Morgan Stanley IM: Looking Beyond Private Equity Secondary Markets

Secondary markets for hedge funds and private credit can offer compelling returns and important risk mitigation benefits.

09.06.2023 | 06:11 Uhr

The private equity secondary market is fairly well known to investors but other secondary markets—such as those for hedge funds and private credit—may be less familiar. While smaller, transactions in these markets can still offer compelling returns. With the majority of return coming from realization of discount to net asset value (NAV), these investments can offer important risk mitigation benefits as well. This may be of particular interest today, against a backdrop of quantitative tightening and declining liquidity.

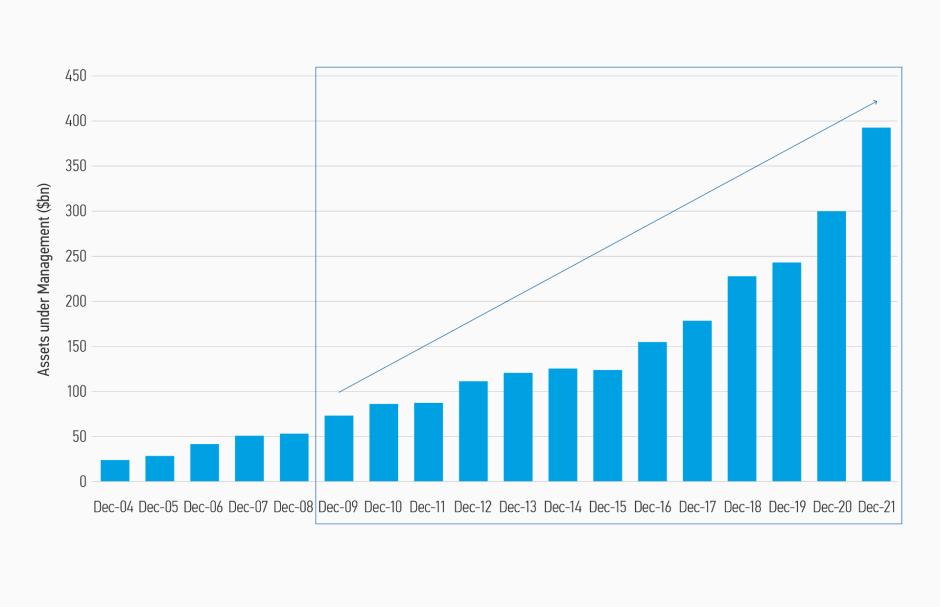

Private equity fund investors seeking to sell interests on the secondary market have been met with robust demand. According to Preqin, the private equity secondary market has grown over five times in the last decade. Today, private equity secondary buyers collectively manage almost $400 billion with $141 billion of dry powder.1 (Display 1) This has resulted in high transaction volumes at limited discounts to net asset value for traditional private equity secondaries, serving to bring an element of liquidity to an otherwise illiquid asset.

DISPLAY 1 Private Equity Secondaries Assets Under Management ($bn)

Lorem ipsum dolor sit amet, consectetuer adipiscing elit. Ut commodo pretium nisl. Integer sit amet lectus. Nam suscipit magna nec nunc. Maecenas eros ipsum, malesuada at, malesuada a, ultricies dignissim, justo. Mauris gravida dui eget elit.

Diesen Beitrag teilen: