Janus Henderson: Low carbon investing - win/win?

Low carbon is an important feature of our investment approach: the Janus Henderson Global Sustainable Equity Strategy has been low carbon for 28 years. There is a clear moral imperative to transition to a low carbon economy – but does it also make investment sense?

08.05.2019 | 11:04 Uhr

In crisis: cost of natural disasters

It is hard to overstate the importance of the role played by fossil fuels in the history of economic development and social progress. We are now at the stage, however, where the costs are starting to outweigh the incremental benefits. Climate change, air pollution and plastic waste are all reaching crisis levels.

The Paris-based International Energy Agency recently reported sobering news that global energy demand had risen by 2.3% in 2018, met mostly by fossil fuels, with global carbon dioxide levels rising to a record high.

Areas such as the European Union and the UK saw emissions decline, while China, the US and India saw the largest increases, prompted by 2018’s unusual weather patterns that resulted in more demand for air conditioning in the summer and heating in the winter. An increase in renewable power generation of 7% in 2018 was not able to keep up with demand, meeting only 45% of global electricity demand growth. The Climate Change Forum, hosted in Dubai in February, strongly emphasised the crucial role of renewable energy as an economically attractive solution to many threats posed by climate change.

What makes economic sense for countries makes sense for our sustainable investment approach: we have long recognised the negative externalities associated with fossil fuel industries and our strategy has adopted a low carbon approach since it was launched in 1991. Importantly we believe it makes great investment sense to go fossil-free today, despite the fact it will take many decades to transition to an entirely low carbon economy. In fact we view low carbon investing as a win/win proposition.

The reason is basic economics – the substitution effect. Over the last five years, the price of renewable energy technology has declined by as much as 80%, so that wind and solar are now the cheapest forms of power generation in many parts of the world; and this is without subsidies. Batteries have had similar cost declines and we are starting to see the emergence of competitively priced, long range electric vehicles. Even at the low price of US$50 per barrel, as we saw last December, oil cannot compete with electricity generated by wind or solar.

In crisis: air pollution

We regard the low carbon energy transition as a generational investment trend; and it is unstoppable. Investment in alternative technologies has continued, even during periods when fossil prices have declined. And higher fossil fuel prices contain the seeds of their own destruction – they simply accelerate substitution to lower cost, cleaner alternatives. It will not be a straight line but, looking a decade ahead, we feel confident in saying it will be a losing proposition to invest in fossil fuels. The time is close when we will be talking about ‘peak’ fossil demand and once that happens there will be structural deflation in fossil fuel industries.

Conversely, there is much growth and opportunity in new technologies that are providing solutions. We feel equally confident in predicting that there will be many more electric cars and far more renewable power in 10 years’ time.

In crisis: plastics & oceans

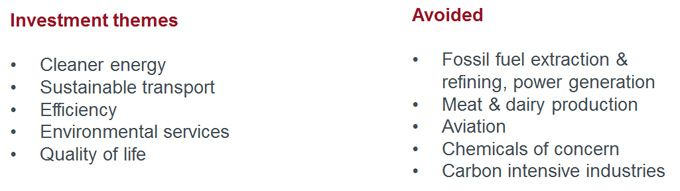

Low carbon investing involves much more than simply avoiding investment in fossil fuels. There are many industries that will be disrupted as we go through the low carbon energy transition. Similarly, investing in clean technology is much more than simply investing in wind and solar. There are many different types of companies providing a diverse range of technologies and solutions across the power, electrical, transportation, and infrastructure and real estate sectors.

Active, low carbon investment within a disciplined risk framework

Importantly, despite our highly active approach to low carbon investment, we are able to construct a well-diversified, global equity portfolio with balanced risk characteristics and a modest tracking error when compared to the MSCI World index. This is due to our multi-thematic sustainable investment framework, which provides us with a rich universe of companies to choose from.

There are multiple levels to our low carbon investment approach

As active investors we engage with the companies we invest in. This year, we are making carbon reduction a core element of our engagement programme, with the aim of encouraging our holdings to chart a path towards achieving carbon neutrality.

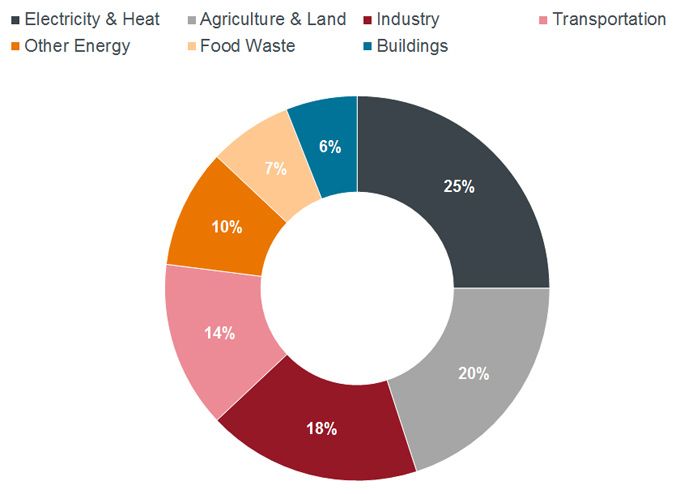

Sources of greenhouse gas (GHG) emissions

Sources: UN IPCC Fifth Assessment Report (2014). UN FAO Food Wastage Footprint (2013)

Source: Janus Henderson Investors, December 2018

We believe that only an active management solution can deliver a truly low carbon portfolio and, at the same time, specifically target investing in companies playing a positive role in the transition to a low carbon economy.

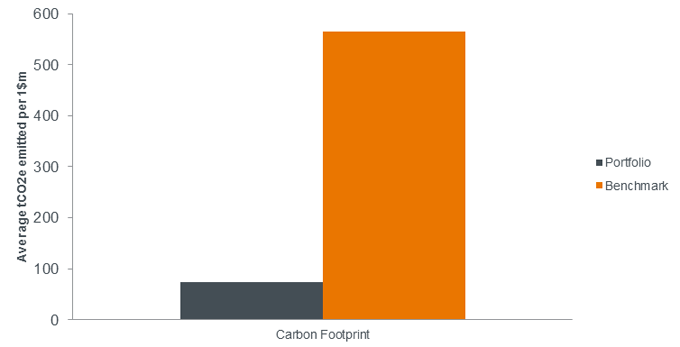

Measuring the strategy's carbon footprint

We define our carbon footprint as the direct and indirect operational emissions associated with the company and its value chain. Carbon footprint is measured in tonnes of carbon dioxide equivalent (tCO2e). The carbon dioxide equivalent (CO2e) allows different greenhouse gases to be compared on a like-for-like basis relative to one unit of CO2. According to Institutional Shareholder Services Inc. (ISS) climate change data, the strategy is considerably less carbon intensive than its benchmark (MSCI World Total Return Index) when looking at Scope 1, Scope 2 and Scope 3 emissions.

We are limited by the lack of data on the embodied carbon of the products in our strategy. But, due to the strategy's strategic focus on sustainability, in particular the fact that we do not invest in any fossil fuels or contentious industries, we estimate that performance would be significantly better were it possible to assess this.

When we compare the strategy to our benchmark index, we significantly outperform.

Source: Janus Henderson Investors, ISS Climate Impact, latest available data as at 31 December 2019. Benchmark: MSCI World Total Return Index.

Discover more about our favoured stocks in the following document:

Diesen Beitrag teilen: