BNP Paribas AM: Japan elections and China’s Communist party congress

The winner of Japans elections is Primeminister Abe and his Liberal Democratic Party. This reduced policy uncertainty and leads into Monday’s rally in Japanese equities. On China’s Communist party congress was growth in focus. A market update from BNP Paribas.

26.10.2017 | 12:21 Uhr

Last week financial markets continued to price in hopes of US fiscal stimulus as the Senate passed a budget resolution that opened the door to tax reform. As a result, US equities touched record highs and yields on the 10-year US Treasury bond rose by 11bp. However, emerging market equities fell slightly, reflecting investor worries over higher core market yields and what to many is looking like an over-extended rally. The other big performer was the Japanese equity market, which rallied by close to 2% as investors started discounting a victory by Prime Minister Abe in Sunday’s parliamentary elections.

On the data front, the week was fairly quiet. Perhaps the most notable release was that of Chinese activity data for Q3. GDP growth, for instance, came in at 6.8% YoY, which was robust, but broadly in line with market expectations. As a result, the strong numbers did not suffice to provide a further boost China-linked assets, including emerging markets. The headlines from China’s 19th party congress, which runs from 18 until 24 October, were not incisive enough to move markets either.

JAPAN ELECTIONS: ABENOMICS STAYS ALIVE

PM Abe’s coalition, led by his Liberal Democratic Party, won a super majority in parliament after Sunday’s clear victory. This does not necessarily reflect overwhelming support for Abe. According to a poll over the weekend, for example, 51% of those polled do not want Mr Abe to remain as prime minister. Despite the limited political support for Abe, the pro-growth, pro-inflation Abenomics programme remains in place. Sunday’s election gains should also clear the way for BoJ Governor Kuroda to be reappointed. That should mean that unconventional monetary policy will continue; a consumption tax rise will go through; and further fiscal stimulus measures will be announced. Overall, the election outcome has reduced policy uncertainty in Japan, which was reflected in Monday’s rally in Japanese equities and the USD/JPY exchange rate.

CHINA: GROWTH IN FOCUS, BUT EXPECT KEY POLICY CHANGES AFTER CONGRESS

Another important political development in Asia was China’s 19th Communist party congress. President Xi Jinping did not mention a GDP growth target in his opening speech, which left some observers speculating that economic growth might have ceased to be a policy priority. Xi’s opening speech was certainly focused on improving the quality of future growth rather than chasing a set quantity of growth. While he did not mention a specific target, the goal of doubling China’s per capita real GDP by 2020 from 2010 remained firmly in place.

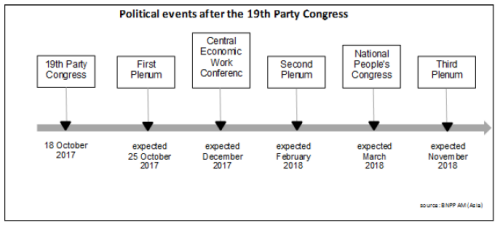

Our Macro Team reminded us that the party congress ratifies the government’s personnel changes, but not its policy changes. The political calendar in the chart above shows the sequence of events where policy decisions are likely to be taken. According to the party’s conventional practice, details of economic reforms and policies are announced at the Third Plenum of each five-year party congress. Thus, any policy changes that may come prior to this plenum, such as currency reform (e.g., a possible widening of the CNY-USD trading band), the expansion of the renminbi offshore market and increasing access by foreigners to the onshore market, will be the result of the decisions made before, not at, the current congress.

ECB MEETING: EXPECT A REDUCTION IN ASSET PURCHASES

The crisis in Catalonia deflected attention from this week’s ECB policy meeting at which the policy-setting council is likely to announce changes to its asset purchases for next year. Our Macro Team expects the council to announce a nine-month extension of the quantitative easing programme, with a reduction in the pace of purchases to EUR 25 billion per month and a removal of the easing bias to policy. It is not expected to set a clear end date for the programme. The council may try to camouflage the sharp slowdown in the pace of net purchases by shifting attention to the pace of gross purchases (i.e. including the reinvestment of funds as bonds already in the central bank’s portfolio mature).

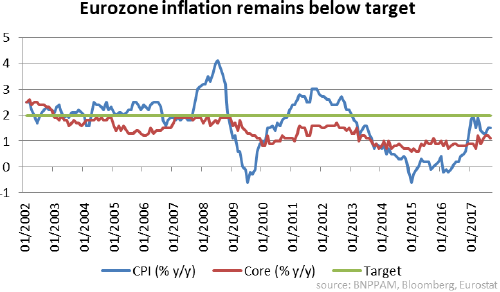

We continue to expect the council to apply firmer language in its guidance on the circumstances under which interest-rate rises would come into play, in other words, it would provide more information on the sequencing of the steps leading to the ECB exiting QE. The central bank already faces a shrinking pool of asset to buy from, so it makes sense for it to reduce the pace of purchases, while extending the length of the programme. The latter move and guidance on interest rates can be seen as the ECB seeking to avoid a de facto tightening in monetary conditions as it trims its liquidity-injecting purchases. While winding down QE as the eurozone economy recovers may look justifiable, inflation, as the chart shows, is still well below the ECB’s target and we believe the outlook does not yet warrant tighter policy.

ASSET ALLOCATION: CLOSED LONG US SMALL CAPS VERSUS LARGE CAPS

We closed our long US small caps versus US large caps trade at a profit last week. The main reason was our concern that the composition of the fiscal package in the US might end up being less friendly for companies than we had previously envisaged. In particular, we see greater risks that the expected fiscal expansion will be implemented through cuts in personal tax rather than through corporate tax cuts. If that is the case, small caps are not likely to benefit as much as we had expected.

We remain underweight duration, particularly in European bonds. If the ECB decides to materially reduce the pace of its asset purchases this week (as we expect), European bond markets may sell off, even if the programme is allowed to run for longer.

In currencies, we remain long USD versus EUR. Over the medium to long term, we see the USD strengthening, especially once the Trump administration starts implementing reforms and as the Federal Reserve proceeds with its monetary policy normalisation plan.

On real estate, European stocks have rallied significantly this year, while US real estate has lagged. This encourages us to maintain our overweight in US real estate as we expect this divergence to reverse over the coming months amid a pick-up in demand for US real estate.

Diesen Beitrag teilen: