NN IP: Consolidating

Fundamentals remain supportive for risky assets, but some indicators show signs of fatigue and market dynamics are negative. We maintain our overweights in commodities and spreads.

11.08.2017 | 13:49 Uhr

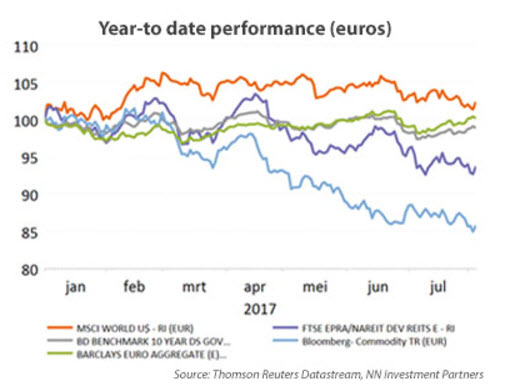

This year it matters a lot whether you are a US-based or a Euroland-based investor. The former can look back at strength in the domestic market (in equities and in fixed income) and at gains from investments abroad, which were partially boosted by the weakness of the USD. Euro-based investors, on the other hand, had to cope with the strength of the euro, which translated investment profits in foreign currencies into a loss (e.g. commodities, real estate) or a modest gain (equities) at best.

The environment remains rather benign for most risky assets. Indeed, economic growth has picked up and inflation remains puzzlingly low, despite a general improvement in the labour market. In the past, this has always given way to a rise in wages. Thus far this has not been the case in the current cycle but it may only be a matter of time before we see wages rising. The positive side of this is the observation that central banks are not in a hurry to tighten policy but have the luxury to move in a gradual way. It is also positive for corporate margins.

In addition to this supportive macro and policy environment, the corporate side is strong. Earnings grew at a double-digit pace in Q2 and in combination with solid balance sheets (especially outside the US) this should keep default rates low and hence be positive for corporate spreads. On top of this, the recovery in commodity prices (oil and metals) limits the potential fall-out for the US high yield sector, and financial conditions in emerging markets benefit from the weaker USD and the gradualist approach of the Fed. The Eurozone periphery enjoys a period of political calm and good growth. In equities, the risk premium has come down over the past months but at 4%, it is still around its long-term average, with the European and Japanese risk premiums at especially attractive levels.

So, given this supportive environment for risky assets, why aren’t we more exposed to these assets? One reason is the risk surrounding these fundamentals. Economic growth is positive but is no longer accelerating, according to our global cycle indicator. Earnings momentum for 2018 is still positive but also loosing strength. Moreover, the mind set of central bankers has changed towards tightening, even if gradualism is their keyword. Real estate from its side is struggling with some structural issues in the retail space. We could also enter a more turbulent period over the coming weeks with Jackson Hole and the upcoming discussions in the US on the debt ceiling and budget. At a time of record low volatility in equities and fixed income, this could lead to outsized reactions of the market.

On top of this, there is more than just fundamentals. Market dynamics also matter and these give us less buoyant signals currently. For equites, real estate and commodities, market dynamics are affected either by weak sentiment (in the case of equities and commodities), weak momentum (real estate) or negative liquidity and flows (real estate, commodities and equities). Only in spreads do we have a positive fundamental and a positive market dynamics signal.

So adding it all up we look to be in an environment that is more likely to lead to a consolidation in risky assets over the coming period than to a further rise. We keep our allocation unchanged.

Diesen Beitrag teilen: