Janus Henderson Investors: Finding value in the Covid-19 crisis — a secured loans view

Elissa Johnson, Portfolio Manager and secured loans specialist within the Secured Credit Team, examines developments in the leveraged finance markets since the extent of the Covid-19 crisis became apparent in March.

11.05.2020 | 09:43 Uhr

Key takeaways:

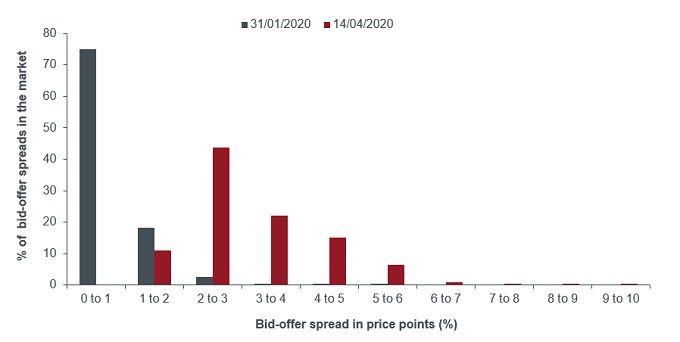

- European loan markets have not been immune to the indiscriminate sell‑off and steep bounce-back experienced across all credit markets in recent weeks. While markets continue to ‘normalise’, bid‑offer spreads remain wider than usual, reflecting the significant uncertainty regarding both market liquidity and corporate performance.

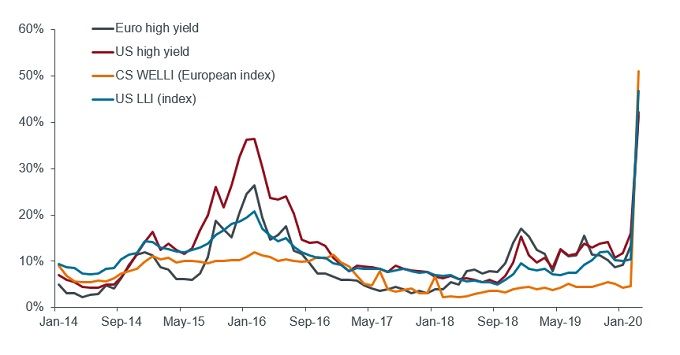

- Loan dispersion has significantly increased and looks set to stay. Distress ratios have unsurprisingly risen in all leveraged finance markets and default rates are forecast to rise.

- Credit investing remains uncertain, but with some credits trading at distressed levels and others demonstrating business resilience, the team think there are selective, sensible investments in leveraged finance available.

European loan markets have not been immune from the indiscriminate sell‑off and steep bounce-back experienced across all credit markets since the unprecedented extent of the Covid‑19 crisis became apparent in March.

Certain sectors are clearly significantly affected — some European and US non‑food retail and leisure related businesses are shut and earning close to zero revenue. In contrast, food manufacturers are operating at full capacity, albeit with some extra costs to ensure employee safety and mitigate some supply chain disruption. The question now, with a consensus forecast for a near‑term deep global recession, and significant uncertainty about the shape of any recovery as economies hopefully start to reopen during the second quarter, is how to find long‑term attractive risk‑adjusted returns.

Where are we now?

Investment grade bond markets were the first to reopen in the credit space. Initial borrowers were those considered largely immune from the effects of Covid‑19, such as American multinational personal care corporation, Kimberley Clark, and Anglo-Dutch consumer goods company, Unilever, but we also saw fundraising from cruise line operator, Carnival in the US. High yield markets followed with ‘fallen angels’ such as Ford, while in Europe, B1/B rated alarm company, Verisure, opened the European high yield market with a small €150m (upsized to €200m) floating rate note (FRN) priced at a yield of 5%, paying a small premium as it priced in line with the yield of its shorter‑dated 2022 loans before the announcement. While markets continue to ‘normalise’, we note bid‑offer spreads remain wider than usual.

Chart 1 shows the bid‑offer spread in the European loan market at the end of January and in mid‑April. In January, the majority of the market traded with a bid‑offer price spread of less than one point; whereas now, the average is over three points. We believe, this reflects the significant uncertainty regarding both market liquidity and corporate performance.

Chart 1: bid‑offer spreads remain wider than usual

Source: Markit, Bloomberg, as at 31 January 2020 and 14 April 2020.

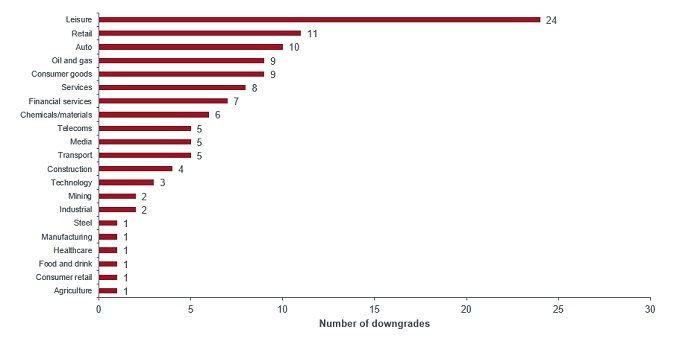

Rating agencies have been quick to act. March saw more than 80 downgrades; around a quarter into the CCC rating band for companies which were not already CCC, and heavily skewed towards affected industries such as leisure. Given the macro outlook, we think other sectors will see downgrades over time with the agencies focusing on the highest risk names first. We started to see this in April.

Chart 2 shows the number of rating downgrades across the three main credit rating agencies in March 2020.

Source: Capital Structure, as at 31 March 2020.

Distress ratios have unsurprisingly risen in all leveraged finance markets. While default rates are forecast to rise, the question is how much is already in the price? Chart 3 shows the percentage of each market (US and European loans and high yield bonds) trading with a spread of more than 7.5% over equivalent government bonds.

Chart 3: percentage of market trading at a spread of over 750 basis points

Source: Credit Suisse, JP Morgan, as at 31 March 2020.

Is there value to be found?

We believe opportunistic investing can provide good medium‑term, risk‑adjusted returns for those prepared to take a view of 12 months or more. When looking at European loans, a very simplistic estimate suggests that default rates of around 15% are currently priced into the market, above the forecasts of many credit-market strategists’ base case (eg, Deutsche Bank’s 10.2% on their base case economic outturn, and 19.3% on a protracted pandemic case)1. To calculate this, we have assumed a recovery rate of 30%, substantially below historical averages and rating agency forecasts, using the average market price of 88.9 as at 30 April 20202. If one were to assume a 50% recovery rate for European loans, still below historical levels and below rating agency forecasts, then a default rate of more than 20% is priced into European loans today.

In high yield, we note that many strategists are suggesting that current spread levels (eg, US high yield at around 8.5%) price in default rates of 8‑10%, which are commensurate with their 2020 default rate forecast, and also in line with the rating agencies’ default forecasts for this year.

Dispersion has significantly increased. For example, the Credit Suisse Western European Leveraged Loan Index (CS WELLI)’s average market price of 88.9 and 5‑year average discount margin of 6.1% (as at 30 April 2020)2 does not really paint a true picture. Chart 4 shows the current level of dispersion in the US and European Loan markets.

Chart 4: significant increase in dispersion

Source: Credit Suisse, JP Morgan, Janus Henderson Investors, as at 20 April 2020

Dispersion for loans is defined here as the percentage of the market trading +/- 1% away from the median 4-year discount margin of the market. For US and European high yield, it is the percentage of the market trading +/-1% away from the average yield to maturity (note: if we used median for high yield, dispersion would have risen 25% in the past six months).

The US has historically traded with higher levels of dispersion, reflecting its higher proportion of CCC and higher-risk sectors (eg, energy), but today dispersion levels are similar — and very high. As an example, in European loans, the average price in the healthcare sector is 93, whereas in leisure it is 832.

In our view, higher levels of dispersion are set to stay as companies, and industries, work through the forthcoming recession and the potential for ‘normal’ demand to remain absent for the medium‑term.

Which investment strategy to adopt?

There are three main approaches to investing from here in our view. One is to seek largely unaffected businesses where there is a high conviction that the 3.5-4.5% return on offer is realisable and be prepared to invest through any future market volatility. The second, is to model scenarios for future demand and hence cash flows, taking account of any structural shifts in demand that the virus brings about and cherry pick loans and bonds trading with a higher than 10% yield‑to‑maturity, to capture significant future excess returns, albeit with substantially higher risk. Finally, one could seek a mix of defensive lower yielding names and higher risk (but not high risk) names where fundamental analysis supports an investment and seek returns of 5-8%.

Currently, there are some loans and bonds, which we believe to be in a ‘lower risk’ category that could deliver reasonable returns. However, it is important to note that during these uncertain times, with the potential for structural changes to demand and consumer and corporate behaviour yet to be seen, what may be considered lower risk today may prove not to be so in the future. Clearly if the macro economy and markets recover faster than currently expected, then the pull to par for the majority of these names has the potential to result in higher returns over the near term than indicated by the yield to maturity.

Conclusion

In these unprecedented times, significant uncertainty remains. It is likely that going forward there will be a material part of the market rated CCC. This has implications for collateralised loan obligation (CLO) investors on both sides of the Atlantic, as managers will be facing difficulty maintaining cash payments to equity investors as the CCC percentage of their portfolios rise. This could lead to technical selling, which could pressure the market as a whole; but could equally provide some attractive buying opportunities for investors with a 12‑18‑month investment horizon.

The degree of any economic downturn and recovery remains highly uncertain. Will furloughed workers all be re‑employed or will companies find they can manage without a significant number of them? If Covid‑19 has second or third spikes over the estimated 12‑18 months that a vaccine may take to develop and test, will governments step up again to help support businesses as they have so far?

Credit investing remains uncertain, but with some credits trading at distressed levels already and others demonstrating business resilience, we think there are selective, sensible investments in leveraged finance available.

1Deutsche Bank, 2020: Default seems to be the hardest word, 27 April 2020.

2Credit Suisse, Western European Leveraged Loan Index (CS WELLI), 30 April 2020.

Die vorstehenden Einschätzungen sind die des Autors zum Zeitpunkt der Veröffentlichung und können von denen anderer Personen/Teams bei Janus Henderson Investors abweichen. Die Bezugnahme auf einzelne Wertpapiere, Fonds, Sektoren oder Indizes in diesem Artikel stellt weder ein Angebot oder eine Aufforderung zu deren Erwerb oder Verkauf dar, noch ist sie Teil eines solchen Angebots oder einer solchen Aufforderung.

Die Wertentwicklung in der Vergangenheit ist kein zuverlässiger Indikator für die künftige Wertentwicklung. Alle Performance-Angaben beinhalten Erträge und Kapitalgewinne bzw. -verluste, aber keine wiederkehrenden Gebühren oder sonstigen Ausgaben des Fonds.

Der Wert einer Anlage und die Einkünfte aus ihr können steigen oder fallen. Es kann daher sein, dass Sie nicht die gesamte investierte Summe zurückerhalten.

Die Informationen in diesem Artikel stellen keine Anlageberatung dar.

Zu Werbezwecken.

Diesen Beitrag teilen: