UBS: Are Investors finally returning to Europe?

US investors were net sellers of European equities via ETFs for 11 months in a row last year. But this is now reversing

12.04.2017 | 12:53 Uhr

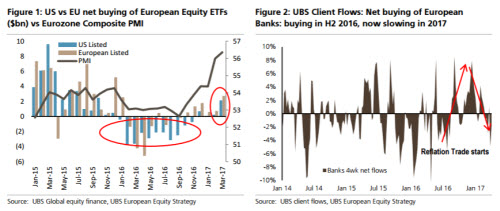

In March US net buying was the highest since October 2015 (Figure 1) and from mid-March, European equity ETFs have seen inflows and USEquity ETFs have seen outflows (Figure 4).

What's the key driver: The first turn in European Earnings in 7 Years

After 6 years of disappointments there are signs that earnings are turning: YTD the bottom-up earnings estimates have been revised up for only the second time in a decade (the other was the 2010 base effect). And the Q4 results season saw the best net beats in 6 years. This trend has continued into March--with the 5th month in a row of earnings upgrades (the best for 7 years) -- and is driven by the top-line recovering.

UBS Client Flows: Long Only selling vs. Hedge Fund buying

Client data suggests Long Only investors have been net sellers YTD: this seems counter intuitive, but is not unusual. Both in the rallies in Q1 2015 (post-QE) and summer 2012 (post-Draghi's speech) Long Only investors were net sellers and their flows are negatively correlated to the market. But Hedge Funds' net buying hit a 4-year high in February, though fading somewhat since then.

Sectors & Countries: Buying Switzerland and Pharma

We saw net buying of cyclicals over defensives since the "reflation trade" started in July 2016, but this is now stalling. Likewise, there was large net buying of Banks in H2 2016, but recently shifting to selling. Sectors: net buying in Pharma after selling over last year, Countries: biggest net buying of Switzerland since our data began in 2005. Selling Spain and Sweden, net selling in France has been modest.

Lesen Sie den vollständigen Artikel hier als PDF.

Diesen Beitrag teilen: