Columbia Threadneedle: How the Australian canary shows this cycle is different

Rate hikes but no recession. Understand the lessons from Australia’s economic resilience and why they bode well for global growth.

19.01.2024 | 08:49 Uhr

- This cycle is different. Rate hikes around the world have not tipped economies over the edge.

- Balance sheet discipline in the private sector means the debt shock is greatest for the government sectors, not corporates.

- Australia is our canary in the coalmine: it has experienced one of the largest rate shocks…and yet the economy has continued to grow

- In 2024 rate cuts are now coming into view globally meaning the riskiest period for global earnings is now behind us

Across 2023 we had been using Australia as our “canary in the coalmine” to highlight why this cycle is different. Despite some of the shortest maturity mortgages in the world, Australia’s economy has hummed along nicely. Our canary remains singing and shows why meaningful recessions are unlikely.

If you were a client last year, the chances are you would have heard us talk about the significance of the Australian economy. We highlighted the country as an example to the world and why that meant global growth was intact.

Our rationale was simple: before the rate hikes started in 2022, many sell-siders highlighted Australia as a country particularly vulnerable to a rate shock. It had some of the world’s highest house price-to-income ratios and the shortest maturity debt stock.

The fact the Australian economy did not react as many northern hemisphere experts believed was something we talked about a lot. It was a key demonstration for us that this cycle is different and illustrated why forecasts of rate hikes pushing the world into recession were wrong.

Recapping our view – private sector discipline means this cycle is different

Typically, two conditions are required for a recessionary earnings per share (EPS) shock. Firstly, a boom time with wasted spend. Examples include corporates getting overexcited and ill-disciplined with wasted capex or an M&A spree that stretches balance sheets. Secondly, a change in conditions brings the boom times to an end. Typically this is via an interest rate shock. This starts the process of write-offs that show up as “non recurring and discontinued operations” in income statements and is the usual culprit behind big falls in EPS.

But this cycle has been different. In the lead up, global corporates were generally well disciplined. They did not go on shopping sprees or buy loss making companies at huge premiums. Instead, corporates did the sensible thing and termed out their bonds, stretching their debt profiles and limiting any impact from future rate rises.

Even households were generally fairly well behaved, with many using Covid windfalls to pay off debt. So when the hikes eventually happened not much went wrong (beyond a few headline names such as Silicon Valley Bank).

The difference this time is that the misallocation of capital has been on government balance sheets. Most countries, with the possible exception of Germany, have seen government debt levels increase with little improvement in infrastructure or economic output as a result. In contrast to the private sector, with ever more debt to service it is on government balance sheets that much of the pain from higher rates will be felt.

Australia as a microcosm

Australia encapsulated how a reasonably disciplined private sector can withstand even hefty rate shocks. We use it as an example due to the fact that mortgages tend to be floating rate or at most involve one-, two- or three-year fixes. There are no US-style 30-year mortgages to protect households and delay the pain. Effective mortgage rates therefore follow the Reserve Bank of Australia (RBA) policy rate very quickly.

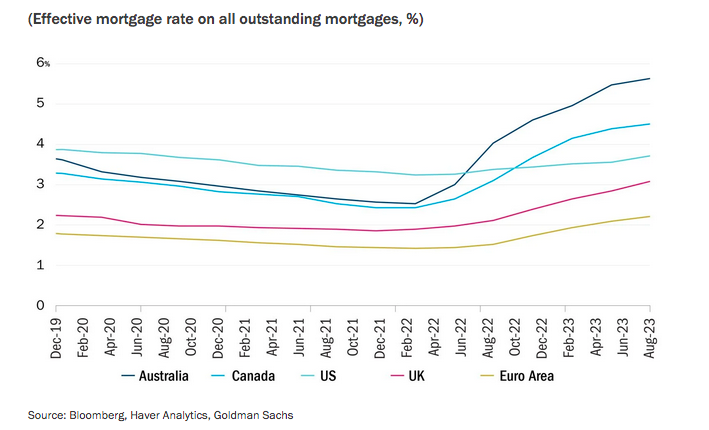

As a result, far more of the transmission from rate hikes has been felt in Australian households than in their US, UK or European counterparts (Figure 1 – upper chart). So those expecting long lags from monetary policy partly from the slow moving effective rates on legacy mortgages can simply press the fast forward button and look at what has happened in Australia.

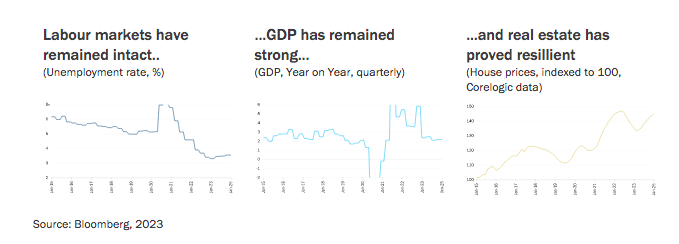

So when the rate hikes came, many were surprised that the macro impact on the Australian economy was fairly muted. A reader would have to use a magnifying glass to see substantive impact on indicators such as employment, output or real estate (Figure 1 – lower charts).

Figure 1: Australia has already absorbed the rate hike pain …

...without showing obvious impact

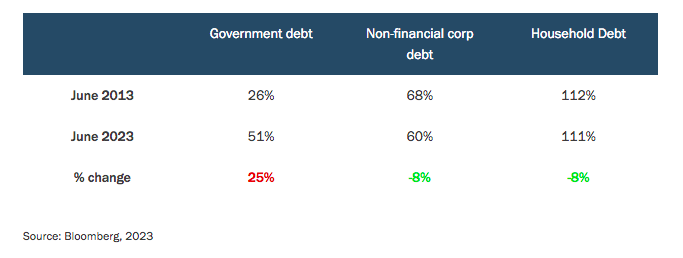

For us, a good part of the explanation comes down to the lack of a private sector credit boom over the preceding years. According to Bank for International Settlements (BIS) data, over the past 10 years private sector debt as not grown as a percentage of Australian GDP, and on some measures has been falling. By contrast, government debt has been expanding (Figure 2).

Figure 2: Australia debt as % of GDP

Global relevance of the Australian story

While other countries are all slightly different, in general our observation of private sector discipline versus government profligacy is broadly true around the world. Most famous is the case of the US, where government debt has grown from 96% to 110% of GDP since 2013, while private sector debt has remained unchanged at the aggregate level. Another example is the UK, where government debt has grown from 85% to 102% over the past decade, while the private sector has deleveraged really quite significantly (by around 30% of GDP).

Private sector discipline means corporates and households can – even in extreme cases such as Australia where the transmission is swift – absorb the pain from rate hikes in a reasonable fashion.

Many commentators failed to appreciate this shift in dynamics. They remain wedded to projections based on prior cycles where the misallocation of capital took place in the private sector. For us, the Australian economy has been a perfect illustration of why we do not think interest rate shocks – even after waiting for the transmission to kick in – will push economies over the edge. This was a big reason we stayed positive for 2023.

Of course, this is meant as a general statement. There are exceptions. Around the world government sectors will be under pressure. Governments grew used to low rates and let the debt pile grow. On top of this, certain parts of the private sector economy did have a boom and are indeed vulnerable to shifting patterns of consumer spending.

For example, smaller unlisted sectors often servicing highly discretionary spend is an example of an area feeling the pain from higher rates. Examples where we expect continued soft or weak data include home renovations and furnishings or certain types of domestic tourism – many of which typically tended to boom during the Covid pandemic. For those involved, this feels like a recession. But such sectors tend to be poorly captured in economic data releases and have low weights in listed markets.

In other words, for the headline indices the mix effect is still likely to work in equity indices favour.

Updating the view for 2024

Certain high profile commentators are still expecting meaningful labour market weakening, both in the US and the UK. They believe in the delayed impact of rate hikes. If they are right, corporate profitability would come under pressure, with sales volumes declining and knock-on effects to margins.

We think this is unlikely. The Australian canary is still singing and interest rates have not knocked that economy into a tailspin. So it is probably unlikely that other economies, which have the protection of longer-term mortgage profiles, will be knocked off course either.

While it is true that certain economies – Germany being the most obvious – have fallen into recession, for the most part these are technical reccessions that have no relevance for corporate earnings. Forward earnings on the DAX index, for example, are up over 10% on the year to 31 December 2023.

With the prospect of rate cuts growing in 2024, the riskiest phase is behind us. Globally our preference remains for larger companies less likely to be exposed to the sectors that remain vulnerable – even if we end up with more technical recessions.

This remains an unusual cycle but one which is good news for investors. Around the world, companies have been disciplined, with reasonable debt levels termed out in many cases. Consumers have remained employed and spending patterns have not changed much. So we are content to believe markets are in a sweet spot of falling inflation, decent sales volumes and high enough margins to sustain earnings across 2024. For now, we remain positive.

Diesen Beitrag teilen: