Morgan Stanley IM: Markets jitter, but economy on track

Cyclical recovery continues: Global equities continued their move up for most of February and after a volatile final week, they closed the month positive at 2.4% (MSCI ACWI in USD terms1), despite markets’ nervousness over the prospect of inflation and rate rises.

26.03.2021 | 10:51 Uhr

Here you can find the complete article

Both the US and Europe had the same narrative, ending the month up (S&P 500 2.8%1, Euro STOXX 50 4.6%1). The VIX came down from the late January spike, caused by the short squeeze generated by Reddit investors and others, to hover around the low 20s throughout February. However, by month-end the VIX spiked back up to 282 in the wake of the volatility of the final days.

Economic recovery still on track

Strong retail sales data and PPI in the US beat consensus expectations, reinforcing the ongoing recovery story. Retail sales increased 5.3%3 MoM compared to an expected 1.1%, reflecting increased spending after the December stimulus. US PPI had its largest increase since 2009, rising 1.3%4 MoM in January, reflective of some supply side pressure. In the longer term, rising input prices could represent a risk though for corporate earnings. We are positive with regard to growth, given encouraging vaccine news. The US was particularly positive due to faster vaccine rollouts and less severe lockdowns compared with the EU, which also faced some supply challenges. In addition, the weak employment data in the US reinforces the need for stimulus and easier monetary policies. With further potential stimulus in March, more household spending is likely and would be further supportive. That said, such stimulus implies a downside risk for bonds.

Markets jittery as anticipated risks materialise

Whilst we have confidence in the economy, it is important to distinguish this from the jittery market, which is expensive and has been exhibiting exuberance. In January, retail investors appeared to drive valuations up, however institutional investors may also now have already bought and cannot be relied upon to support the market. In particular, the risks surrounding interest rate rises are materialising, which was the main contributor to end of February volatility in equities and fixed income markets. Whilst the Federal Reserve tried to calm markets by indicating they are in no rush to hike rates, they also believe the economy will strengthen, which suggests the contrary – unless they allow the economy to run hot for a while. If indeed the economy does improve faster than expected, bond yields are likely to go up – bad for bonds, but also possibly unnerving equity investors.

The supply and demand for bonds may also be an issue. The US Treasury is issuing substantial amounts of debt, with the Fed being the main incremental buyer, artificially suppressing interest rates. Whilst the Fed is currently accommodative, growth expectations are high and could lead the Fed to consider reducing buying. In fact, in order to restrain a rise in bond yields, the Fed may need to step up buying of newly issued government debt, as private sector demand for the debt might fall when economic growth strengthens.

Investment implications

We increased our allocation to equities twice during February from a neutral allocation. This was on the basis of a continuing positive growth outlook, with the prospect of further stimulus from the US, central banks remaining accommodative, positive earnings trends and lower market volatility. While in the month we raised our equity allocation, the rising risks associated with potentially rising bond yields in the face of strong economic growth have led to a risk budget driven reduction in equities right at month-end. We maintain a bias to cyclicals over growth stocks, as we continue to have confidence in the recovery and rotation trade.

Gold

We moved from positive to neutral gold on the basis that fiscal stimulus, a decline in COVID-19 cases and likely acceleration in economic recovery bode well for pro-cyclical trades, with likely more downside to “safe haven” assets. US real yields, which have a negative correlation to gold, have risen sharply over the past month, removing a key pillar of support for the asset. Also, gold’s correlation with equities and fixed income are at historical highs, so benefits from diversification have likely diminished.

LatAm Equities

With respect to LatAm equities we also moved from positive to neutral given our anticipated rerating scenario has played out. LatAm growth momentum has also slowed in 2021 owing to a slow vaccine roll-out, a re-escalation in COVID-19 cases, and ongoing inflationary pressure in Brazil, which has pushed forward expectations of rate hikes. Government intervention in the state-run oil group signals the risk of further populist driven policies, likely making investors more cautious. With respect to valuations, the discount that was present when we moved positive has been eroded.

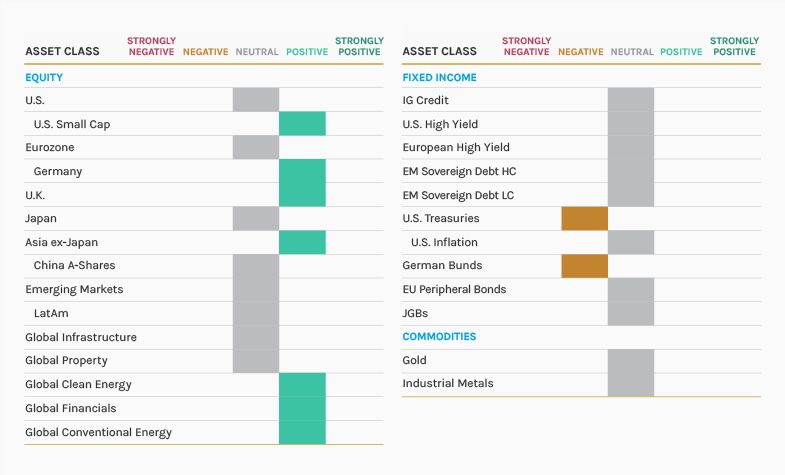

Tactical positioning

We have provided our tactical views below:

Source: MSIM GBaR team, as of 8 March 2021. For informational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy. The tactical views expressed above are a broad reflection of our team’s views and implementations, expressed for client communication purposes. The information herein does not contend to address the financial objectives, situation or specific needs of any individual investor.

Risk Considerations

There is no assurance that the strategy will achieve its investment objective. Portfolios are subject to market risk, which is the possibility that the market values of securities owned by the portfolio will decline and that the value of portfolio shares may therefore be less than what you paid for them. Accordingly, you can lose money investing in this portfolio. Please be aware that this strategy may be subject to certain additional risks. There is the risk that the Adviser’s asset allocation methodology and assumptions regarding the Underlying Portfolios may be incorrect in light of actual market conditions and the portfolio may not achieve its investment objective. Share prices also tend to be volatile and there is a significant possibility of loss. The portfolio’s investments in commodity-linked notes involve substantial risks, including risk of loss of a significant portion of their principal value. In addition to commodity risk, they may be subject to additional special risks, such as risk of loss of interest and principal, lack of secondary market and risk of greater volatility, that do not affect traditional equity and debt securities. Currency fluctuations could erase investment gains or add to investment losses. Fixed-income securities are subject to the ability of an issuer to make timely principal and interest payments (credit risk), changes in interest rates (interest-rate risk), the creditworthiness of the issuer and general market liquidity (market risk). In a rising interest-rate environment, bond prices may fall and may result in periods of volatility and increased portfolio redemptions. In a declining interest-rate environment, the portfolio may generate less income. Longer-term securities may be more sensitive to interest rate changes. In general, equities securities’ values also fluctuate in response to activities specific to a company. Investments in foreign markets entail special risks, such as currency, political, economic and market risks. Stocks of small-capitalisation companies carry special risks, such as limited product lines, markets and financial resources, and greater market volatility than securities of larger, more established companies. The risks of investing in emerging market countries are greater than risks associated with investments in foreign developed markets. Exchange traded funds (ETFs) shares have many of the same risks as direct investments in common stocks or bonds and their market value will fluctuate as the value of the underlying index does. By investing in exchange traded funds ETFs and other Investment Funds, the portfolio absorbs both its own expenses and those of the ETFs and Investment Funds it invests in. Supply and demand for ETFs and Investment Funds may not be correlated to that of the underlying securities. Derivative instruments can be illiquid, may disproportionately increase losses and may have a potentially large negative impact on the portfolio’s performance. The use of leverage may increase volatility in the Portfolio. Diversification does not protect you against a loss in a particular market; however, it allows you to spread that risk across various asset classes.

Diesen Beitrag teilen: