Robeco: Filtering out fraud risk in Chinese A-share markets

Chinese equity markets have emerged as one of the big winners following the Covid-19 shock. And their prospects remain bright for 2021, provided investors take the necessary steps to prevent certain China-specific risks – in particular fraud risk – from spoiling the party.

27.11.2020 | 10:56 Uhr

Laurens Swinkels, Researcher at Quant Research team, Robeco and Yaowei Xu, Portfolio Manager

Until recently, Chinese domestic stock markets, so-called A-share markets, were largely shunned by international investors. But as China recovered faster than most countries from the sudden economic contraction induced by the Covid-19 pandemic in the first quarter of 2020, and remained one of the few economies expected to grow this year, the tide is appearing to turn for these mainland stocks.

As we enter into 2020’s final stretch, A-shares are amongst the best performers year to date, with strong double-digit returns. Looking forward to 2021, this situation remains relatively favorable. Although a re-escalation of US-China tensions is possible, if increasingly less likely, the Chinese economy is expected to post significant growth, helped by strong fiscal and monetary support as well as ongoing structural reform efforts.

Yet this does not mean investors should rush headlong into buying. Although big steps have been taken over the past decade, A-share markets remain in their early development stages. Regulation is still catching up with common standards in developed markets, and important issues still exist regarding disclosure and transparency. This is particularly relevant for quantitative investors, as their models – usually designed to operate in developed markets – typically fail to capture such risks.

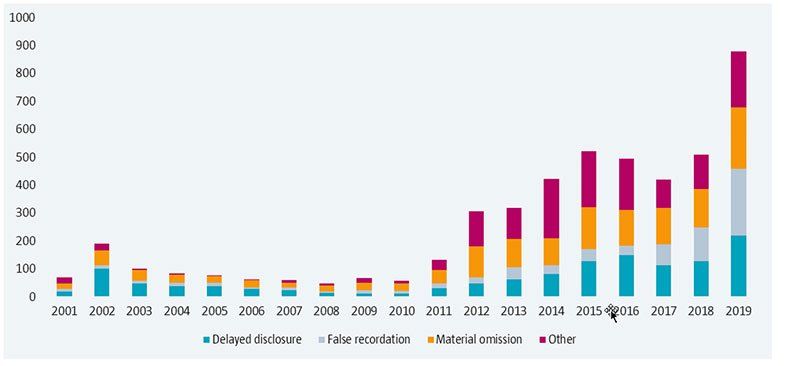

Fraud cases are by no means a marginal phenomenon in China, as Figure 1 illustrates. It shows a steady rise in the number and type of regulatory violations reported by the China Securities Regulatory Commission (CSRC) between 2001 and -2019. Since 2015, the number of enforcement actions has exceeded 400 per year. The most common types of violation are shown separately, being delayed disclosure, false recordation, and material omission.

Figure 1: Rising number of regulatory violations reported by the CSRC

Source: Robeco, China Stock Market and Accounting Research. We count the number of regulatory violations reported by the CSRC for each calendar year.

Admittedly, the number of listed firms has risen sharply over this period, especially since 2012, which may partly explain why fraud cases have been growing sharply. Also, the frequency of CSRC enforcement actions has also risen, relatively speaking.

An important point to remember is that fraud cases are not only restricted to small companies. Among constituents of the CSI 300 Index, the 300 largest A-share companies, there have been at least 20 fraud cases every year since 2014, with a high of 35 cases in 2015.

Opportunity and incentive

The two main conditions necessary for fraud to prosper are opportunity and incentive, both of which tend to be high in China. The country’s still rudimentary regulatory framework means that Chinese companies tend to have weaker internal controls and poorer governance than their Western counterparts. Moreover, sanctions for regulatory violations are often relatively minor, and the potential benefits from undetected fraud can be huge.

In May 2019, for instance, a Chinese pharmaceutical company was found to have falsified its financials. However, the firm’s chairman was not sentenced to a jail sentence and was only fined RMB 0.9 million (EUR 120,000), after having pocketed RMB 10 billion (EUR 1.3 billion) from the fraud. Meanwhile, the stock was allowed to resume trading only after a short suspension period, although its price subsequently declined by more than 80%.

As a comparison, back in 2009, Bernie Madoff was sentenced to no less than 150 years in prison in the US (the maximum allowed), having been found guilty of stealing an estimated USD 65 billion from approximately 4,800 clients, through the largest Ponzi scheme in world history, making it the country’s largest financial fraud case to date. Such harsh sentence reflects the much stricter approach to fraud sanctions applied in the US and more generally in Western countries.

As long as opportunities remain plenty and incentives high, the number of fraud cases is likely to remain substantial in Chinese A-share stock markets. It is therefore crucial for quant investors to have the detection tools necessary in order to avoid such risks. Unfortunately, existing available databases relating to fraud-risk screening lack the broad coverage and level of detail typically needed for this purpose.

Here you can find the complete article

Diesen Beitrag teilen: