Morgan Stanley IM: Is Low US Government Issuance Depressing US 10-Year Yields?

Markets were spooked mid-month as the Delta variant of COVID-19 surged across many parts of the globe. This made for a choppy period, but markets regained composure before month-end.

18.08.2021 | 07:20 Uhr

Here you can find the complete article.

The S&P 500 still managed to reach an all-time high in the second half and had a positive return of 2.4% (USD) . The US outperformed Europe, with the EuroStoxx 50 returning 0.8% (EUR)1.

Despite Olympic hosts Japan doing well in the medals table, the same cannot be said for its market with the Nikkei 225 down -5.2% (JPY)1, almost flat YTD. However, the worst performer of major markets this month was China. Having already underperformed relatively throughout 2021, this month’s market rout pushed the MSCI China Index (USD) down -13.8%1. US-China relations deteriorated and China asserted a regulatory crackdown, which included Chinese technology, as well as private tuition companies. The VIX remains low at 18.22 and only reached 22.22 during the mid-month jitters2.

The path forward for US rates

The US 10-year Treasury yield continued its move down from a seemingly low 1.5%3 at the end of June, to 1.2%1 as of 31 July 2021. This is counter-intuitive because last month’s Federal Reserve dot plot for 2023 to now, includes two rate hikes. Furthermore, in July the Federal Open Market Committee (FOMC) continued to suggest the Fed is moving towards announcing tapering plans, probably in late 2021.4

One explanation for the drop in yields is the normal seasonal decline in July/August US Treasury issuance. In addition, this year the US Treasury has benefitted from having raised substantial funds last year, not all of which have been spent, further reducing required issuance now. By maintaining bond purchases at the same level whilst issuance is down, the Fed is temporarily easing monetary policy. This puts significant downward pressure on yields. Once issuance and therefore the supply shortage eases, we expect rates to resume their move up. Importantly, however, the shortage of US debt may be exacerbated in the near-term by the debt ceiling that came into effect on 1 August, which limits total US debt issuance to its aggregate level as of 31 July 2021. It is extremely likely that the debt ceiling will be raised. Until then, US debt issuance is likely to be subdued and rates may struggle to rise in the face of continued Fed bond buying.

The start of a new capex cycle?

We are seeing an increase in capex that we expect will continue. Both the CEO Confidence Survey5 in the US (lead Q4) and the Euro Area Business Climate Indicator (lead Q1)6 are up. A vigorous capex cycle in this low interest rate environment, could have a significant multiplier effect, driving up hitherto stagnant economic productivity and economic growth. Moreover, a capex increase has typically led to a pick up in loan demand. Banks could decide to finance these loans by pulling reserves currently sitting idly in central bank accounts and lending these out to the real economy. This is likely to raise the “velocity of money” with concomitant upward pressure on both inflation and interest rates.

Investment Implications

We continue to be constructive with respect to global growth. Given the recent low volatility environment, we have been fine-tuning our portfolios by raising equities slightly, to ensure that our portfolios remain in line with their respective volatility targets. That said, amidst consensus optimism, we are considering how long the low volatility environment is likely to persist. As discussed in our last outlook, we are keeping a keen eye on any catalysts. These range from inflation to anti-trust policy, US-China tensions to virus variants, any of which may upend the current low volatility and trigger a spike.

In July, from a tactical stand point, we trimmed Financials and below we describe the rationale for this change:

Financials

We remain overweight Financials and have been since November 2020, in keeping with our cyclicals theme and tilt to value. However, we trimmed our position in July to take some profit. We implemented the position last November, in anticipation of a synchronised return of global growth, with banks amongst the highest sector beta of earnings to global GDP growth. At the time, valuations were also depressed in absolute terms. However, now the sector appears to be slightly expensive.

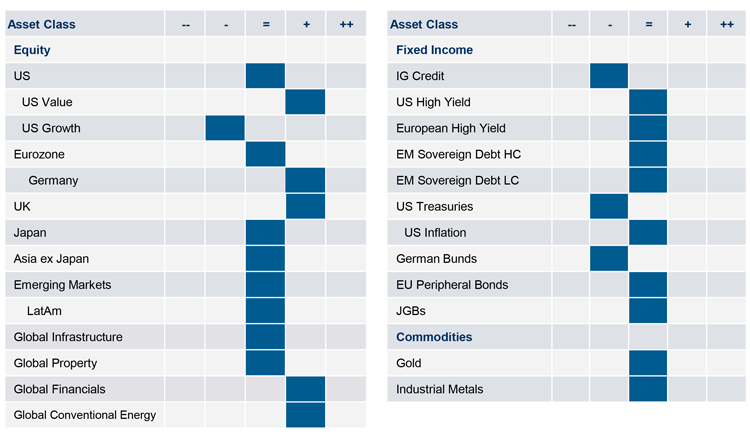

Tactical positioning

We have provided our latest tactical views below:

RISK CONSIDERATIONS

There is no assurance that the Strategy will achieve its investment objective. Portfolios are subject to market risk, which is the possibility that the market values of securities owned by the portfolio will decline and that the value of portfolio shares may therefore be less than what you paid for them. Market values can change daily due to economic and other events (e.g. natural disasters, health crises, terrorism, conflicts and social unrest) that affect markets, countries, companies or governments. It is difficult to predict the timing, duration, and potential adverse effects (e.g. portfolio liquidity) of events. Accordingly, you can lose money investing in this portfolio. Please be aware that this strategy may be subject to certain additional risks. There is the risk that the Adviser’s asset allocation methodology and assumptions regarding the Underlying Portfolios may be incorrect in light of actual market conditions and the Portfolio may not achieve its investment objective. Share prices also tend to be volatile and there is a significant possibility of loss. The portfolio’s investments in commodity-linked notes involve substantial risks, including risk of loss of a significant portion of their principal value. In addition to commodity risk, they may be subject to additional special risks, such as risk of loss of interest and principal, lack of secondary market and risk of greater volatility, that do not affect traditional equity and debt securities. Currency fluctuations could erase investment gains or add to investment losses. Fixed-income securities are subject to the ability of an issuer to make timely principal and interest payments (credit risk), changes in interest rates (interest-rate risk), the creditworthiness of the issuer and general market liquidity (market risk). In a rising interest-rate environment, bond prices may fall and may result in periods of volatility and increased portfolio redemptions. In a declining interest-rate environment, the portfolio may generate less income. Longer-term securities may be more sensitive to interest rate changes. Equity and foreign securities are generally more volatile than fixed income securities and are subject to currency, political, economic and market risks. Equity values fluctuate in response to activities specific to a company. Stocks of small-capitalization companies carry special risks, such as limited product lines, markets and financial resources, and greater market volatility than securities of larger, more established companies. The risks of investing in emerging market countries are greater than risks associated with investments in foreign developed markets. Exchange traded funds (ETFs) shares have many of the same risks as direct investments in common stocks or bonds and their market value will fluctuate as the value of the underlying index does. By investing in exchange traded funds ETFs and other Investment Funds, the portfolio absorbs both its own expenses and those of the ETFs and Investment Funds it invests in. Supply and demand for ETFs and Investment Funds may not be correlated to that of the underlying securities. Derivative instruments can be illiquid, may disproportionately increase losses and may have a potentially large negative impact on the portfolio’s performance. A currency forward is a hedging tool that does not involve any upfront payment. The use of leverage may increase volatility in the Portfolio.

Diesen Beitrag teilen: