BNP Paribas AM: The top performer among the G-10 currencies 2018

2017 was a disappointing year for foreign currency investors. Consensus opinion of a stronger US dollar after the US elections has not to materialize. So, what should investors be focusing on in 2018?

20.02.2018 | 12:53 Uhr

2017 was a disappointing year for currency investors. The consensus view for a stronger US dollar following the US elections did not materialize. The US dollar peaked at the beginning of the year at 1.04 against the euro and at 118 against the Japanese Yen, and finished the year as the worst performing currency. The euro was the best performing currency, outperforming both the US dollar and the Japanese yen by more than 10%. Stronger economic growth in the Eurozone has been singled out as the most important driver for the euro outperformance in 2017. Emerging market currencies did even better, with the Polish zloty and the Czech koruna outperforming the US dollar by more than 20%. Even the Turkish lira, despite all the political turmoil, outperformed the greenback.

In terms of expectations, investors are starting 2018 with the opposite US dollar view compared to last year. This time the consensus is for a weakening US dollar. The arguments are that US asset valuations are at record highs so capital flows will leave the US and go into other countries (and boost foreign currencies), that US twin deficits are widening driven by the fiscal stimulus, and finally that the US is reengaging with a weak dollar policy similarly to 1994-1995. Is this consensus view going to suffer in the same way as it did in 2017 (i.e. US dollar will be stronger, or are the majority of the commentators going to be right this time)? In particular, the EUR/USD exchange rate remains in focus, with 1.30 being a popular target.

In our view, focusing on EUR/USD is similar to Kylo fighting Luke Skywalker in the movie “Star Wars: The Last Jedi”. In the eighth main installment of the Star War franchise, Luke appears to confront the First Order to enable surviving Resistance members to escape. Kylo orders the First Order’s forces to fire on Luke but to no effect. He then engages Luke in a lightsaber duel and strikes the jedi only to realize that he has been fighting Luke’s Force projection. Kylo wasted precious time, which enabled the surviving resistance members to escape. Investors might be wasting precious time focusing entirely on EUR/USD.

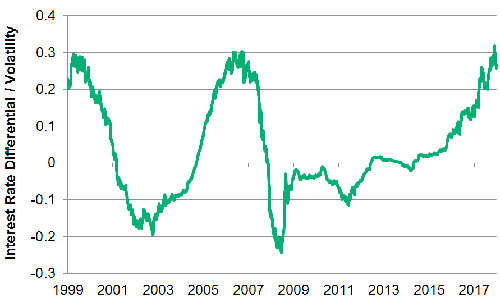

The reason is that even the most bullish projections are only calling for euro at 1.30 by the end of the year. Given that euro was at 1.25 just recently and that the one year forward rate was at 1.28, this implies an appreciation of less than 2%. The reason is that the implied interest rate differential in EUR/USD is at almost 3% - this is a pretty big hurdle to be excited about long euro positions vs the greenback. In fact, this interest rate differential has almost never been so attractive relative to the volatility of the exchange rate (see Exhibit 1).

Exhibit 1: EUR/USD Implied Interest Rate Differential Relative to Volatility

(Source: Bloomberg, as of February 9, 2018)

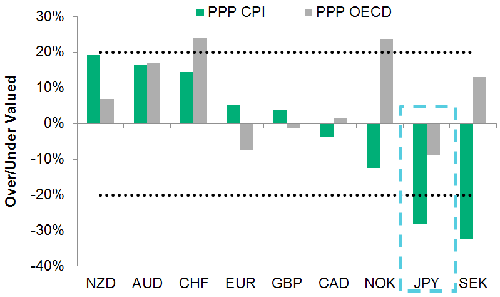

So, what should be investors be focusing on in 2018? In our view, the Japanese yen can easily be the top performer among the G-10 currencies and can do better than both the euro and the US dollar. First, for the past two years Japan’s economy has been expending above its potential growth rate. Wage growth remains lackluster and the Bank of Japan remains dovish for now, but this means that the next policy shift can only be hawkish. Second, the Japanese yen is one of the cheapest currencies in the world (see Exhibit 2).

Exhibit 2: G-10 Purchasing Power Parity (PPP) Valuations

(Source: Bloomberg, as of January 31, 201)

Third, the return of financial market uncertainty is supportive for the Japanese yen, which traditionally rises in periods of equity stress. After the last five years of falling volatility, rising stock markets and falling global bond yields, the recent market turmoil might persist for longer than expected.

Momtchil Pojarliev, PhD, CFA Deputy Head of Currencies

BNP Paribas Asset Management

Diesen Beitrag teilen: