Morgan Stanley IM: US Presidential Election - The State of Play

The GBaR team provides an update on its latest market views and asset allocation positioning.

23.11.2020 | 11:18 Uhr

Here you can find the complete article

With the US presidential election finally called, closely followed by encouraging news on vaccine progress, we may finally have reached a turning point on a number of factors creating uncertainty. We assess the state of play including the impact of a Biden Presidency for the economy and markets. We expect market volatility to decrease, which could provide an opportunity for an upward adjustment in risk allocations.

A Biden presidency: What is on the cards?

1. Co-operation over confrontation

Former Vice President Joe Biden appears to favour co-operation over confrontation, which is a likely positive for risk assets. International relations are likely to be more constructive and Biden has also vowed to “unify” the US, which if successful could be positive for markets, as could his moderate, bi-partisan track record with many decades of experience working across the aisle.

2. Likely lower policy risk for business

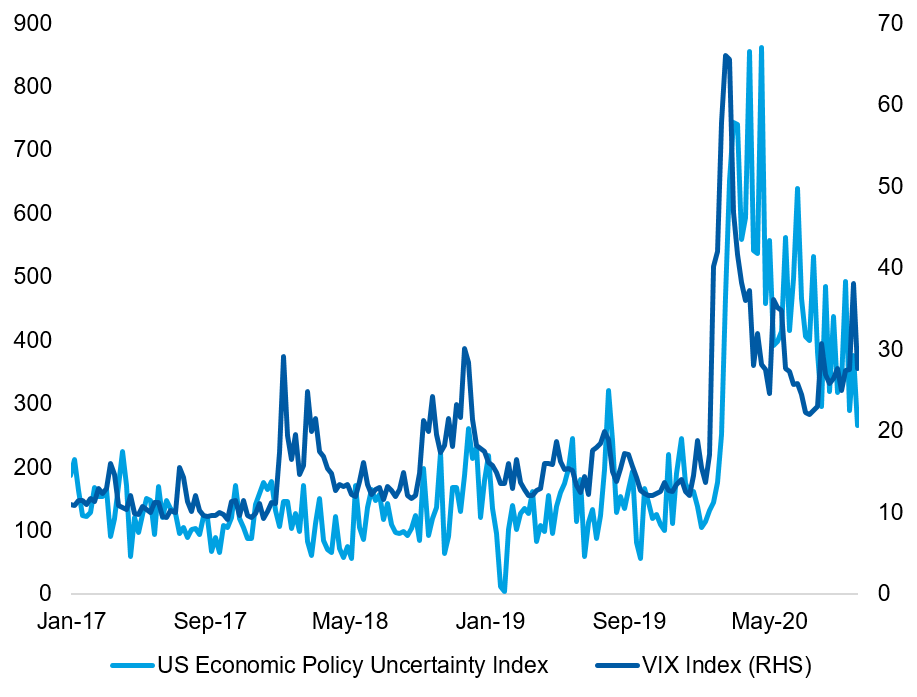

Joe Biden appears to have clear, well-defined policies, which could reduce uncertainty for businesses, encourage business investment and growth. They should support a decline in volatility. Even before the US election, the VIX declined steadily from a recent high of 40 in late October and now sits at 261.

Source: Datastream, MSIM, Bloomberg. 6 November 2020. The index performance is provided for illustrative purposes only and is not meant to depict the performance of a specific investment. Past performance is no guarantee of future results.

3. Two major catalysts: Fiscal stimulus and Biden’s COVID-19 strategy

We are watching closely for two major catalysts, which could prove positive for markets. Hopes for any long-awaited and much-needed fiscal stimulus faded as the election drew closer and as the Republican-controlled Senate and House Democrats failed to come to an agreement. The Democrats had been aiming for a package close to $2tn, but the likelihood now of Republicans maintaining their majority in the Senate, should moderate major fiscal stimulus. However since the election, Senate Majority Leader Mitch McConnell (R-KY) has stated that achieving an agreement for fiscal stimulus is the top priority, raising hopes of a deal. In fact, a split Congress could be a net positive for markets as a Republican Senate is likely to mitigate against major tax increases.

It should be noted however, that tech companies would not be protected by a Republican Senate majority - they may still be exposed to increased regulation and potential anti-trust action, as this is determined by the Justice Department, which reports to the White House. Moreover, the subject of tech anti-trust has bi-partisan support.

In addition, a credible approach to managing the virus is one of the indicators to go back into the market that we have been monitoring since the beginning of the pandemic. During his campaign, Joe Biden put virus control as a top priority and his transition team has already unveiled the members of his COVID-19 task force made up of doctors and academics. Biden’s determination to contain COVID-19 is a major long-term positive and is one of the signs we have been waiting for.

It is possible that policy actions addressing COVID-19 may not take place until 20 January 2021. Markets could run for now, but experience a temporary shock once closer to inauguration date as potentially “draconian” measures needed to control the virus become clear. However, given the virus escalation in the US and the urgency, this action may happen sooner at the State rather than Federal level. Therefore, in the near term a sharp escalation in cases and hospitalisations could add to market volatility should state-level lockdowns be re-introduced.

4. Biden will not have direct impact on policy until 20 January 2021

As expected, President Trump will not go without a fight, having made it clear that he will mount legal challenges on a number of States. The transition process is therefore unlikely to be easy for Biden and may distract from major tasks such defining policies and the review of around 4,000 political appointment positions. If this is the case, markets may have to look through a potentially chaotic interim period, especially if this is combined with an escalation of the virus, but with the anticipation of a steady hand, with clear direction and communication once Biden comes into office.

Vaccine hope

After gaining clarity on the election result, markets received further good news with a positive surprise on 9 November on the announcement of a vaccine with an expected 90% efficacy. The price action has been dominated by a rotation into cyclicals, with the Euro Stoxx 50 leaping over 6% on the news.2 Given the rapid progress being made on vaccine development, we remain confident that a vaccine will be available in 2021 – currently there are nine companies engaged in vaccine trials, with interim progress announcements expected to start coming out from November. This should solidify the containment of the virus and reduce the chances of its resurgence next year.

Sector opportunities

Against this backdrop, cyclical sectors and regions, many of which currently have good valuations, should benefit, as should those with green credentials. Joe Biden’s focus on clean energy investment should further stimulate growth. This should be positive for risk assets, but the benefit is likely to be very sector dependent. However, growth sectors and those exposed to regulatory and/or anti-trust risk, such as tech, are less likely to benefit.

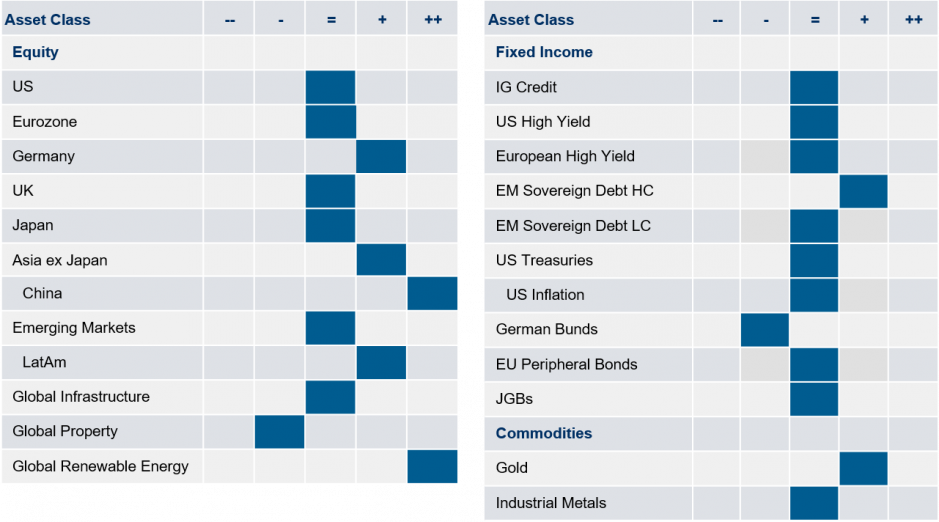

Investment positioning: Adding to risk assets as uncertainties start to fade

As election draws to an end, we expect market volatility to decrease and in anticipation, we became more positive on risk assets and started to increase our allocation to equities on 6 November. As discussed, a Biden administration should mean clearer, credible and consistent policies, including a strategy for tackling COVID-19, which should be positive for markets, whilst the potential for a Republican Senate should be favourable for business from a tax perspective. At the same time, Mitch McConnell’s signalling that fiscal stimulus is a priority before year end, bodes well for the economy. We believe, on balance a Biden presidency with a split Congress will be good for markets.

Source: MSIM GBaR team, as of 10 November 2020. For informational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy. The tactical views expressed above are a broad reflection of our team’s views and implementations, expressed for client communication purposes. The information herein does not contend to address the financial objectives, situation or specific needs of any individual investor.

1 Datastream, the VIX closed at 25 on 6 November 2021, down from 40 on 28 October 2021, the highest since 11 June 2021 when the VIX closed 41.

2 Euro Stoxx 50 returned 6% on 9 November 2020.

RISK CONSIDERATIONS

There is no assurance that the Strategy will achieve its investment objective. Portfolios are subject to market risk, which is the possibility that the market values of securities owned by the portfolio will decline and that the value of portfolio shares may therefore be less than what you paid for them. Market values can change daily due to economic and other events (e.g. natural disasters, health crises, terrorism, conflicts and social unrest) that affect markets, countries, companies or governments. It is difficult to predict the timing, duration, and potential adverse effects (e.g. portfolio liquidity) of events. Accordingly, you can lose money investing in this portfolio. Please be aware that this strategy may be subject to certain additional risks. There is the risk that the Adviser’s asset allocation methodology and assumptions regarding the Underlying Portfolios may be incorrect in light of actual market conditions and the Portfolio may not achieve its investment objective. Share prices also tend to be volatile and there is a significant possibility of loss. The portfolio’s investments in commodity-linked notes involve substantial risks, including risk of loss of a significant portion of their principal value. In addition to commodity risk, they may be subject to additional special risks, such as risk of loss of interest and principal, lack of secondary market and risk of greater volatility, that do not affect traditional equity and debt securities. Currency fluctuations could erase investment gains or add to investment losses. Fixed-income securities are subject to the ability of an issuer to make timely principal and interest payments (credit risk), changes in interest rates (interest-rate risk), the creditworthiness of the issuer and general market liquidity (market risk). In a rising interest-rate environment, bond prices may fall and may result in periods of volatility and increased portfolio redemptions. In a declining interest-rate environment, the portfolio may generate less income. Longer-term securities may be more sensitive to interest rate changes. Equity and foreign securities are generally more volatile than fixed income securities and are subject to currency, political, economic and market risks. Equity values fluctuate in response to activities specific to a company. Stocks of small-capitalization companies carry special risks, such as limited product lines, markets and financial resources, and greater market volatility than securities of larger, more established companies. The risks of investing in emerging market countries are greater than risks associated with investments in foreign developed markets. Exchange traded funds (ETFs) shares have many of the same risks as direct investments in common stocks or bonds and their market value will fluctuate as the value of the underlying index does. By investing in exchange traded funds ETFs and other Investment Funds, the portfolio absorbs both its own expenses and those of the ETFs and Investment Funds it invests in. Supply and demand for ETFs and Investment Funds may not be correlated to that of the underlying securities. Derivative instruments can be illiquid, may disproportionately increase losses and may have a potentially large negative impact on the portfolio’s performance. A currency forward is a hedging tool that does not involve any upfront payment. The use of leverage may increase volatility in the Portfolio.

Diesen Beitrag teilen: