Schroders: The Financial Choice Act

Donald Trump’s position on financial regulation was abundantly clear throughout his presidential campaign. He has long advocated a lighter touch from regulators. As president, he has remained especially committed to stripping back the Dodd-Frank banking rules introduced after the global financial crisis (GFC). The Financial CHOICE Act of 2017 is the result.

30.06.2017 | 09:09 Uhr

Amongst its key potential outcomes are the following:

- To reduce capital requirement constraints. Within the CHOICE framework, banks can avoid regulation if they have leverage ratios of at least 10% and have a CAMELS rating of 1 or 22. Qualifying banks would be exempt from Dodd-Frank regulations, the Basel III capital and liquidity standards and a number of other regulatory requirements that pre-date Dodd-Frank.

- To stimulate growth. Qualifying banks would be able to make capital distributions freely, could eliminate the “living will” requirement and could see a repeal of the Volcker Rule.

- It would strip Federal Deposit Insurance Corporation (FDIC) authority. The CHOICE Act creates a new subchapter of the Bankruptcy Code, tailored specifically to address the failure of a large, complex financial institution.

- It would repeal “too big to fail” legislature by curtailing the Financial Stability Oversight Council’s (FSOC) authority to designate banks as systemically important financial institutions (SIFIs).

- It would support community banks & credit unions. The act would reduce the authority of financial regulatory agencies - presently headed by single directors - by making them bipartisan commissions.

Why it’s unlikely to work

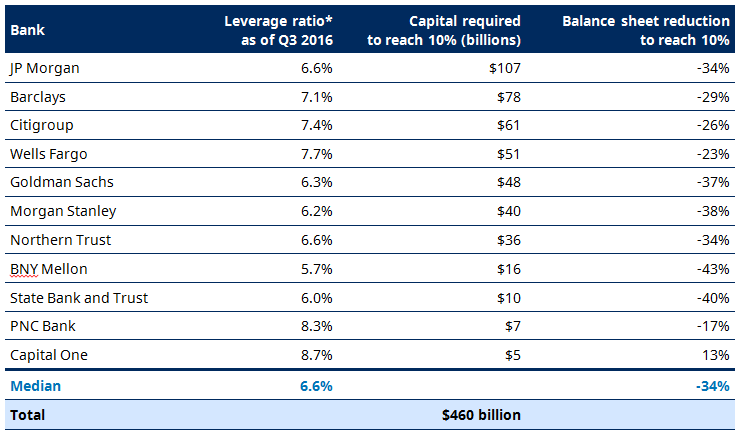

The act, in its current form, looks to have a very slim chance of passing into law (through the Senate). The chances are low for some very good reasons. Chief amongst them, the act would require almost half a trillion dollars of additional capital to capitalise the banking sector according to its requirements. The alternative is for the big banks to shrink their balance sheets by 34%, both would likely impair economic expansion.

Source: Barclays, Federal Reserve *Here, the leverage ratio is the Supplemental Leverage Ratio (SLR)

However, while the act itself may not pass in its entirety, aspects of it are highly likely to be implemented. With little fanfare, the US Treasury - to which Trump has appointed Steve Mnuchin Secretary – has published its response to President Trump's “core principles” in a 149-page report.

Why no CHOICE can still be good for investors

As is often the case in politics, diversion is part of the process. While the CHOICE Act is working its way through the traditional channels, we believe the real catalysts for change will come from the Treasury report.

Unlike the CHOICE Act, many of the Treasury’s proposals do not need Congressional approval, and can be implemented through a simple change in regulatory interpretation. Personnel, in other words, is policy.

The most significant Treasury proposals for investors affect stress testing, the supplemental leverage ratio (SLR), the Volker rule and lending. Our view is that the proposals of the Treasury will create a healthier system, with a better balance of returns to providers of debt and equity to the US banking system.

For example, the report reduces short-term thinking by proposing stress testing and living will assessments every two years, instead of annually. More importantly, stress testing would become more predictable and less subjective to qualitative inputs.

Further, while the Volker rule began life at a modest 165 words (outlining its key points in just 40), it ballooned to over 900 dense pages during its implementation. The Treasury’s proposal for the Volker rule should reduce risk management costs for investors by increasing market capital. Likewise, the report also recommends increasing credit to the real economy, which should benefit the mortgage market.

Additionally, the report proposes international banking standards in order to synchronize the US/global capital and liquidity standards. This could benefit global SIFIs, as US banking agency standards are much more conservative than the international standards established by the Basel Committee or the Financial Stability Board.

Misdirection

Some commentators are likely to fixate on the binary outcome of the CHOICE Act passing through the Senate. However, as with all great tricks, the CHOICE Act appears to be the subtle sleight of hand that diverts attention away from what’s really going on. Through the changes suggested in the Treasury report, we believe the financial system will be healthier and investors happier.

Diesen Beitrag teilen: