Robeco: Local elections in Sicily this weekend

While the arrest warrant for members of the Catalan Cabinet in Catalonia creates further tensions, Italy is watching the regional elections in Sicily over the weekend. The current strategy of Robeco.

06.11.2017 | 14:28 Uhr

Main market events

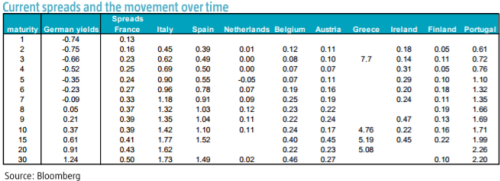

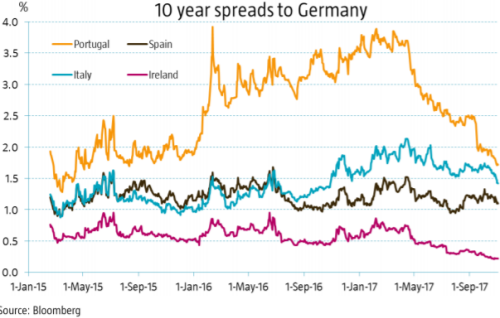

Periphery bonds continued to rally in the past week. Supported by less anxiety about Catalonia and by the credit rating upgrade of Italy, spreads over German Bunds tightened by 15bps for Italy and 10bps for Spain. While Portuguese bonds tightened another 10bps, Irish spreads remained stable. Italian bonds have returned 2.06% this year, Spanish bonds 1.42%, Portuguese bonds 11.96% and Irish bonds 1.06%.

Italy

S&P has nudged up Italy’s rating one notch to BBB, citing the country’s firming economic recovery on the back of rising private-sector investment and employment. Factors supporting the upgrade include improving economic prospects, expansionary monetary policy, reduced risks from its banking sector and expectations that the government would be able to make progress in reducing its “very high” government debt-to-GDP ratio. S&P analysts added: “The stable outlook balances the potential for more-robust economic growth and further improvements in the monetary transmission mechanism over the next two years, against persistent political uncertainties and their potentially adverse implications for economic and budgetary credit measures.”

On Sunday 5 November regional elections will be held in Sicily. This is the last electoral test before the general elections that will take place in early 2018 (no later than 20 May). For this regional election the centre-right candidate is slightly ahead in the polls.

Spain

After the unilateral declaration of independence by the Catalan parliament, the Spanish Court has ordered for the detention of eight members of the Catalan cabinet. The state prosecutor has asked for an arrest warrant for the four Catalan cabinet members that fled to Belgium (including Carles Puigdemont). The former cabinet members are accused of rebellion, sedition and misuse of public funds. In response, pro-independence organization have organized more demonstrations. The Bank of Spain has calculated that the economic impact from the tensions in Catalonia could range from 0.3% GDP to 2.5%, depending on the magnitude and timespan of the escalation. October data on PMIs and economic sentiment have shown little impact so far.

Robeco Euro Government Bonds

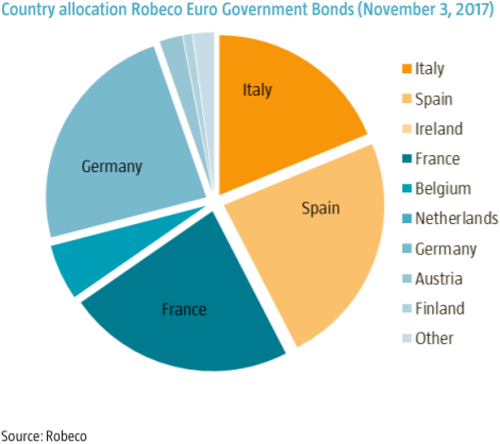

We took profit on part of our overweight position in Spain as Spanish bonds have recovered from the Catalan turmoil. We have also largely closed the underweight position in Italian government bonds. We remain wary of the political risks in Italy, but for now the ongoing ECB buying and the improving economic backdrop support Italian bonds. We maintained an underweight position in short-dated bonds in Italy, which offer no premium over short-dated Spanish bonds. On net the fund remains overweight peripheral bonds, concentrated in Spain. Despite the improvements in Italy, we still prefer Spanish fundamentals. Currently the fund is 42% invested in peripheral bonds compared to 40% in the index. Year-to-date the fund’s absolute return is 0.63%*.

* Robeco Euro Government Bonds, gross of fees, based on Net Asset Value, November 2, 2017. The value of your investments may fluctuate. Past results are no guarantee of future performance.

Diesen Beitrag teilen: