Janus Henderson Investors: Outlook for Asia ‒ potential to surprise amid uncertainty

Andrew Gillan and Mervyn Koh, Asian growth equities portfolio managers, provide a year-end review of the market and discuss where they see compelling opportunities to invest in Asia’s vast growth potential.

14.01.2020 | 08:09 Uhr

Key takeaways

- Despite a challenging backdrop, Asian equities still delivered healthy gains last year

- The team continues to find compelling investment opportunities driven by the strength of the Asian consumer

- The team’s outlook for the region remains optimistic given the market’s expectations for robust earnings growth, Asia’s superior economic growth potential, currently attractive valuations and long-term outperformance

2019 ended positively for Asian equities (MSCI AC Asia Pacific ex Japan Total Return Index +19.5% in USD1), which were buoyed by news of a phase one resolution in the trade dispute between the US and China in December. The dispute dominated the headlines throughout the year and led to weaker consumer sentiment and a deferral in capital expenditure from corporates as a result of the uncertainty. On the flip side, a supportive factor for Asia was the change in tone from the US Federal Reserve, which cut interest rates three times in 2019. This offered more room for Asian central banks to also cut interest rates to help stimulate economic growth, including India and Indonesia, while China loosened monetary policy through its reserve requirement ratios.

Lessons from 2019

When we look back at last year, we were probably too disciplined on valuations, particularly early in the year, which did mean we missed out in some areas or had lower exposure given the broad-based expansion in (price-to-earnings) multiples through the year. The technology sector, where we were consistently overweight, is the best example where semiconductor and memory shares had earnings declines in 2019 but were still among the top performers in 2019 as the market’s expectations for future earnings strengthened. Our portfolios had decent exposure but we were reluctant to add significantly early in the year into a declining short-term earnings outlook. There will obviously be a time in the future when a consistent valuation discipline is rewarded so it is not something we will change markedly. However, it is a reminder that it is the strength of the company’s franchise and longer-term earnings trajectory that is most important.

Expectations for strong earnings growth

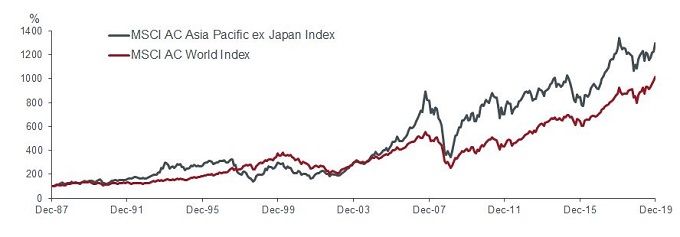

We think the key to continuing positive equity market performance in Asia in 2020 will be corporate earnings growth, which disappointed in 2019 and has been lacklustre for four of the last five years with only 2017 offering double-digit earnings growth. Asian equities also underperformed developed equities, in particular the US market over the past decade.

However, now there is more optimism surrounding a US-China trade deal, and consensus earnings expectations for more than 10% growth for 2020.2 This, coupled with Asia’s longer-term outperformance relative to global equities, gives us reason to be optimistic about the year ahead.

Asia’s long-term performance

Source: Bloomberg, Janus Henderson Investors. Indices rebased to 100 at 31 December 1987. Monthly cumulative total returns reported gross of dividends in US dollars. Past performance is not an indicator of future performance.

Opportunities from continued Asian consumer strength

Certain sectors and themes remain attractive to us, with some delivering strong returns in recent years despite the sluggish growth of the overall region. Areas of the market that we continue to like include technology (software and hardware in particular), given the strength of the digital consumer in Asia. Financial services also offer very compelling growth opportunities, particularly banks in emerging markets like India and Indonesia, while life insurance also presents attractive growth potential across the region, and most notably in China. We continue to see many attractive investment opportunities driven by the strength of the Asian consumer; more recently these include investments within education, travel and leisure.

Solid investment case

In spite of ongoing challenges including the trade dispute, protests in Hong Kong and regulatory changes in countries such as India and the Philippines, Asian equities still delivered healthy gains despite the uncertain backdrop. While some of these issues are likely to continue into the year ahead, longer term, we believe the investment case for Asia remains very positive given the region’s superior economic growth, while valuations are currently at an attractive discount relative to developed market equities. Our focus remains on identifying high quality businesses at reasonable prices and offering our investors a truly active portfolio of around 30 to 40 of our highest conviction companies.

1Source: Refinitiv Datastream, for the period 12 months to 31 December 2019. Past performance is not a guide to future performance.

2Source: Factset market aggregates as at 7

January 2020. MSCI AC Asia Pacific ex Japan Index estimated one-year to

December 2020 EPS (earnings per share) growth. Data shown is estimated

and not guaranteed.

Diesen Beitrag teilen: