Janus Henderson: Don’t buy the dip, buy bargains

“It’s tough to make predictions, especially about the future.” While never quite definitively attributed (US baseball catcher Yogi Berra – known for his malapropisms – is one potential source), this wisdom has nevertheless stood the test of time.

14.12.2018 | 09:59 Uhr

Consider a 2013 paper by Itzhak Ben-David, John Graham and Campbell Harvey, which found the range of outcomes that chief financial officers (CFOs) provide for their one-year stock market forecasts tend to be unrealistically narrow. Over a 10-year period, a panel of CFOs were asked to estimate market return probability ranges that would lead them to be right 80% of the time. However, instead of working 80% of the time, barely more than one in three was correct. The authors note that executives were severely miscalibrated and too sure of their ability to predict the future.

The spectre of overconfidence could also loom over decisions to buy dips in the stock market. At its core, ‘buy the dip’ is a speculation that the next move in the market will be higher, thus making the decline (dip) a buying opportunity. It has worked for what seems like a very long time now – nearly 10 years into the current bull market. But, about those predictions – if the CFOs themselves do not know, then investors should ask themselves how confident they are in what the future holds.

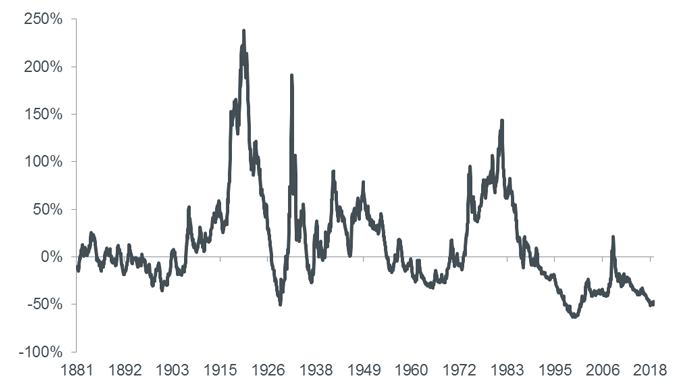

There is also risk of buying, not a mere dip, but rather a prelude to a more serious market decline. Here, the scenario goes from bad to worse for the dip buyer: a reversion to the long-term median cyclically adjusted price-to-earnings (CAPE) ratio for the S&P 500 Index has rarely suggested a worse potential loss (see chart 1). For investors who aim to compound returns over the long haul and who cannot tolerate significant losses along the way, buying the dip simply will not cut it as an investment strategy. We suggest an alternative approach. Don’t buy the dip. Evaluate the dip and buy bargains.

The risk of loss from potential mean reversion has rarely been higher

Source: Robert Shiller, http://www.econ.yale.edu/~shiller/data.htm, as at 31 October 2018. The chart line shows the potential risk to the value of investments should the S&P500 revert to its long-term median cyclically adjusted price/earnings (CAPE) ratio (16.2x earnings over the entire data set). The S&P500 Index at 2,711 represents a CAPE of 30.6x, suggesting a 47.1% potential loss.

The investment team at Perkins is evaluating the equity market’s recent dip by reviewing the weakest areas (i.e. stocks with the biggest price declines). As a general note, it seems that concerns about the duration of the economic cycle are spreading, and each particular sector and industry has its own dynamic to consider. For example, the semiconductors & semiconductor equipment sector has been one of the worst-performing industry groups within the MSCI World Index in recent months. After several years of surging demand and record profits, companies are now seeing falling prices for memory chips, declining orders for equipment and weakening end demand.Other areas seeing big declines include materials and automobile and automotive components companies, where there have been recent warnings on earnings, due to rising input costs, falling demand and trade war developments. Banks have also come under pressure – in Europe on slowing economic growth and Italy-related euro turbulence, and in the US on weak loan growth and higher funding costs. Aggregating across the market’s laggards, the stock market consensus appears to be grappling with the idea that we may have passed the peak of the current expansion / benign investing environment.In our opinion, as trading conditions become more volatile and sellers more fearful, the likelihood of identifying bargain stock prices grows. Pain on the other side of the trade is the first, but not the only, criteria for the bargain hunter. Second, the company should have a durable competitive advantage, such that, over time and through market cycles, it should be able to earn more than its fair share of profits. Third, the balance sheet should be well capitalised and liquid to ensure the company can endure a much more difficult operating environment, should that scenario prove true. Finally, a stock’s price should be low enough relative to a company’s earnings power/net asset value to offer a margin of safety (should the market environment weaken further) and attractive return potential (over the long term).

In addition to orienting our research effort around identifying stock bargains, we are mindful of correlations across the various cyclical exposures in our portfolios, as well as the aggregate weights we have in those areas. Given that we do not know whether the economy and/or market are at the beginning of a major downturn – remember the CFOs and their too-narrow predictions – we are attempting to trade slowly and cautiously, particularly in more economically sensitive areas of the market. At some point, the bull market will end, and patience may prove the most important investing attribute of all.

Diesen Beitrag teilen: