Janus Henderson Investors: Winners and losers from the falling oil price

Daniel Sullivan, Head of Global Natural Resources, discusses the recent oil price movements and its implications for resources companies.

17.06.2020 | 08:09 Uhr

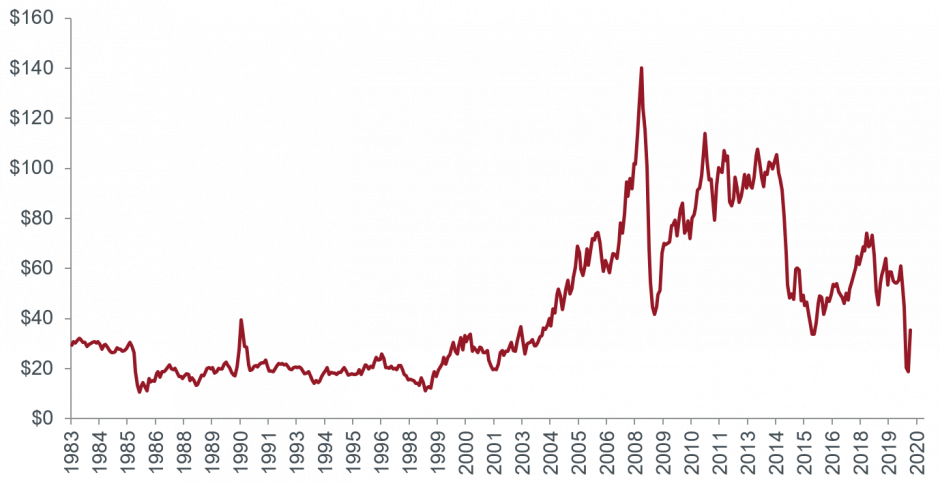

While oil has had nine major downturns in the past 35 years, the latest has been nothing short of spectacular. COVID-19 and the ensuing lockdown measures to control it have led to the destruction in demand for oil, resulting in the oil price adjusting to dramatically lower demand levels.

Chart 1: West Texas Intermediate Oil price (per barrel)

Source: Bloomberg, Janus Henderson Investors as at 29 May 2020.

Compounding this situation has been the untimely failure of OPEC+ to maintain production discipline, with supply ramping up in March while demand fell away. Broadly, the impact on the oil price has been a drop of a half to two thirds, from US$60 per barrel to US$20.50 at the end of March. There has since been an extraordinary market recovery, with oil trading up 88% in May to US$35.50. At the time of writing in early June, the oil market has now had its worst (-54%, March) and best (+88%, May) months in the past 37 years. Both of these price moves are nearly double the prior records (-32% in Oct 2008, and +45% in Sep 1990).

The shale oil revolution has seen the re-emergence of the United States as a major oil producer and has helped lead to the oversupply that has broken the market balancing function of OPEC+. US producers, having borrowed heavily in recent years were reluctant to cut production and even hit record output of 13 million barrels of oil per day at the end of February, leading to April’s historic negative WTI oil price (-$39) due to a shortage in storage facilities.

Advocates of the ‘peak oil’ theory (who contend that conventional sources of crude oil globally have already reached or are about to reach their maximum production capacity and will diminish significantly in volume by the middle of this century), so vocal in recent years, were resoundingly silenced as the market was awash with oil, seemingly with no one to use it and nowhere to store it.

Who are the losers?

The collapse in the oil price significantly impacted the whole oil supply chain, from producers and suppliers, to integrated majors and refiners. The largest sector hit has been oil services, which provides the specialist drilling, fracking and other field activities. Some exploration and production (E&P) shale producers will not be drilling or fracking in Q2 2020 in response to the oil price collapse.

The normally more stable and less volatile midstream and infrastructure sector that provides oil gathering/transportation services has also been impacted by lower volumes, reducing their revenues.

More broadly in the energy sector, the global liquefied natural gas (LNG) market has seen a material price decline, with recent spot sales below cost. Many normally reliable customers have been looking to cancel deliveries due to low end-market demand. The much-touted next wave of proposed LNG projects may need to be delayed.

We are now seeing the self-correcting nature of a commodity market at work, with very low prices rapidly driving cuts to production and growth activities. Having only recently restructured their businesses to cope with the fall in prices from US$100 to US$50-60 per barrel, oil producers are now scrambling to adjust again. The first transition was long and painful as denial and inertia slowed the rate of restructuring required to achieve costs around the US$40 per barrel level. This cycle, with oil collapsing to US$20 per barrel so quickly, has prompted a very rapid response from the industry. Cutbacks to production are helping balance the market and as demand recovers, oil has already recovered to more than US$35 per barrel. This prospect will provide a path to survival for those companies that were not too highly exposed to debt and high cost production methods.

Following OPEC+’s announced cuts of approximately 10 million barrels of oil equivalent (MMboed), to-date non-OPEC+ oil producers have cut their capital budgets between 30-40%, with production declines in the range of 10-20% to follow.

Who are the winners?

While lower fuel prices would normally cut costs for households and fuel-burning industries like aviation, in this instance the lockdown restrictions have meant limited benefits to consumers and businesses. This will naturally unwind as the COVID-19 pandemic is brought under control, but demand for oil could be lower in the longer term given the severe impact to economies, businesses and individuals.

Near-term beneficiaries have been North American pure gas producers that have seen New York Mercantile Exchange (NYMEX) gas prices rise on the back of lower by-product gas production due to lower shale basin activity.

Other winners have been companies that provide oil storage capacity to deal with near-term excess oil that cannot be sold. As a result, oil shipping companies that provide crude or refinery product tanker capacity for offshore storage have been in strong demand.

Will the environment be another winner?

The sustainable energy transition required to meet net zero emissions by 2050 could see a rapid boost as the super majors scramble to find solid energy investments with long life and less cyclical exposure to the oil price. Previously, renewable generation assets earning 7-10% were seen as sub-standard against hoped for 15%+ returns from oil and gas. Capital previously planned for short-cycle oil shale projects could see investment flows rapidly switch over to longer duration stable renewable utility investment.

Governments, directly or indirectly, influence more than 70% of global energy investments and investing in decarbonisation arguably achieves two objectives; stimulating job creation and addressing climate change. The fall in fossil fuel prices also affords policymakers the chance to reduce and reallocate fossil fuel subsidies towards competitive renewables. Beneficiaries of this megatrend include renewable energy developers and producers, wind turbine manufacturers, battery companies and renewable diesel producers. The impact will also be felt in several metal markets. Huge amounts of copper will be needed for electric vehicles and electricity networks. Battery raw materials such as nickel, cobalt and lithium stand to benefit in the transition from internal combustion engines to electric vehicles.

Conclusion

Lower commodity prices for producers means cheaper input costs. Looking specifically at the agriculture sector, lower gas prices are positive for fertiliser producers, for example, and lower fuel costs benefit companies involved in the transportation of agricultural output. In mining, lower oil prices lead to better economics for bulk mining of iron ore, copper and gold. With China’s economy restarting, demand for resources will start to build once again.

A possible permanent reset in demand post COVID-19 and acceleration in renewable energy sources will make it a trying time for all but the best of the companies in the energy sector. While lower oil prices reduce input costs, like economic stimulus, it should benefit more uniformly rather than provide any one company with a competitive advantage.

Glossary:

OPEC+: The coalition of the 14 OPEC members nations and 10 other oil-producing nations.

Super majors: BP, Chevron, ExxonMobil, Royal Dutch Shell, Total.

Diesen Beitrag teilen: