NN IP: Green shoots

Growth hopes overtake growth fears as March PMIs surprise to the upside, suggesting increased likelihood of a more pronounced cyclical recovery.

11.04.2019 | 11:36 Uhr

Only two weeks ago, disappointing European flash PMIs caused a shudder in financial markets, pushing equity markets down and Bund yields into negative territory. The story then was about growth uncertainties linked to global trade, China and Brexit. While the investment community is still awaiting a resolution of the US-China trade conflict and the UK’s departure from the European Union, it appears to have exchanged its growth concerns for growth hopes.

March PMIs surprise to the upside

The recent strength in risk appetite stems from an improvement in certain economic data in the US, the Eurozone and Asia. In particular, the March PMIs surprised positively. It is early days yet, and the better figures are far from conclusive, which is why we prefer to talk about green shoots. Nevertheless, a more pronounced cyclical recovery has become more likely over the past week. This is the main reason why we have moved to an overweight in global equities.

Contrary to the negative signal sent by the flash PMIs, the global composite PMI actually rose in March for the second consecutive month, which means that on a trend basis it has been more or less flatlining since December. This result stemmed from stability in the manufacturing PMI and a small increase in its service-sector counterpart. Meanwhile, new orders improved modestly, while the employment component continued to move sideways at a similar pace to the 2017 growth acceleration phase. The key takeaway is that on a global level, businesses are keeping their nerve. The longer this holds in the face of diminishing risks from trade, Brexit and other political factors, the better the chance that the global economy will emerge from its soft patch.

The most pronounced upside surprise came from China, where both the manufacturing and services PMIs came in stronger than expected and substantially higher than in February. We think it is too early to take this as conclusive evidence that Chinese policy stimulus has been effective. For quite a while, our view has been that Chinese domestic demand growth should bottom in the second quarter. In that sense, it is tempting to regard this as the first indication of a growth pick-up, but the data remain blurred by seasonal effects. Following the Chinese New Year, the March PMI is always stronger than in February. The magnitude of the improvement this year is in line with moves in previous years when the holiday took place around the same time. Nevertheless, it is worth noting that the Chinese PMI is back above the neutral 50 mark.

Global capex cycle may soon bottom out

Elsewhere in Asia, the Japanese, Korean and Taiwanese manufacturing PMIs remained below 50, although the latter two clearly improved. Meanwhile, in Japan, confidence in the non-manufacturing sector held up well and capex plans surprised on the upside. In the Eurozone, the picture was rather mixed: the service PMI and retail sales came in strongly, while the German manufacturing PMI and manufacturing goods orders continued to slide. This poor performance is largely driven by weak orders from outside the Eurozone, which lines up with the notion that the German industrial sector is more sensitive to changes in global trade in general and Asian (Chinese) demand in particular. If we are close to a rebound in the Chinese manufacturing sector – as the most recent PMIs perhaps suggest – this should show up in the German data with a lag of between three and six months. The European and Asian data, in combination with the improving momentum in US capital goods orders and shipments and a still-solid US composite PMI, offer somewhat more hope that the global capex cycle may indeed find a bottom soon.

Equity rally continues with support for banking sector

Increasing hope of a cyclical recovery is partly reflected by the strong continuation of the equity rally. The economic green shoots of the past weeks have pushed recession fears into the background again. Meanwhile, the drivers of the rally since Christmas – the dovish central banks and the perception that a US-China trade deal is in the making – remain intact. Financial markets have largely discounted these two elements, so in order to keep the bull market alive, more evidence is needed of an approaching global growth recovery.

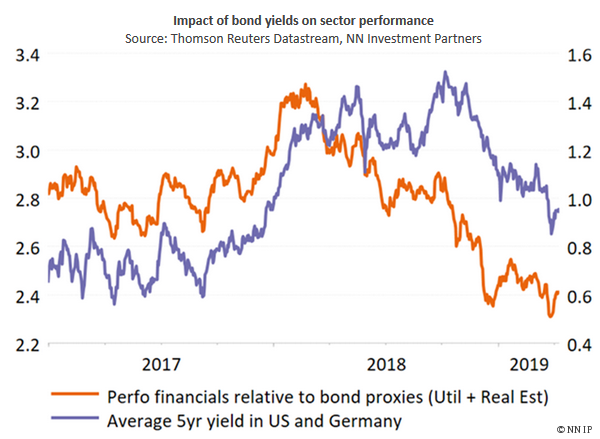

For now, the shift from recession fears to recovery hopes is clearly driving markets. This is reflected in the strong performance of the cyclical sectors and the underperformance of bond proxies. In our sector allocation, we upgraded financials to neutral and downgraded utilities to a small underweight. In other words, we introduced a positive tilt towards higher bond yields. Additional support for the banking sector could come from the new targeted longer-term refinancing operations (TLTROs) and the possible introduction of a tiered deposit mechanism in the Eurozone. Until now, both elements have had little or no influence on the sector performance, reflecting a fair degree of scepticism among investors. Bank valuations are low (30% discount to the market) while earnings growth estimates are ticking up (+8% in 2019 and 2020). Finally, we may see more cross-border mergers in the Eurozone, which would be a clear positive step towards the creation of a banking union.

Equity markets project US earnings recovery following Q1 deadline

Another important more general driver of equity markets is corporate earnings. The Q1 earnings season will start this week, and for the first time in three years, a decline in US earnings is expected (-2%). We will look primarily at the outlook for margins, given the increasing pressure coming from higher wages, commodity prices and transportation costs. The market is expecting a gradual earnings recovery in the following quarters (+8% in Q4). This appears optimistic but can be largely explained by the timing of the tax cuts and their diminishing effect during 2018. The full-year estimate has stabilised just below 4%. Historically, GDP growth of 2% in the US and 1% in the Eurozone is sufficient to stabilise margins. Given the early signs of an economic recovery, the commitment to easy monetary policy and the likely resolution of the US-China trade conflict, market expectations do not look unrealistic.

Asset allocation

In addition to our existing medium overweight in spreads and small underweight in Bunds, we have now opened a small overweight in equities. The economic green shoots and the moderately positive expectations for the Q1 earnings season are the main fundamental reasons for the move. Also, investor sentiment is not overly bullish (with a bull-to-bear ratio close to neutral), price momentum remains strong and technical indicators are neutral.

Diesen Beitrag teilen: