Morgan Stanley IM: Equity Market Commentary - August 2022

The epic battle between bulls and bears has raged throughout 2022. In his August TAKE, senior portfolio manager Andrew Slimmon makes the case that Mr. Market may be showing signs of optimism while Wall Street strategists remain overwhelmingly pessimistic.

26.08.2022 | 10:00 Uhr

Here you can find the complete article

Who Do You Listen To?

The battle between the bears and the bulls at the intersection of Wall and Broad appears as epic as ever.

In the bear corner are major Wall Street firms’ strategists.

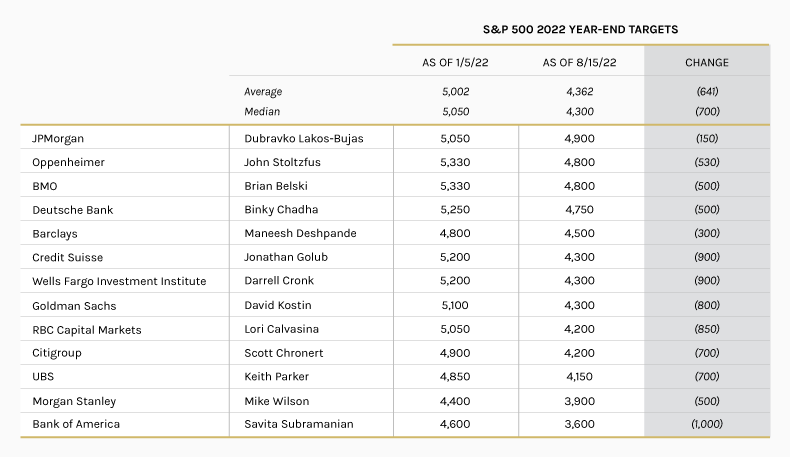

Chart 1 shows their beginning of the year 2022 S&P 500 year-end targets and those same targets as of August 15th.

Chart 1

Every strategist is more pessimistic today than they were at the beginning of the year.

With a median year-end target of 4,300 for the S&P, that’s a potential 2% return from where we sit today, as of August 22. This is certainly no reason to be anything but cautious.

- In many ways, the increasingly clouded macro picture explains the higher pessimism today versus the beginning of the year. Russia’s invasion of Ukraine and the protracted war’s impact on gas and food prices were certainly not on investors’ radar and is one of the many reasons why inflation is proving to be far stickier today than expected.

- As a result, the Fed has pursued a far more hawkish path, reminding us of the adage, “Don’t fight the Fed”.

- Not to mention, at an 18.8x forward P/E, the market does not appear all that cheap1

Clearly, a majority of strategists would consider this recent rally to be a “bear market rally”.

Meanwhile, over in the bull corner is … “Mr. Market”.

Despite all the negative headlines that are undoubtedly driving the bearish sentiment above, the market internals are flashing a far more optimistic tone.

- The S&P 500 has put in an awe-inspiring recovery since its June 16th low. The extent of the rally historically suggests far more than a simple “bear market rally.”

Consider:

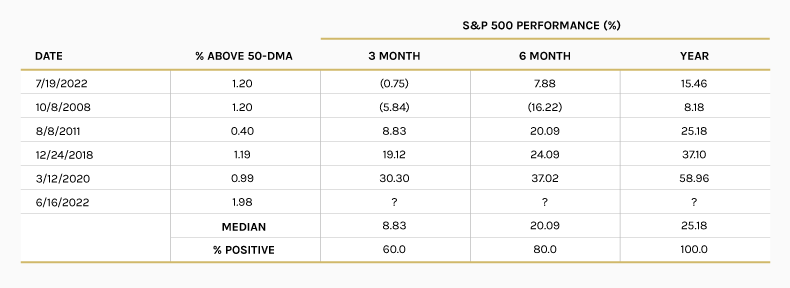

- By June 16th, the S&P 500 had faced a thorough washout. On that day, less than 2% of stocks were trading above their 50-day moving averages. Such extreme readings are quite bullish and reflect some level of maximum pessimism. In fact, Chart 2 shows the past occurrences since 1990 of similar sub-2% readings with their corresponding future returns.

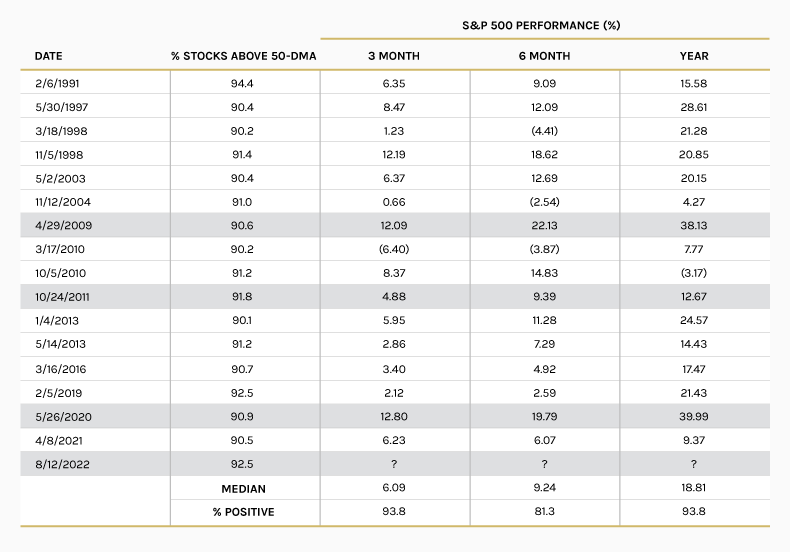

- Fast forward to August 14th and over 90% of the S&P 500 stocks traded above their 50-day moving average. Wow, what a turnaround!

Chart 2

Chart 3 shows the returns for the S&P 500 (since 1990) with a similar kind of broad rally.

Chart 3

- However, it’s not only the magnitude and breadth of the rally that is flashing a far more optimistic tone. Market leadership has shifted dramatically, and this is a very bullish sign.

Consider:

In the first half of the year, the best performing sectors relative to the S&P 500 (down -19.97% as of June 30) were energy (+51.39%), utilities (+19.37%), staples (+14.69%) and health care (+11.65%). The worst performing sectors were consumer discretionary (-12.53%) and technology (-6.60%).2

Makes total sense to me:

Energy and utility stocks have done well as inflation rises and demand continues. But as growth contracts, stocks that are sensitive to the health of the economy lose favor and defensives perform better. These include stocks of companies that produce items such as toothpaste, electricity, and prescription drugs.3

However, since the end of the second quarter, there has been a complete market leadership change. The best performing sectors relative to the S&P 500 (up +13.44% as of August 18) are consumer discretionary (+11.09%) and technology (+5.46%). Meanwhile the worst performing sectors are health care (-10.21%), consumer staples (-6.93%) and energy (-2.87%).2

Since 1962, stocks have delivered their highest performance during the early cycle, returning on average 20% per year during this phase. Consumer discretionary stocks have beaten the broader market in every early cycle since 1962.3

While it’s not surprising to see some weakness after such a strong move into overbought territory, could Mr. Market be sending a signal that we are at the beginning of a new bull market?

Or is this just a bear market rally head fake?

I guess it depends on whose corner you are in.

Diesen Beitrag teilen: