Morgan Stanley IM: Navigating Changing Correlations

The US led the rebound in risk assets during the last week of May. However, most markets ended the month flat.

28.06.2022 | 08:47 Uhr

Here you can find the complete article.

The S&P 500 returned 0.2% (USD), the MSCI Europe was down 0.6% (EUR) and MSCI Japan paused its downward trajectory of previous months, ending May up 0.9% (JPY)1 . The MSCI Emerging Markets Index returned 0.5%1. Energy continued to be the clear sector outperformer with the MSCI ACWI Energy index up 12.2%, on the back of slowly rising oil prices1. The US 10-Year Treasury yield appears to have finally settled, ending the month a fraction lower than in April, at 2.8% . The VIX moved down to end the month at 262.

The fall in the S&P 500 at the beginning of the month appeared mostly driven by multiple compression. Despite a bounce in the final week, we still believe though this is likely a bear market rally, due to increasing signs of deteriorating consumer confidence and slowing growth. We finally saw the correlation between equities and fixed income turn negative. Should equities fall, investors at least now may have somewhere to hide. Now that the correlation appears to have been restored, we are increasingly comfortable with fixed income and believe the decline in yields should stabilise. With tentative signs that inflation is plateauing, as we progress through the late stages of the cycle, we believe US investment grade credit should outperform high yield credit and equities, especially if recession risks rise. That said, we do not anticipate a US recession until 2H 2023.

Investment Implications

We have been keeping our powder dry, so we can move cash back into markets at opportune moments. We are already seeing opportunities in the fixed income space. In May we maintained our allocation to equities, but deployed cash to increase duration risk by allocating broadly to fixed income. Before the last week of the month, we increased equity exposure via futures, as options deltas had dropped. This is consistent with the team’s view that the market may be oversold in the near term. The subsequent rally in equities in the last week of May indicated our view was correct.

We have made the following tactical changes over May. The implementation of these is dependent on portfolio guidelines and some portfolios may not permit:

High Dividend, Low Volatility Equities

We added an overweight to high dividend, low volatility equities, through an ETF. This offers an attractive dividend yield from US equities, plus exposure to defensive and value sectors, which continue to trade at a discount to growth. The relatively low volatility and beta characteristics should mitigate the downside, in the event of further volatility.

US Equities Enhanced Value

We removed our position in an ETF and moved to Russell 1000 Value futures to take exposure to the value sector more broadly and make room for more focused allocations to other ETFs or mutual funds, for portfolios which have an allocation restriction.

Brazilian equities

We moved from overweight to neutral Brazilian equities. We had moved overweight in April, but the investment case is weakening. Terms of trade have likely peaked in the short term, while prospects for two key exports have deteriorated; soybean prices could come under pressure from higher global supply in 2022/23, while China’s continued zero-Covid policy is likely to hit iron ore demand.

Commodities

We have increased total exposure to commodities, for portfolios which permit, while changing their composition. Within this we have reduced gold, and added a position in an agriculture fund ETF, to gain exposure to agricultural commodity futures. We aim to hedge upside risks to agricultural commodity prices, due to supply disruptions from the conflict in the Ukraine, which is leading to growing food protectionism and rising input costs such as fertiliser, all of which pushes food prices higher.

Emerging Market Local Debt

We moved from overweight to neutral emerging market short-duration commodity-exporter high-yielder countries, implemented through a bond securities basket. Both the key drivers, real yield and terms of trade have deteriorated since we put on the position.

US 10-year Treasuries

We have removed the US 10-year Treasuries underweight. Inflation risks are more balanced, given tentative signs of stabilising wage growth, especially as the global growth outlook dims. Expectations of 50bps Fed hikes in the near term, with several 25bps hikes thereafter, are priced in, leaving little room for a hawkish surprise.

Investment Grade Corporates

We removed our US Investment Grade Corporates underweight and moved to neutral. After recent rates and spreads adjustments, risk-reward in future forward is more balanced as monetary tightening is largely priced in and we see tentative signs of sequential inflation plateauing. Even if recession risks are rising, our analysis suggests higher spreads can be offset by lower rates, leaving an attractive yield. At the same time, we maintained our underweight in European Investment Grade Corporates, as high duration of Investment Grade and compressed spreads are likely to result in poor total returns when yields/spreads rise.

The index performance is provided for illustrative purposes only and is not meant to depict the performance of a specific investment. Past performance is no guarantee of future results. See Disclosure section for index definitions.

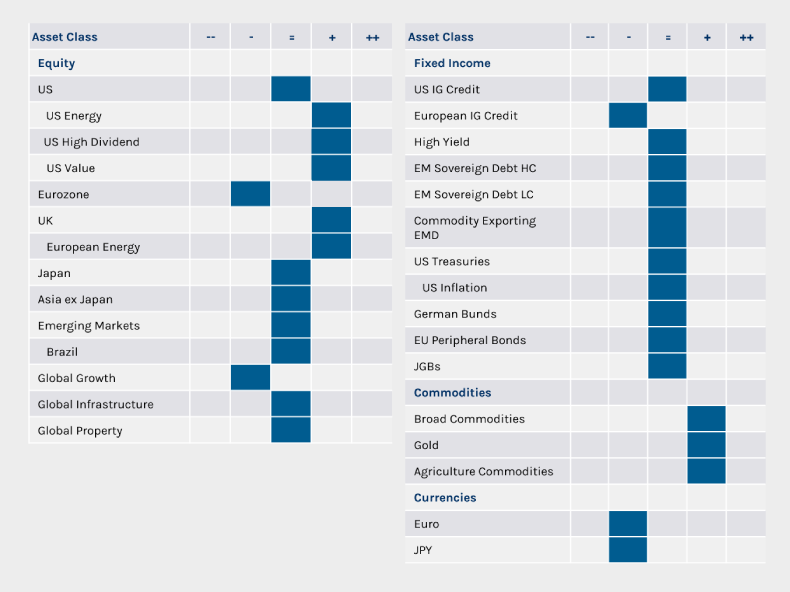

Tactical Positioning

We have provided our tactical views below:

Source: MSIM GBaR team, as of 31 May 2022. For informational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy. The tactical views expressed above are a broad reflection of our team’s views and implementations, expressed for client communication purposes. The information herein does not contend to address the financial objectives, situation, or specific needs of any individual investor.

RISK CONSIDERATIONS

There is no assurance that the Strategy will achieve its investment objective. Portfolios are subject to market risk, which is the possibility that the market values of securities owned by the portfolio will decline and that the value of portfolio shares may therefore be less than what you paid for them. Market values can change daily due to economic and other events (e.g. natural disasters, health crises, terrorism, conflicts and social unrest) that affect markets, countries, companies or governments. It is difficult to predict the timing, duration, and potential adverse effects (e.g. portfolio liquidity) of events. Accordingly, you can lose money investing in this portfolio. Please be aware that this strategy may be subject to certain additional risks. There is the risk that the Adviser’s asset allocation methodology and assumptions regarding the Underlying Portfolios may be incorrect in light of actual market conditions and the Portfolio may not achieve its investment objective. Share prices also tend to be volatile and there is a significant possibility of loss. The portfolio’s investments in commodity-linked notes involve substantial risks, including risk of loss of a significant portion of their principal value. In addition to commodity risk, they may be subject to additional special risks, such as risk of loss of interest and principal, lack of secondary market and risk of greater volatility, that do not affect traditional equity and debt securities. Currency fluctuations could erase investment gains or add to investment losses. Fixed-income securities are subject to the ability of an issuer to make timely principal and interest payments (credit risk), changes in interest rates (interest-rate risk), the creditworthiness of the issuer and general market liquidity (market risk). In a rising interest-rate environment, bond prices may fall and may result in periods of volatility and increased portfolio redemptions. In a declining interest-rate environment, the portfolio may generate less income. Longer-term securities may be more sensitive to interest rate changes. Equity and foreign securities are generally more volatile than fixed income securities and are subject to currency, political, economic and market risks. Equity values fluctuate in response to activities specific to a company. Stocks of small-capitalization companies carry special risks, such as limited product lines, markets and financial resources, and greater market volatility than securities of larger, more established companies. The risks of investing in emerging market countries are greater than risks associated with investments in foreign developed markets. Exchange traded funds (ETFs) shares have many of the same risks as direct investments in common stocks or bonds and their market value will fluctuate as the value of the underlying index does. By investing in exchange traded funds ETFs and other Investment Funds, the portfolio absorbs both its own expenses and those of the ETFs and Investment Funds it invests in. Supply and demand for ETFs and Investment Funds may not be correlated to that of the underlying securities. Derivative instruments can be illiquid, may disproportionately increase losses and may have a potentially large negative impact on the portfolio’s performance. A currency forward is a hedging tool that does not involve any upfront payment. The use of leverage may increase volatility in the Portfolio.

Diesen Beitrag teilen: