Janus Henderson Investors: Tech stocks - looking for secular growth, but not at any price

Global Technology Team portfolio managers Alison Porter, Graeme Clark and Richard Clode discuss why they believe an active approach is now needed more than ever to avoid pockets of extreme tech stock valuations.

14.08.2020 | 08:49 Uhr

Key takeaways

- While tech trends are accelerating and giving rise to elevated tech valuations, in the longer term valuations need to be supported by profits and cashflow.

- The top five S&P 500 companies are currently all in the tech sector, contribute a much larger percentage of earnings, and are growing much faster than the rest of the index. Trading on a much lower valuation premium than in 2000, these companies have an attractive price/earnings to growth (PEG) ratio compared to the rest of the market.

- Given a plethora of risks for tech stocks the team believes active management, valuation discipline and a strong risk framework while engaging proactively with technology companies on ESG factors are paramount in the current market.

“'In the short run, the market is a voting machine but in the long run, it is a weighing machine.” ̶ Benjamin Graham

As growth investors we do not quote revered value investors, such as Benjamin Graham, very often. However, having navigated the hype cycle of technology since the dot.com bubble 20 years ago – and even though technology in many ways is unrecognisable today – we believe the dangers of excessive valuations and investor overexuberance still hold true. A market increasingly dominated by machines and passive flows only serves to exacerbate momentum trades, while record low or in some cases negative interest rates make the attraction of owning longer duration stocks (that are more sensitive to interest rate changes) more palatable in a low growth world.

As growth investors we do not quote revered value investors, such as Benjamin Graham, very often. However, having navigated the hype cycle of technology since the dot.com bubble 20 years ago – and even though technology in many ways is unrecognisable today – we believe the dangers of excessive valuations and investor overexuberance still hold true. A market increasingly dominated by machines and passive flows only serves to exacerbate momentum trades, while record low or in some cases negative interest rates make the attraction of owning longer duration stocks (that are more sensitive to interest rate changes) more palatable in a low growth world.

Periods of extreme tech valuations typically do not last

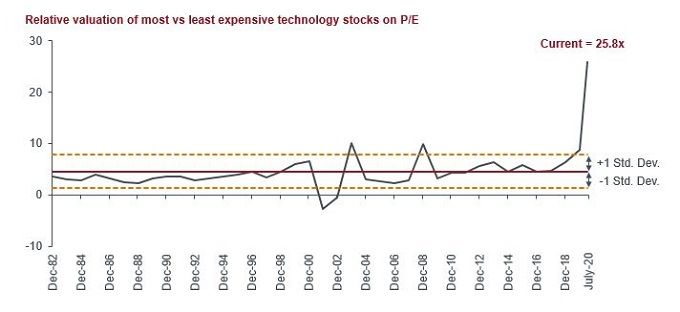

These market and economic factors, combined with accelerating technology trends over the past decade that have been turbo charged by the recent tragic events of the global coronavirus pandemic, have created the recipe for growing pockets of extreme valuations. While these remain only pockets, the long-term valuation chart for technology stocks (chart 1) shows that we are clearly in a period where the relative valuation of the most expensive versus the least expensive technology stocks is currently not just at historical highs, but literally off the chart.

Chart 1: Most expensive versus least expensive tech stock valuations are stretched

Source: Bernstein Quant Team (Larson), as at 1 July 2020. Note: chart uses price-to-earnings (P/E) year-end datapoints to 2019 and current datapoint as at 1 July 2020. Past performance is not a guide to future performance.

The chart also highlights that while many things change in technology, one constant is that an extreme bifurcation of valuations in the technology sector has never lasted. An obvious caveat to the extraordinary crisis we currently face is that the resultant severe recession has led to a significant divergence in the growth prospects between secular stocks and those with more economic dependency and cyclicality. That holds true in the technology sector as well as the wider market.

At the end of April Microsoft CEO Satya Nadella quipped, “we’ve seen two years of digital transformation in the space of two months.” The acceleration we have seen in key technology trends such as internet transformation, next generation infrastructure, payment digitisation, process automation and artificial intelligence during the lockdown and ongoing work from home guidance has been breath-taking. Unsurprisingly, that has resulted in many secular growth companies reporting significant accelerations in their growth rates, which when compared to the severe declines being witnessed in many other sectors makes the contrast even more stark. This extreme situation is being used by some investors to justify growth at any price.

Fundamentals matter at the end of the day

We take a different view. We have long advocated the strength of these key technology themes but have always reminded investors that at the end of the day we are investing in a stock not a technology. Coming back to Benjamin Graham’s quote, while near-term momentum and ‘animal spirits’ may propel a stock’s valuation well beyond what fundamentals would justify, in the longer term that valuation needs to be supported by profits and cashflow. Currently, some investors are ignoring that adage and may be using valuation techniques such as price-to-sales and price-to-total addressable market that are fraught with risks.

Ultimately, as shareholders we own a share of the profits and cashflows of a company. Generating sales alone has no economic value to an investor in the longer term. A growing coterie of stocks, notably in the growth software sector and work from home beneficiaries, currently trade on north of 20x sales with no net profits or little or negative cashflow. To justify that valuation as an investor, an assumption that many years of high sales growth ahead will ultimately translate into strong profit margins and cashflow needs to be made. That indirectly presumes that in the dynamic world of technology, a company will retain a dominant position for many years to come. The history of technology investing is littered with the ashes of such false hopes and investor overconfidence going up in smoke.

Why we navigate the hype cycle

As experienced, active technology investors we have seen this ‘movie’ before. Navigating the hype cycle is embedded in our investment process. This involves identifying and understanding where an emerging technology is on the hype cycle (hype, adoption, maturity, social application phases), which helps us to avoid areas of the market in the hype phase.

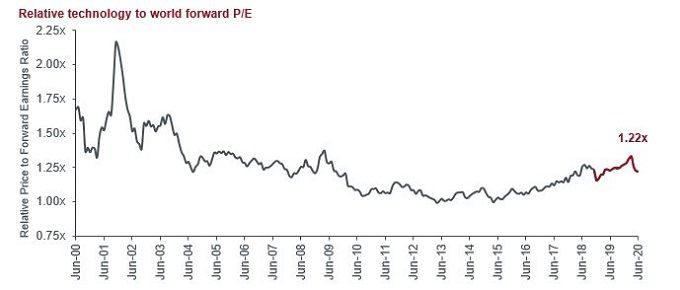

Rising thematic appetite in recent years and the emergence of more niche thematic funds, both active and passive, with limited investment universes has resulted in strong demand for many thematic stocks, with some having questionable fundamentals and valuations. Wirecard, the troubled payments provider, is the most recent example of how badly that can end. Importantly, this is a pocket within technology, albeit an expanding one, leaving us with a multitude of other attractive opportunities in the sector. As depicted in chart 2 the relative valuation of the technology sector to general equities currently remains attractive, albeit flattered by the decimation of the earnings power of other sectors. Technology has long been taking share of the global economy and those gains have only been accelerated by the recent crisis driving superior earnings growth.

Chart 2: Relative valuation of tech to global stocks

Source: Bernstein, as at 30 June 2020. Note: forward P/E = price-to-forward earnings. (Grey line) MSCI ACWI Information Technology Sector, price-to-forward earnings relative to MSCI All Country World Index (ACWI) from June 2000 to November 2018 pre GICS sector changes in MSCI Global indices, then (red line) MSCI ACWI Information Technology + ACWI Communication Services Index relative to MSCI ACWI Index to 30 June 2020 post GICS sector changes in MSCI global indices. Past performance is not a guide to future performance.

Not cheap but tech does offer superior growth and strong cashflows

If we break that down further, much has been made of the concentration of performance in the S&P 500’s top five companies by market cap (chart 3), which are all technology companies (Apple, Microsoft, Amazon, Google and Facebook). While those five companies are now a larger percentage of the index than at the peak of the dot.com bubble, crucially they now contribute a much larger percentage of earnings and are growing around three times as fast as the rest of the S&P 500 Index. Given these companies trade on a much lower valuation premium than in 2000 means they have an attractive price/earnings to growth (PEG) ratio compared to the rest of the market.

Chart 3: Characteristics of top five companies versus S&P 500

Source: Standard & Poor’s. Thomson Financial. FactSet and Credit Suisse. Credit Suisse US Equity Research 21 July 2020: Market concentration not a problem.

To illustrate that another way, if we compare some of the leading listed technology companies in the US and China to some of the higher quality, non-technology companies (see Coca-Cola, McDonald’s and Procter & Gamble in chart 4) and exclude value cyclical plays like energy and financials, then the comparison is even more stark with a similar valuation for twice the growth and much stronger balance sheets.

Chart 4: Technology emerging stronger from the crisis

Source: Bloomberg consensus estimates and Bloomberg net debt and net cash, as at 9 July 2020. Please note the data shown is based on forecasts for calendar year 2022, not real data (excluding net debt and net cash). P/E and growth is calculated using adjusted earnings per share. Use of third-party names, trademarks or logos is purely for illustrative purposes and does not imply any association between any third party and Janus Henderson Investors, nor any endorsement or recommendation by or of any third party. References made to individual securities should not constitute or form part of any offer or solicitation to issue, sell, subscribe or purchase the security.

We have long highlighted the strength of balance sheets and it has taken a crisis to remind investors how important cash is. These technology mega cap companies have not had to make tough decisions to lay off employees, cut research and development (R&D), ask for government bailouts or reduce shareholder returns. As these companies look to disrupt new markets they look set to emerge from this crisis stronger while many incumbents will struggle. In contrast, in those pockets of extreme valuation in technology, many companies are burning cash and remain reliant on capital markets to fund their growth. Currently, investor appetite to support such companies is sky high but experience tells us that investor sentiment can turn negative quickly, leaving these companies exposed and in a weak position.

Active management: it pays to be selective

Beyond the mega cap technology companies, attractive opportunities also exist in some of the most exciting secular growth areas of the technology sector. However, we believe the key is to be highly selective by searching for unexpected earnings growth at a realistic valuation. This is valuation discipline rather than searching for cheap value stocks, which historically has not been a successful strategy in the technology sector. Maintaining valuation discipline is possible within a broader technology fund but is more challenging in a niche thematic fund focused on a single technology trend with a limited investment universe. Identifying the ‘winners’ in a new market rather than buying every stock in a theme allows us to identify stocks with a higher potential for unexpected earnings growth.

The sheer scale of the disruptive powers of technology have been evident for many years but all the more so during a very distressing 2020 where technology became a life essential. The acceleration of technology trends makes it a very exciting time for the technology sector. However, as long-term investors in technology stocks our extensive experience tells us that if there was ever a time to be cognisant of the risks, then it is today. This is because of extreme valuations, unrealistic expectations, US/China tensions, and environmental, social and governance (ESG) issues ranging from the responsibility of social media platforms to the health, safety and rights of gig economy workers. In our view, active management, valuation discipline and a strong risk framework while engaging proactively with technology companies on ESG factors are paramount in the current market.

Diesen Beitrag teilen: