Janus Henderson: Tail risk report

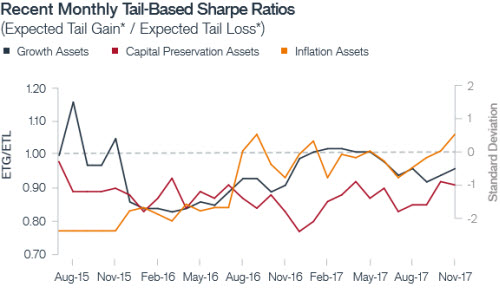

Myron Scholes, Chief Investment Strategist, and Ashwin Alankar, Global Head of Asset Allocation and Risk Management, present their latest tail risk report. This is an asset class outlook based on potential tail gains and losses.

21.11.2017 | 13:24 Uhr

Inflatio Appearing on the Red Carpet

The option markets continue to signal new life for inflation, reversing its beningn outlook, and showing signs of moderate price pressures going forward. Moderate is the operative Word, as moderate inflation allows the federal reserve (Fed) to continue on its path of gradual normalization.

Gradual policy normalization removes a significant source of left tail risk caused by central banks draining liquidity too aggressively. Consistent with this, our option-implied signals do not show much concern about large downside risk brewing in the equity markets.

Nevertheless, we do see rates heading higher and bonds have become the most unattractive asset class. Longer maturity bonds look less attractive than shorter maturity bonds from the perspective of their expected "tail-based" Sharpe rations, which are defined as the expected upside to expected downside. in other words, we see the interest rate curve steepening.

Laden Sie sich den vollständigen "Tail risk report" hier herunter.

Diesen Beitrag teilen: