Schroders: European equities outlook 2019

European equities may remain volatile in 2019 but this can open up opportunities for investors seeking out under-valued companies.

13.12.2018 | 14:04 Uhr

Rory Bateman, Head of UK and European Equities:

The global economic picture for 2019 looks more challenging as we approach the closing stages of this economic cycle. The equity market has already factored in the slowdown, leading to disappointing returns across most regions in 2018.

We believe Europe’s economy should enjoy above trend growth in the year ahead given the later post crisis recovery compared to the rest of the world and the continuing domestic consumer expansion. Investors can access European equities at a five-year valuation1 low (see chart 1) following the market decline experienced during 2018.

Over recent months we have seen higher global volatility due to trade wars, rising interest rates in the US and the progressive withdrawal of quantitative easing in Europe.

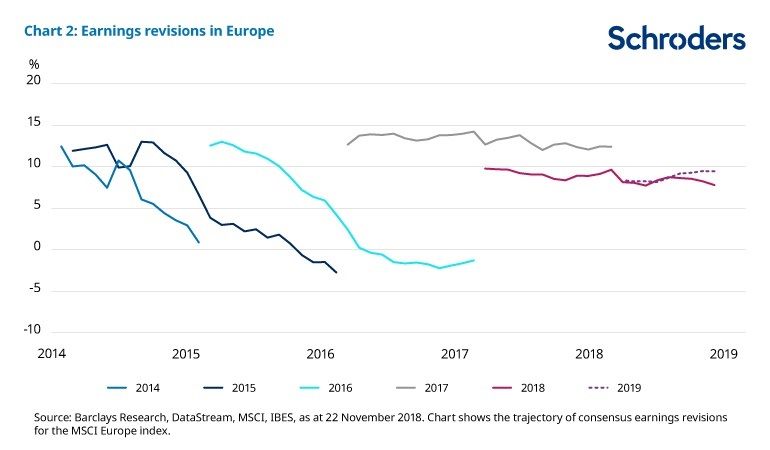

In addition, Germany in particular has grown below expectations. This is largely due to changes in diesel emissions regulations for the auto industry. However, our sense is that the German industrial issue is temporary therefore helping to ensure positive corporate earnings growth in 2019 (see chart 2).

The chart shows positive earnings growth for 2018 and realistic expectations for 2019.

The forecasts included should not be relied upon, are not guaranteed and are provided only as at the date of issue. Forecasts and assumptions may be affected by external economic or other factors.

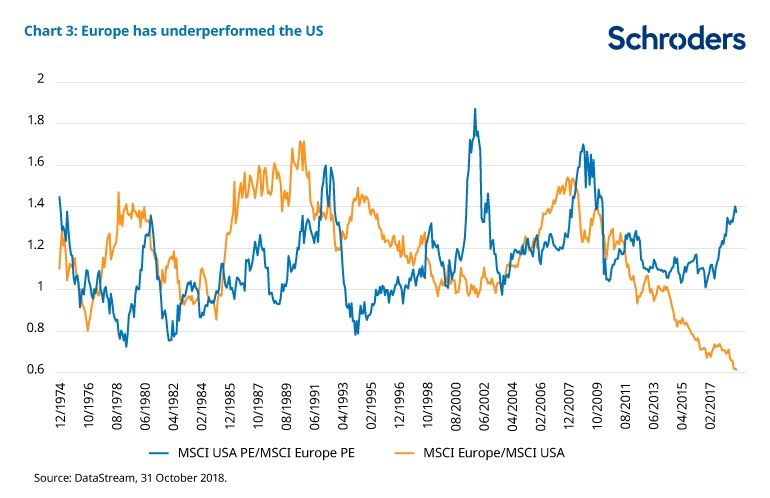

We often discuss the valuation differential between the US and Europe. At this particular moment the European price-to-earnings (P/E) discount appears extreme.

While European companies have not benefited from the share buyback bonanza2 experienced in the US, the dividend yield on European equities is a very healthy 3.7% (MSCI Europe, as at 31 October 2018) and overall corporate balance sheets are in rude health.

Chart 3 below shows the US versus European market current P/E multiple (blue line); the US is trading at a significant premium to Europe - close to historic peaks. The orange line illustrates the significant underperformance of the European market compared to the US (both in US$).

We expect the inevitable political uncertainties in Europe to present investors with opportunities to buy select stocks at attractive levels. International sentiment towards European equities is currently extremely sceptical given Brexit and Italian budget concerns. Stock market history shows that such times of extreme sentiment can be a good opportunity to take a contrarian approach. Some investors may therefore consider making a tactical near-term allocation to European equities.

Having said that, timing is always difficult. Our expertise is in identifying under-valued companies that we expect to deliver strong returns during the medium to long term. We are currently exploring heightened numbers of attractive stocks given compelling valuations and increased levels of volatility.

The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested.

Martin Skanberg, Fund Manager, European equities:

There are clouds on the economic horizon as we head into 2019 and this has resulted in exaggerated market volatility recently. Positioning in markets has become very defensive, with investors favouring the perceived safety of sectors such as consumer staples over those more closely linked to the economic cycle, such as industrials.

At a time of fear in the market, it is anti-consensual to favour these more economically sensitive sectors and stocks but they are the ones we think, if chosen correctly, have the ability to outperform the most in any rebound. We are seeking out areas of the market where we see value as well as sensitivity to the economic cycle.

For example, sectors such as tech hardware or the automotive space are valued at levels that imply we are in a mild recession. Yet the US economy is performing well and the eurozone economy continues to expand, albeit more slowly than at the start of 2018. The current very defensive market positioning could quickly unwind.

At the same time, we look for stocks that can deliver growth and/or a share price uplift irrespective of the general market environment. This leads us to focus on corporate change stories. Examples include businesses that are under-earning versus peers, or where the corporate structure is overly complicated and therefore the market awards the business a discount valuation. Such opportunities are always interesting, as long as we feel there is a credible strategy to unlock this value and the share price does not already reflect the opportunity.

James Sym, Fund Manager, European equities:

Investors face a changing market environment as we head into 2019 and a key feature of this is the return of inflation. Anecdotal evidence tells us that many European companies are facing an increasingly tight labour market, so they need to pay higher wages to attract and keep employees. Meanwhile, underinvestment since the global financial crisis combined with steady economic growth means many companies now find themselves with full factories, so they need to invest in new capacity.

Both of these factors are inflationary, and could weigh on the kinds of companies that fared well in the low rate and low inflation environment. Can a company still grow if it is unable to add new workers or new capacity? We think investors will need to look at a different type of company as higher inflation becomes embedded.

Financials could benefit from the new inflationary environment because they can re-price the rate they charge on loans and other products. Revenues should rise more quickly than staff costs, and financial firms benefit from volume growth as the economy continues to expand. Within financials, we prefer insurers; it remains important to be selective when investing in European banks.

The telecoms sector is another that should benefit from higher inflation. The infrastructure is already there and rising wages mean consumers are able to bear higher prices. Similarly, consumer cyclical sectors – like the carmakers – are currently very cheaply valued and could benefit from a more confident consumer in 2019.

We see this return of inflation as an embedded structural factor - the result of years of underinvestment and pressure on wages. The important thing, as investors, is to identify this changing environment early before it becomes obvious to the whole market.

The opinions above include forecasted views, there is no guarantee than any forecasts or opinions will be realised, they should not be relied upon. Nothing in this material should be construed as advice or a recommendation.

Risk Considerations

The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested.

Equity prices fluctuate daily, based on many factors including general, economic, industry or company news.

Investments concentrated in a limited number of geographical regions, industry sectors, markets may result in large changes in the value, both up or down, which may adversely impact the performance.

1. The chart shows the price-earnings ratio (P/E ratio) which is the ratio for valuing a company that measures its current share price relative to its per-share earnings.

2. A buyback, also known as a share repurchase, is when a company buys its own outstanding shares to reduce the number of shares available on the open market.

Die hierin geäußerten Ansichten und Meinungen stellen nicht notwendigerweise die in anderen Mitteilungen, Strategien oder Fonds von Schroders oder anderen Marktteilnehmern ausgedrückten oder aufgeführten Ansichten dar. Der Beitrag wurde am 6.12.18 auch auf schroders.com veröffentlicht.

Diesen Beitrag teilen: