Robeco: Elections in Catalonia and Italy

While the Spanish government decides to suspend the Catalan government, in italy the new electoral law has passed the senate and prepared the general elections, probably early March. - The Robeco Europe Update.

30.10.2017 | 09:17 Uhr

Main market events

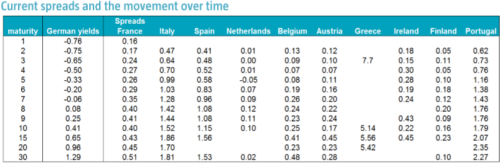

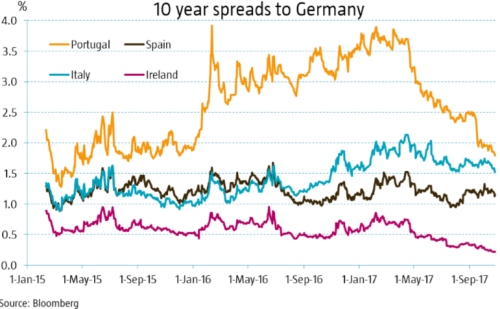

Peripheral bonds outperformed German bonds this week. Yields and country spreads declined especially after the ECB meeting on Thursday. Tensions around Catalonia also seemed to ease that day, but they rose again on Friday. Italian bonds have returned 1.01% this year, Spanish bonds 0.91%, Portuguese bonds 10.98% and Irish bonds 0.64%.

ECB

The ECB announced that they will continue their QE program at least until September 2018, but with a monthly pace of EUR 30bn next year instead of the current EUR 60bn. Draghi delivered this message in a dovish way, strongly emphasizing that the monthly amounts can be increased again if necessary and that official interest rates will remain low for a long time. Draghi even hinted at potential further bond buying beyond September 2018.

Spain

The Spanish government proposed measures to suspend the Catalan government, take control of Catalan institutions and call elections for a new regional government. These measures are debated in the Senate at the time of writing. The Catalan parliament is simultaneously debating whether to declare independence. Catalan Premier Puigdemont claims he wanted to defuse the tensions by calling new elections himself, but eventually did not do as the Spanish government refused to guarantee that they would refrain from taking control over Catalonia in exchange.

Italy

The final approval of the new electoral law in the Senate clears the way for the general elections, probably early March. The new law favors coalitions and hence is disadvantageous for the 5 Star movement, which rules out teaming up with other parties. However, it could benefit the euro-sceptic Lega Nord, which is enjoying some momentum as the wealthy regions Lombardy and Veneto voted for more autonomy in last weekend’s referendums. It remains questionable whether a stable (leave alone reform-minded) government can be formed after the elections.

Robeco Euro Government Bonds

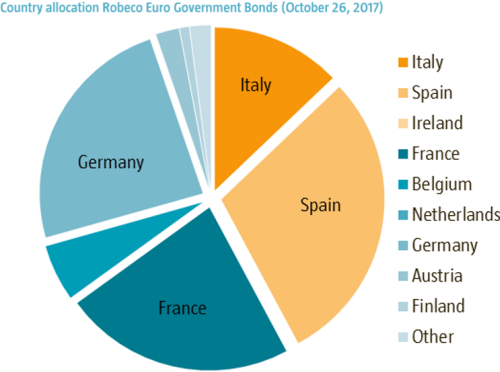

We have increased both the overweight position in Spanish bonds and the underweight position in Italian government bonds at the start of the week. Effectively we used the outperformance of Italian over Spanish bonds in the previous weeks to shift some exposure from Italy to Spain at more attractive levels. We prefer Spanish fundamentals and while Spanish political risks are now reflected in bond prices, Italian political risks can rise into the elections.

We have also sold our last bit of Irish exposure as Irish government bonds now yield only 0.1% more than French bonds. At these levels we prefer French bonds, given their liquidity, higher rating and the looming risks to Ireland posed by the Brexit and potential US tax reform.

Currently the fund is 42% invested in peripheral bonds compared to 40% in the index. Year-to-date the fund’s absolute return is 0.00%(*). (* Robeco Euro Government Bonds, gross of fees, based on Net Asset Value, October 26, 2017. The value of your investments may fluctuate. Past results are no guarantee of future performance.)

Diesen Beitrag teilen: