NN IP: Neutral positioning on risky assets

Underweighting government bonds and beeing neutral on other asset classes, seems to be the right asset-strategy right now.

23.08.2018 | 15:33 Uhr

Last week we neutralized our last overweight on risky assets by bringing equity from a medium overweight back to its strategic weight. Being neutral is always a bit uncomfortable for an investment strategist or portfolio manager, as we are paid to generate views and take active positions. With neutral allocations we cannot add a lot of value for our clients. However, it is sometimes justified to take risk from the table and sit back for a while.

The US economy is still showing strong growth, while we have witnessed a soft patch of data during the last few months in Europe and EM, for example. High levels of business confidence, strong earnings, an acceleration of wage growth and easy lending standards provide sufficient confidence that the other regions will be able to catch up with the US somewhat later this year and keep global growth close to the current levels. However, the risk of growing protectionism also increases the risk of rising imbalances, as already reflected in the strengthening of the US dollar. Last week’s developments in Turkey and EM assets indicate once more how these imbalances can impact risk markets through rapid changes in investor sentiment.

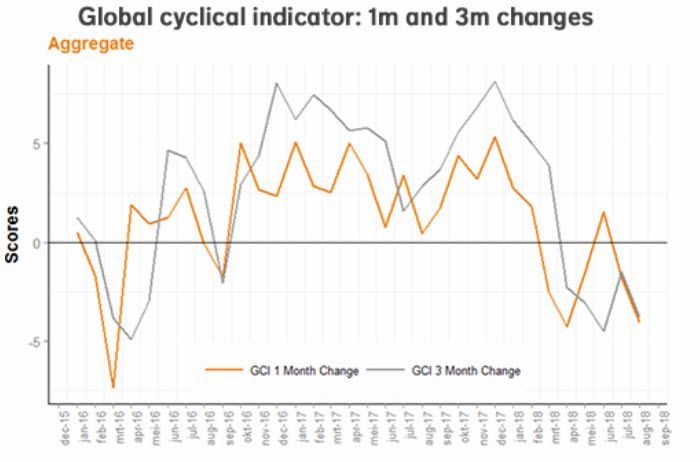

In the meantime, the softer economic data, especially outside the US, have depressed our cyclical momentum indicators and history has shown that the direction of change is often more relevant for markets than the level. At the moment, this negative cyclical momentum weighs heavily on our quantitative assessment of the outlook for equity, real estate, spreads and commodities. Meanwhile, with protectionism risk and the negative sentiment on EM on the table, we do not want to override the negative fundamental signal. However, our behavioural analysis and short-term market assessment provide some counterbalancing support which prevents us from becoming outright negative on any of the risky asset classes. So for the moment, we maintain a neutral stance on equity, real estate, spreads and commodities.

Based on our quantitative work, a neutral or even positive view on European government bonds would be justified. The negative cyclical momentum acts a positive signal for government bond performance. We hold on to the small underweight, though. The technical picture shows that yield levels are close to the lows of a trading range that held over the last 18 months. Furthermore, the risk aversion for European assets over the last few weeks (impact of Italy, Turkey) has probably dominated the normalization trend of monetary policy, leading to the current low level of yields.

Diesen Beitrag teilen: