is hard to see the ECB becoming more dovish as it continues its exit strategy. The bank is showing increased confidence in its base-case scenario, and President Mario Draghi even spoke of “vigorous inflation”. The Fed remains on course for another hike in December after last week’s rate increase, and recent speeches by Fed members are also slightly more hawkish.

We also downgraded listed real estate from a small overweight to neutral. We lost the support of the market dynamics signals as liquidity and momentum indicators turned negative. Short-term sentiment indicators on our dashboard and flow indicators have turned negative as well. Vulnerability to a further rise in interest rates could also come back in play.

Diesen Beitrag teilen: