Robeco: Booming economic activity in the periphery

Despite the stronger economic growth in Italy, Fitch warned this week about a political gridlock after the 2018 elections, which would then hinder structural reforms. While ahead of the Catalan elections, the previously pro-independence parties have moderated their stance.

04.12.2017 | 10:27 Uhr

Main market events

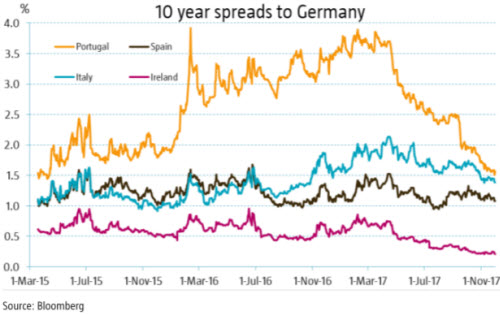

Peripheral bond spreads have continued to tighten this week, supported by strong economic momentum. Strong business confidence figures bode well for GDP growth in the current quarter. Inflation was somewhat lower than expected inflation, but ECB speakers are increasingly disentangling this year’s expected end of QE from the Eurozone inflation outlook. Italian bonds have returned 2.51% this year, Spanish bonds 1.64%, Portuguese bonds 13.51% and Irish bonds 1.04%.

Italy

Despite a downward revision of Italian GDP growth for Q3 to 1.44%, the breakdown displays a rather positive picture, with a strong rebound in investment (+7.7% yoy) and a significant improvement in net exports growth. Meanwhile, CPI inflation in November has surprised on the downside, easing to 0.9% (very low core inflation at 0.4%). It is set to remain weaker than in other Eurozone countries given the larger spare capacity. The Senate approved the 2018 Budget, while its final approval in the Lower House is expected before Christmas. The target deficit at 1.6% is slightly lower than last year (2.1%), but many measures are growth-supportive such as the tax rebates on new business investment and for new young hiring or income support for poor households. Despite the stronger economic growth, Fitch warned this week about a political gridlock after the 2018 elections, which would then hinder structural reforms.

Spain

Spain’s Q3 GDP growth has been confirmed at 3.1% yoy, or 0.8% compared to the previous quarter. The details shows that the only source of growth was domestic demand, while the contribution of external demand remained flat. That said, Spain economic activity remains well above Eurozone peers. The Catalan political stress is expected to modestly affect GDP growth according to the Bank of Spain (-0.2pp in 2018). Ahead of the Catalan elections on December 21, the previously pro-independence parties have moderated their stance, probably in response to the departure of several companies from the region. An immediate unilateral declaration independence seems not to be anymore on the agenda of the Catalan political parties.

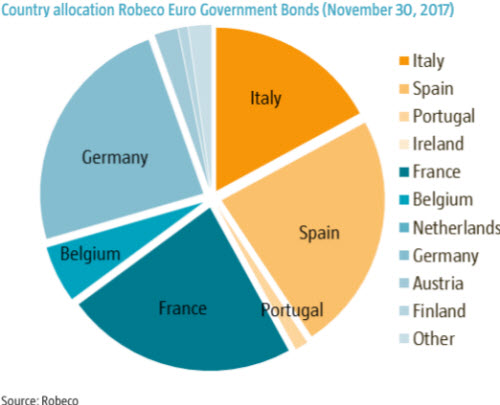

Robeco Euro Government Bonds

We maintained our positions in periphery this week: we have an overweight position in Spain, a small overweight in Portuguese government bonds and a small underweight position in Italian government bonds. We are positive on Spanish fundamentals. We remain wary of the political risks in Italy, but for now the ongoing ECB buying and the improving economic backdrop support all peripheral bonds. We hold no Irish bonds as their spreads over France do not compensate for the potential risks stemming from Brexit, international tax reform and the volatility inherent to Ireland’s size. On net, the fund remains overweight peripheral bonds, concentrated in Spain. Currently the fund is 42% invested in peripheral bonds compared to 40% in the index. Year-to-date the fund’s absolute return is 1.01%.

Diesen Beitrag teilen: