BNP Paribas: Central Banks engineer a fragile goldilocks

After the US Federal Reserve’s dovish turn in January and the renewed easing by Chinese policymakers, the ECB has now also shifted to a more dovish stance and the Fed cemented its dovish position in March.

09.04.2019 | 14:50 Uhr

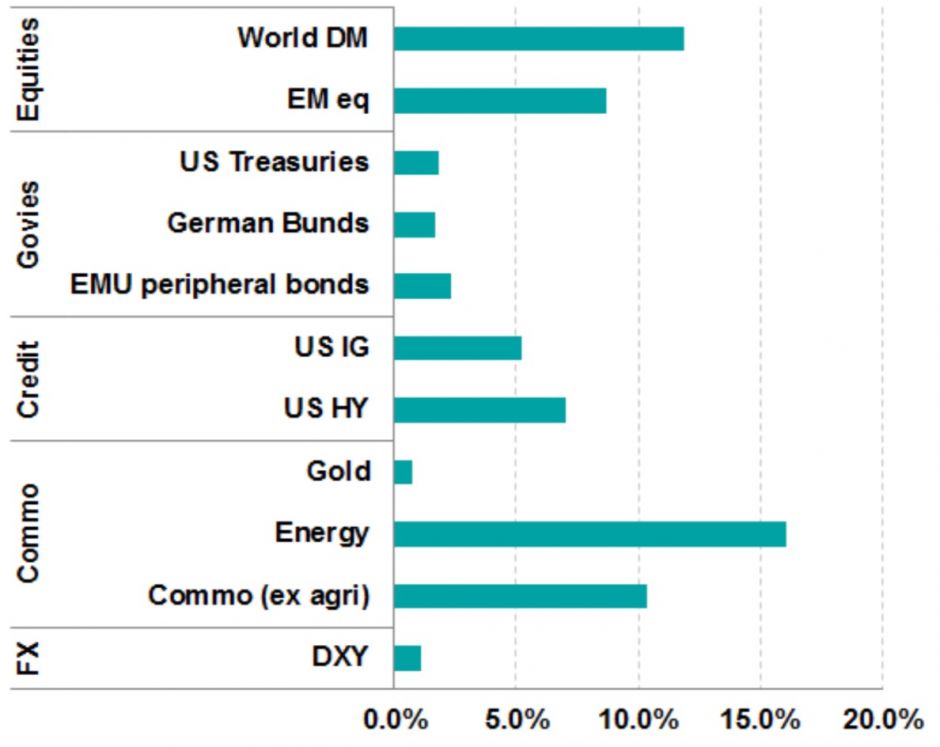

The first quarter of 2019 saw a sharp recovery in investor sentiment. All major asset classes rebounded in the first few months of the year, reversing the late 2018 sell-off (Figure 1). In particular, the risk-on mood led equities back to near their peaks and market volatility fell towards its lows.

US equities gained roughly 12% since early January, supported in particular by the decision of the US Federal Reserve to hold off on tightening monetary policy. Indeed, the March FOMC meeting signalled to markets that interest rates will be unchanged for all of 2019 and that the shrinking of the Fed’s balance sheet will slow from May and stop in September. The dovish policy tilt now adopted by the Fed also supported EMU and other developed market equities in Q1.

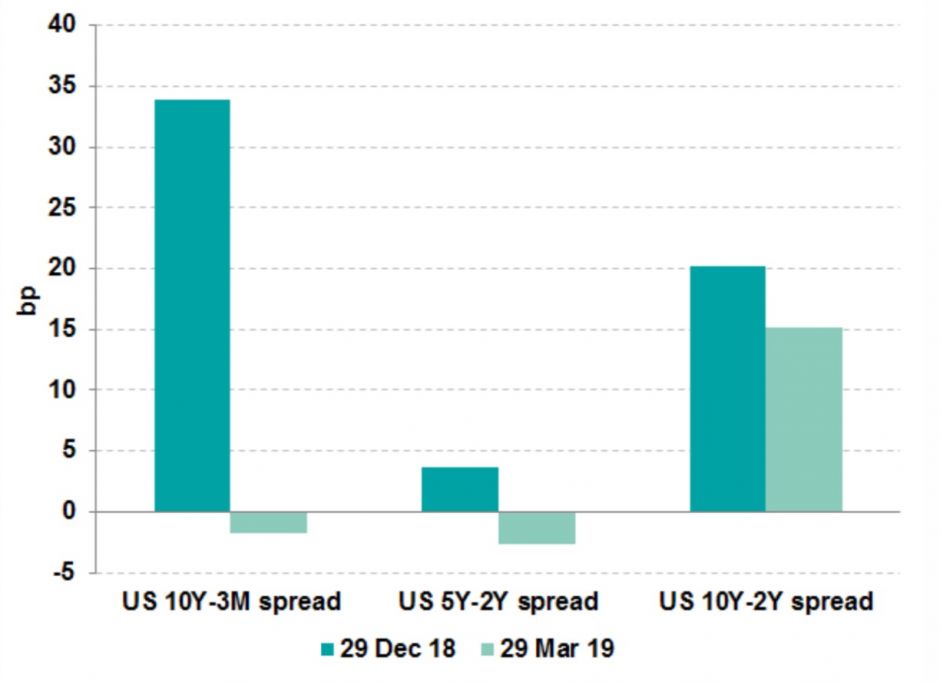

Bond markets were also affected by the Fed’s decisions: US Treasuries did well over the quarter, as did Bunds and EMU ‘peripheral’ bonds. Here, the ECB’s announcement of a new round of TLTROs was a major driver. We note that the US Treasuries yield curve is now basically flat and that the spread between 3-month and 10-year bonds inverted in late March. This was the first time in more than a decade (Figure 2) and reminded investors that the cycle is maturing.

Among currencies, the US dollar did poorly as the Fed shifted its monetary policy stance. Sterling gained on both the US dollar and the euro, fuelled by new hopes and expectations around Brexit.

In commodities, the energy sector rebounded after its late 2018

drop. Crude oil led the rally, mainly supported by the OPEC’s

decision in February to cut output, later confirmed by the Saudi

energy minister. However, some OPEC members said that

given the uncertainties around Venezuela and Iran, further

decisions were unlikely before May or June.

Figure 1: Q1 2019 returns – all assets up

Source: Bloomberg and BNPP AM, as of 29/03/2019

Apart from the Fed’s move, two other major topics affected markets in Q1: Brexit and progress on the Sino-US trade talks.

On Brexit, chaos seemingly rules in the UK Parliament. PM May has not been able to get MPs to approve her deal and the government is becoming weaker, especially after a number of defeats and the resignations of three ministers. Still, the EU granted the UK an extension of the deadline so that work could be done on a new deal or, alternatively, a no-deal Brexit.

On the US-China trade conflict, the situation appears to have improved, making a deal between Trump and Xi more likely.

Finally, on the macroeconomic side, data showed that the global economy remained on a downward trend. Indeed, concerns arose over manufacturing activity in all the developed countries given PMI releases (the US PMI fell to 52.5 from the 53.5 consensus forecast, the EU PMI slipped to 47.6 from 49.5). A drop in US housing starts has added to the concerns.

It is worth noting that the central bank response discussed at

length below – across the major economies – is also a reaction

to this weaker backdrop.

Figure 2: US fixed income: curve movements in Q1

Source: Bloomberg and BNPP AM, as of 29/03/2019

Den vollständigen Bericht können Sie hier herunterladen.

Diesen Beitrag teilen: