Morgan Stanley IM: Vietnam's Emerging Consumer Class

Vietnam’s large, young and tech-savvy middle class, makes it one of a few countries to benefit from globalizing in a deglobalizing world and usher in the next generation of investments in emerging markets. Steve Quattry and Jorge Chirino explain.

24.11.2022 | 06:43 Uhr

Here you can find the complete article

On a recent visit to Hanoi and Ho Chi Minh City, we met with entrepreneurs, corporate executives, and policy makers. While Vietnam needs to navigate near-term challenges from tighter macroeconomic and financial conditions, this “next gen” emerging market country should see its economy continue to thrive over the coming decade. With a relatively well-educated population of nearly 100 million people, and continued inflows of capital into the highly productive manufacturing sector, Vietnam should benefit from a young and tech-savvy middle class, which is expanding at a rapid rate.

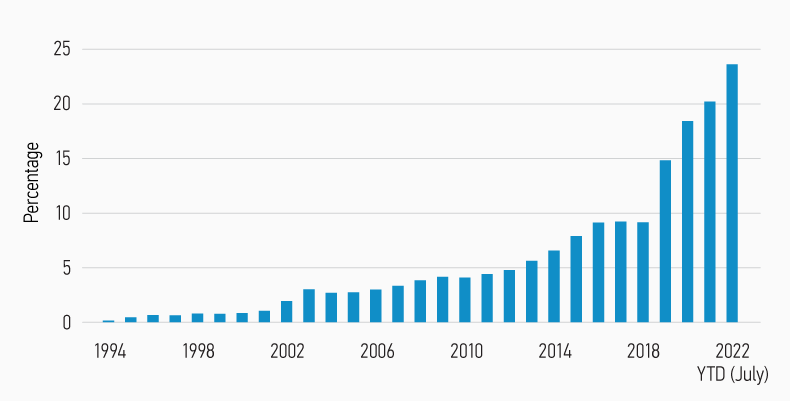

Ever since joining the World Trade Organization back in 2007, Vietnam’s economy has expanded 6.7%, faster than that of any Asian country apart from China.1 Recently, Vietnam came out as a clear winner in the U.S.-China trade war, benefiting from Western economies looking to reduce their exposure to China (Display 1). While Beijing’s growth has been revised downward this year, Vietnam’s was revised upward to 7.5%, outpacing China’s and much of the rest of the world.2

DISPLAY 1:

The U.S. is Relying More on Vietnam

U.S. imports from Vietnam as a share of those from China

Source: U.S. Census Bureau; Empirical Research Partners Analysis

Vietnam has many things working in its favor. The country initially attracted foreign apparel companies seeking cheap labor, but now electronics make up 32% of Vietnam’s exports, compared with 11% a decade earlier, as global electronics companies are creating better paid jobs for more skilled workers.3

Education is one reason for the country’s success. Facing a rapidly growing population, Vietnam made large public investments in primary education during the 1990s, which today scores higher on standardized PISA (Programme for International Student Assessment) tests than most other advanced economies.4 This is one of the forces drawing in foreign capital: productive human capital at competitive wage levels.

The growth has been relatively inclusive: middle-class households are forming at a faster pace in rural areas than urban areas, and Tier 2 and 3 cities are mushrooming around new manufacturing hubs.5 Women have fared well. Vietnam’s female to male labor participation rate is one of the highest in the world at 88%.6 Wage growth has been steady and in line with FDI (Foreign Direct Investment) growth (Display 2).7 By 2030, the country is expected to add an additional 36 million people to the middle class, ultimately reaching 76 million people.8 By some estimates, Vietnam will become one of the ten largest consumer markets in the world by 2030, bigger than Germany or the U.K.9 The new middle class is both young —median age 32.5 — and tech savvy — smartphone usage estimated at 85% of adult population.10 As more people gain the purchasing power to consume goods and services, that will lead to growth for higher priced goods and services such as jewelry, organic dairy, and travel.

Diesen Beitrag teilen: