Janus Henderson: “The King is dead, long live the King!” – real estate and technology

Tim Gibson and Guy Barnard, Co-Heads of Global Property Equities, discuss how real estate is being reinvented and rejuvenated by rapid advances in technology and how their portfolios are actively positioned to gain from these evolving trends.

23.05.2018 | 12:44 Uhr

The bricks and mortar business of real estate is often seen as a traditional asset class, or ‘old economy’ business, which will be negatively impacted by technological advances. While this is true for some areas, the asset class is also evolving in tandem with technological trends and changes in consumer needs, presenting us with many attractive investment opportunities.

The bricks and mortar business of real estate is often seen as a traditional asset class, or ‘old economy’ business, which will be negatively impacted by technological advances. While this is true for some areas, the asset class is also evolving in tandem with technological trends and changes in consumer needs, presenting us with many attractive investment opportunities.

What is going on?

Increasingly sophisticated technology, rapid urbanisation and shifts in demographics have fundamentally changed consumer behaviours and altered the needs and uses for real estate. This is an area we are increasingly focused on. We aim to identify the potential winners and losers (Chart 1) from the structural shifts ignited by technology and actively position our portfolios to benefit from the evolving trends.

Chart 1: Real estate & technology: winners and losers in e-commerce

(Source: Janus Henderson Investors. Pictured is the Rolling Acres Mall in Ohio opened 1975, closed December 2013. At one point it housed more than 140 stores.)

What is the impact?

Internet infrastructure is creating new asset classes

Technological advances and increasing digitalisation are driving massive demand for computing power and an explosion of data. Physical internet infrastructure such as data centres and telecommunications cell towers are growing to cater to this need and have become an integral part of the 21st century real estate universe, giving rise to new asset classes.

We expect surging demand for cloud computing, growth of Internet of Things (IoT) applications, creation of smart cities and the growth of big data will continue to drive demand for data centres. Meanwhile, rising expectations for better performance and service from mobile devices are boosting mobile carrier spending on cell towers.

….and changing traditional ones!

The rise of e-commerce has changed the face of retail and epitaphs have long been written about the death of physical shopping malls. However, the growth of e-commerce is fuelling demand for modern logistics space, for example, traditional warehouse ‘sheds’ have turned into the new shops of the world. E-commerce can require as much as three times more logistics space than traditional brick-and-mortar retailers. Strategically-located logistics assets are becoming more important in order to fulfil ever increasing expectations for online delivery speed − Amazon’s fastest Christmas Eve delivery took only 13 minutes, from click to delivery!

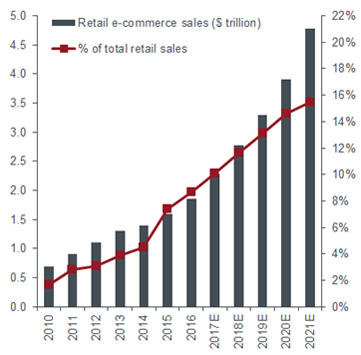

Logistics enjoys one the most positive fundamental backdrops among the traditional real estate sectors. The sector benefits from the continued tailwind of online retail growth, which is expected to outpace a fairly disciplined supply response. We believe this positive trend will endure as internet retail remains underpenetrated in many countries globally (Chart 2).

Chart 2: Global e-commerce sales have much room to grow

(Source: e-Marketer, Prologis Research, MWPVL Supply Chain. Estimated data from 2017 to 2021. Estimates may vary and are not guaranteed.)

What are we doing about it?

As these trends typically develop gradually and rarely happen overnight, we have become very selective in our holdings of retail landlords in recent years, focusing only on ‘best in class’ operators, which we believe have embraced this structural shift and have actively adapted in order to emerge as winners.

Meanwhile, we have increased our positions in global logistics owners and developers who are at the forefront of modern logistics development, e.g. Goodman in Australia, Segro in Europe and DCT Industrial in the US. We also invest in a number of data centres and tower companies eg. Equinix, InterXion and NextDC, where we expect secular growth trends to remain highly favourable for the foreseeable future.

Our fundamental belief is that identifying structural growth within real estate markets is key; particularly in an environment where we are seeing a reversal in monetary policy and many countries and sectors are moving late into the real estate cycle, characterised by increasing vacancies and more supply. We expect the impact of technology to remain a structural driver of growth for companies in our real estate universe and embrace that change within our actively managed, focused portfolios.

These are the views of the author at the time of publication and may differ from the views of other individuals or teams at Janus Henderson Investors. Any securities, funds, sectors or indices and securities mentioned within this article do not constitute or form part of any offer or solicitation to buy or sell them.

Diesen Beitrag teilen: