Schroder's: Do Singapore REITs still possess long-term value?

Globally, real estate investment trusts (REITs) have become a popular way for investors to invest in property while at the same time receiving an income. This is particularly true in Singapore.

10.04.2017 | 13:12 Uhr

Singapore has developed into a hub for REITs in Asia ever since CapitaLand Mall Trust became the first one to launch back in 2002. However, now that the US Federal Reserve is raising interest rates, income-generating investments such as REITs have received little interest.

This is generally because as bond yields rise, the yield difference between a ‘safer’ bond and a more ‘risky’ income stock (normally referred to as the ‘yield spread’) narrows and thus becomes less attractive.

But if we take a look at longer-term performance and see how REITs in Singapore compare to the broader equity market, we can see that they could still have a role to play in investors’ portfolios over longer time horizons and for anyone looking for a source of sustainable income.

Patrick Brenner, Schroders' Head of Multi Asset Investments, Asia said: "Given the advantageous tax structure of REITs, they could be an important component of an income-oriented strategy. However, it is a broad category and different sub-sector REITs behave differently in a market cycle."

"For example, REITs with a larger exposure to the consumer staples sector tend to perform better during a slowdown, while REITs with a bias towards the discretionary or industrials sector will more likely move in tandem with economic cycles."

"Therefore, it is important for investors to distinguish and understand the true exposure in their REITs holdings.”

How do they work?

A REIT is a company that owns or finances income-generating real estate. This can come in an array of different forms of property, from commercial (office space) to retail (shopping malls) or industrial (warehouses & factories).

As a listed entity on a stockmarket it is traded like any other security and their structure allows investors to invest in portfolios of these types of large-scale properties. In return, investors receive a stable stream of income in the form of dividends paid out.

These payouts are usually upward of 90% of the REIT’s distributable net income. In many countries these payouts can be twice a year but for many REITs in Singapore, dividends are paid out quarterly.

REITs vs traditional bricks & mortar

Investors’ natural instinct is to gravitate towards investment in a property. No doubt there are advantages to owning a property outright but the upshot is that the comparative benefits of REITs are often overlooked.

These can include the ease of buying and selling a liquid security on a daily basis, whereas selling a physical property can take a period stretching from weeks to months if you wish to access the capital tied up in it.

Why should investors think about REITs?

This mainly comes down to the long-term returns that can be gained from reinvesting dividends earned back into the market. Utilising the power of compounding, the effect of dividends on overall performance is often understated.

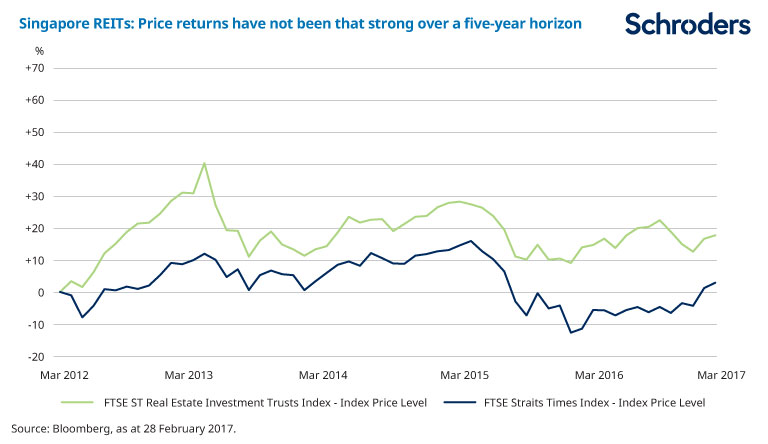

For example, the benchmark FTSE ST REIT Index (FTSREI) in Singapore has returned +19.7% over five years on a purely price return basis versus the broader Straits Times Index’s +3.2% gain.

Past performance is not a guide to future performance and may not be repeated.

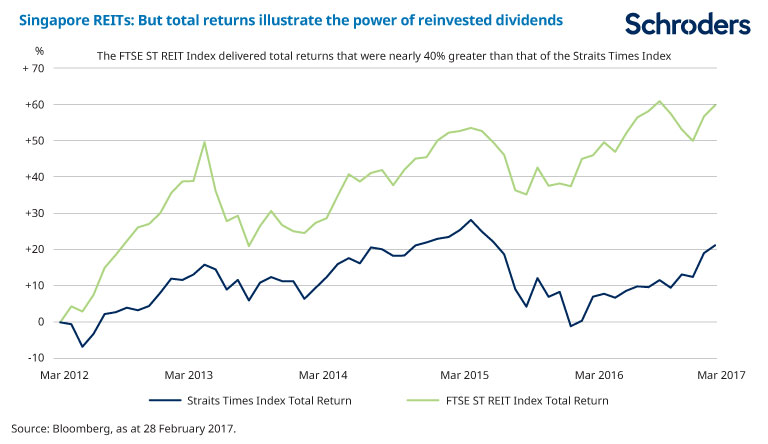

However, if we take into account reinvested dividends and look at this in terms of total returns, then the FTSREI’s numbers are that much stronger – returning just over +60% over five years against a rather less impressive +19.2% for the STI (see below).

The FTSREI’s current dividend yield is also at an attractive level of 6.2% against the STI’s 3.5%.

Past performance is not a guide to future performance and may not be repeated.

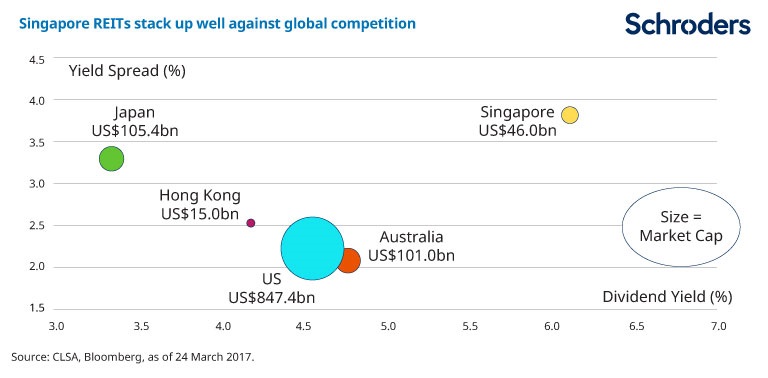

Furthermore, REITs in Singapore also offer a dividend yield that still possesses a significant yield spread (which we mentioned earlier) over its own government’s 10-year bond yield. Comparing it to other REIT markets globally, on a dividend yield basis, it has also performed well.

Of course, all this should come with the caveat that all REITs are different and investors should focus not only on the yield of a REIT but also a host of other factors – most of which will determine its ability to sustainably keep providing income. And as with all investments, capital is at risk.

Factors to look out for include low gearing (a measure of how much debt a company has and therefore its future ability to pay dividends), whether it has been able to grow dividends uninterrupted and the strength of its cash flows – which allow it to maintain dividends without borrowing to fund payouts. It also goes without saying that which sub-sector the REIT operates in, and the outlook for it, is equally important.

Long-term solution?

REITs are in fact a popular investment structure and these listed entities exist in up to 38 countries globally, including all the major developed markets. As a source of income over the long term, there could still be an argument for investors to consider REITs as part of a well-rounded and comprehensive portfolio that serves goals over longer time horizons.

In a recent BBC report, a study by The Lancet suggested that South Korea is likely to be the first country where life expectancy will exceed 90 years by 2030. However, this steady uptick in life expectancy is a global trend as better healthcare becomes available.

At the same time, financing a comfortable retirement is challenged by a rising cost of living and possibly an extended period of low returns. This need to consider REITs is particularly relevant as investors’ natural instinct is to focus on the short-term noise of the market and ignore the long-term financing needs that retirement planning requires.

Showbhik Kalra, Schroders' Head of Intermediary & Product, Asia Pacific said: “Physical real estate has long been the favoured option for most investors. There is growing evidence that just a physical allocation to real estate is no longer the most efficient use of capital from an investment perspective."

"For many investors, a physical allocation to real estate is often characterised by a lack of sufficient diversification, with too many assets in one city, region, country or sub-sector."

"Additionally, as investors analyse their existing real estate allocations and think about the future, we believe that liquidity will be an increasingly key consideration. We question the benefit of reduced volatility from a physical allocation to real estate if you cannot redeem funds when required."

"The exact composition of an investor’s real estate portfolio will depend on their particular needs. However, we believe that with a blend of physical and listed real estate, investors could experience improved long-term returns when compared to a more traditional approach to real estate.”

Please note that past performance is not a guide to future performance and may not be repeated. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. Exchange rate changes may cause the value of any overseas investments to rise or fall.

Den Artikel finden Sie hier.

Diesen Beitrag teilen: