Morgan Stanley IM: The Problem is the P not the E

US and European equities continued their upward momentum. The S&P 500 led the charge in developed markets as expected, reaching new all-time highs, returning 5.3% over the month (USD) and the Euro Stoxx 50 returning 1.9% (EUR).

14.05.2021 | 12:05 Uhr

Here you can find the complete article.

However, the Nikkei 225 lagged, ending the month slightly down, returning -1.3% (JPY)1. Volatility continued to subside, as reflected in the VIX which moved down to 18.6 by April month-end, close to its 5-year median and during the month reached its lowest level since before the pandemic1. This continued trend downward of the VIX and realised volatility comes against a backdrop of encouraging economic data releases.

US initial jobless claims were the lowest since the start of the pandemic at 553K2 and March retail sales reached 9.8%3, exceeding the expected 5.8%. The US and UK continued their positive trajectory in controlling the virus, given vaccine programmes and reopenings and now appear to be past the peak. In contrast, India is suffering a catastrophic escalation in COVID-19 cases, after a new variant emerged, though remarkably the market remains resilient.

Equity valuations - the problem is the P not the E: Equities are currently expensive, but valuations do not yet appear extreme enough relative to historical norms to qualify as a bubble, especially given strong earnings growth and current low interest rates. In particular, for example, the current 12-month forward PE for the S&P 500 is elevated at 21.7 compared to the 5-year median of 17.24. Strong growth in Q2 earnings could help sustain these high valuations in the short term. Generally, the earnings season has, in fact, been strong in the US and Europe, with the market “surprised” by how well large-cap tech has fared. Given the ample fiscal support and liquidity, we see limited downside risk for equities at this time. This constructive near-term outlook as activity normalises, may explain the recent decline in risk indices such as the VIX. That said, as we move into the second half of the year, potential US tax hikes should offset strong earnings growth and, if economic growth continues strong, the risk of central banks pulling back liquidity rises, making valuations even more stretched and increasing downside risk.

Geopolitical risk is rising - not falling: When Biden became President, there was some expectation that uncertainty would reduce. However, a number of geopolitical risks have flared up in recent months, including renewed tensions between the US and Russia. In addition, the Alaska summit in March underlined the increased tensions between the US and China. These tensions are not only related to economic issues, which may make them harder to resolve. We monitor geopolitical risk carefully, as this can disproportionately impact investor sentiment. We aim to act to help mitigate any drawdown should risks materialise from this or other factors.

Investment Implications

We increased our exposure to risk assets to maintain alignment of each portfolio to its volatility target. The reflation environment should continue to support risk assets in the short term – we favour equities over credit, with a pro-cyclical bias within equities. However, we continue to monitor risks which could disrupt our positive outlook of the economic recovery, including delays in vaccine rollouts - especially emerging markets, runaway inflation and geopolitical risks, amongst others.

We have made a number of tactical trades over the month, which we detail below:

Asia ex-Japan Equities

We initiated a small overweight to Asia ex-Japan in February, but moved back to neutral towards the end of April. This is in view of multiple near-term headwinds, most of which are emanating from China, the largest weight in the region and which has driven the underperformance this year. Whilst growth is stable in the region, we believe it is likely to lag compared to developed markets, partly due to vaccine access. US - China relations continue to deteriorate, with US sanctions on Chinese companies and more expected. In addition China’s liquidity is tightening.

US Value Equities

We continue to tilt towards cyclicals and value equities, which should continue to benefit from reopening and strong economic recovery, moving overweight value equities in mid-April. With respect to valuations, US value should outperform growth in view of the valuation gap and its relationship with real yields.

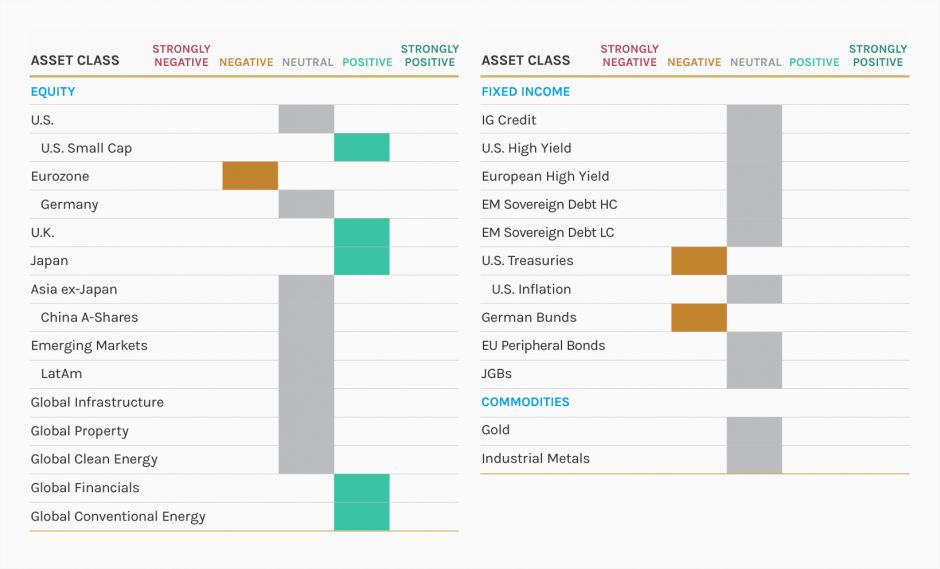

Tactical positioning

We have provided our latest tactical views below:

Source: MSIM GBaR team, as of 30 April 2021. For informational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy. The tactical views expressed above are a broad reflection of our team’s views and implementations, expressed for client communication purposes. The information herein does not contend to address the financial objectives, situation or specific needs of any individual investor.

Risk Considerations

There is no assurance that the Strategy will achieve its investment objective. Portfolios are subject to market risk, which is the possibility that the market values of securities owned by the portfolio will decline and that the value of portfolio shares may therefore be less than what you paid for them. Market values can change daily due to economic and other events (e.g. natural disasters, health crises, terrorism, conflicts and social unrest) that affect markets, countries, companies or governments. It is difficult to predict the timing, duration, and potential adverse effects (e.g. portfolio liquidity) of events. Accordingly, you can lose money investing in this portfolio. Please be aware that this strategy may be subject to certain additional risks. There is the risk that the Adviser’s asset allocation methodology and assumptions regarding the Underlying Portfolios may be incorrect in light of actual market conditions and the Portfolio may not achieve its investment objective. Share prices also tend to be volatile and there is a significant possibility of loss. The portfolio’s investments in commodity-linked notes involve substantial risks, including risk of loss of a significant portion of their principal value. In addition to commodity risk, they may be subject to additional special risks, such as risk of loss of interest and principal, lack of secondary market and risk of greater volatility, that do not affect traditional equity and debt securities. Currency fluctuations could erase investment gains or add to investment losses. Fixed-income securities are subject to the ability of an issuer to make timely principal and interest payments (credit risk), changes in interest rates (interest-rate risk), the creditworthiness of the issuer and general market liquidity (market risk). In a rising interest-rate environment, bond prices may fall and may result in periods of volatility and increased portfolio redemptions. In a declining interest-rate environment, the portfolio may generate less income. Longer-term securities may be more sensitive to interest rate changes. Equity and foreign securities are generally more volatile than fixed income securities and are subject to currency, political, economic and market risks. Equity values fluctuate in response to activities specific to a company. Stocks of small-capitalization companies carry special risks, such as limited product lines, markets and financial resources, and greater market volatility than securities of larger, more established companies. The risks of investing in emerging market countries are greater than risks associated with investments in foreign developed markets. Exchange traded funds (ETFs) shares have many of the same risks as direct investments in common stocks or bonds and their market value will fluctuate as the value of the underlying index does. By investing in exchange traded funds ETFs and other Investment Funds, the portfolio absorbs both its own expenses and those of the ETFs and Investment Funds it invests in. Supply and demand for ETFs and Investment Funds may not be correlated to that of the underlying securities. Derivative instruments can be illiquid, may disproportionately increase losses and may have a potentially large negative impact on the portfolio’s performance. A currency forward is a hedging tool that does not involve any upfront payment. The use of leverage may increase volatility in the Portfolio.

Diesen Beitrag teilen: