Morgan Stanley IM: Developed Markets Leading the Charge

Vaccines and stimulative policy have made DM’s leaders of global recovery. But we are cautious as record equity issuance and inflows create a tug-of-war.

27.04.2021 | 07:10 Uhr

Here you can find the complete article

Global equities continued their move up, closing March positive at 2.7% (MSCI ACWI in USD terms), with the Euro Stoxx 50 closing up a healthy 7.9% (EUR) and the S&P 500 up 4.4% (USD). The Russell 2000 started to lag ending the month at 1.0% (USD)1. The end of the month saw supply chains disrupted by a giant container ship, the Ever Given blocking the Suez Canal and the collapse of a US family office led to some temporary volatility amongst Financials.

Developed Markets leading the charge: The US’s relatively fast vaccine roll out sets it on course to lead re-opening and growth again. It has not experienced some of the bumps that continental Europe has, with first supply issues and then a temporary suspension of one of the vaccines. Excluding China, many emerging markets will have to wait longer for the vaccine and for their economies to fully re-open and normalise. Further good news for the US came in the form of additional stimulus, as the $1.9 trillion The American Rescue Plan Act of 2021 passed2. In addition, President Biden will reveal the $2 trillion US infrastructure plan, anticipated to be funded by tax hikes.

Tug of war: That said, whilst volatility is currently relatively low, there are still reasons to be cautious. There appear to be divergent expectations. Many corporations are issuing record amounts of stock – implying they think pricing is high and that this is a good time to sell. At the same time, there are record equity flows, meaning investors think prices are low enough to be attractive to buy. At $313 billion, global equities experienced the largest quarterly inflow on record3. This is like a tug of war between market participants who have divergent views and is a fragile situation in principle. We have not yet had a correction in valuations, meaning equities could be vulnerable and we do expect another leg down particularly in high-multiple growth stocks, though pinpointing the timing is challenging.

Investment Implications

Although US 10-Year Treasury yields appear to have stabilised at approximately 1.7%4, we still remain concerned about rising bond yields, while a potential shift in the willingness of central banks to suppress bond yields could be negative for equity valuations. Given this risk, we lowered equity exposure, whilst within equities we reduced any growth bias, as we expect investors to position towards cyclical recovery stocks at the expense of growth stocks. Even if the pace of rate rises slows, upcoming tax headwinds, as well as the valuation gap, could still support a continuation of the rotation into value.

US Small Caps

We took profits on this position, moving from overweight to neutral as the valuation gap between small and large caps has narrowed. The price rotation has largely played out compared to past cycles. In addition, earnings revisions have been lagging large-cap peers and negative earnings are at elevated levels. Finally, leverage has increased compared with large caps and so when interest rates rise, this should have a larger relative impact on small cap margins.

Global Clean Energy

Towards the end of March, we closed our remaining position in Global Clean Energy. The case for outperformance in 2021 has diminished. Despite the positive structural growth story and the pull-back in renewables over the course of February, we think structural growth expectations are already embedded in valuations. Moreover, utilities are likely to remain under pressure from a combination of rising bond yields and growth-like valuations.

EUR/USD

We moved from positive to neutral on the euro relative to the US dollar. The outlook for the US dollar has improved, as the US in our view is likely to lead the global recovery, thanks to better access to vaccines and greater fiscal support. The Eurozone’s Current Account is holding up well compared to the twin deficit in the US. Nonetheless, the additional debt-funded US fiscal spending will likely be a catalyst for better growth in the region. The US dollar is also gaining support and reversing last year’s depreciation trend. It is now better supported by the increase in yields, both nominal and real.

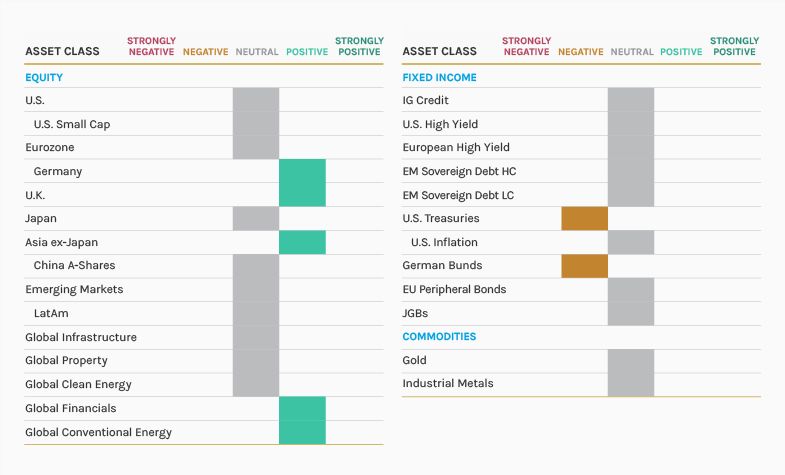

Tactical positioning

We have provided our tactical views below:

Source: MSIM GBaR team, as of 31 March 2021. For informational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy. The tactical views expressed above are a broad reflection of our team’s views and implementations, expressed for client communication purposes. The information herein does not contend to address the financial objectives, situation or specific needs of any individual investor.

Risk Considerations

There is no assurance that the strategy will achieve its investment objective. Portfolios are subject to market risk, which is the possibility that the market values of securities owned by the portfolio will decline and that the value of portfolio shares may therefore be less than what you paid for them. Market values can change daily due to economic and other events (e.g. natural disasters, health crises, terrorism, conflicts and social unrest) that affect markets, countries, companies or governments. It is difficult to predict the timing, duration, and potential adverse effects (e.g. portfolio liquidity) of events. Accordingly, you can lose money investing in this portfolio. Please be aware that this strategy may be subject to certain additional risks. There is the risk that the Adviser’s asset allocation methodology and assumptions regarding the Underlying Portfolios may be incorrect in light of actual market conditions and the portfolio may not achieve its investment objective. Share prices also tend to be volatile and there is a significant possibility of loss. The portfolio’s investments in commodity-linked notes involve substantial risks, including risk of loss of a significant portion of their principal value. In addition to commodity risk, they may be subject to additional special risks, such as risk of loss of interest and principal, lack of secondary market and risk of greater volatility, that do not affect traditional equity and debt securities. Currency fluctuations could erase investment gains or add to investment losses. Fixed-income securities are subject to the ability of an issuer to make timely principal and interest payments (credit risk), changes in interest rates (interest-rate risk), the creditworthiness of the issuer and general market liquidity (market risk). In a rising interest-rate environment, bond prices may fall and may result in periods of volatility and increased portfolio redemptions. In a declining interest-rate environment, the portfolio may generate less income. Longer-term securities may be more sensitive to interest rate changes. Equity and foreign securities are generally more volatile than fixed income securities and are subject to currency, political, economic and market risks. Equity values fluctuate in response to activities specific to a company. Stocks of small-capitalisation companies carry special risks, such as limited product lines, markets and financial resources, and greater market volatility than securities of larger, more established companies. The risks of investing in emerging market countries are greater than risks associated with investments in foreign developed markets. Exchange traded funds (ETFs) shares have many of the same risks as direct investments in common stocks or bonds and their market value will fluctuate as the value of the underlying index does. By investing in exchange traded funds ETFs and other Investment Funds, the portfolio absorbs both its own expenses and those of the ETFs and Investment Funds it invests in. Supply and demand for ETFs and Investment Funds may not be correlated to that of the underlying securities. Derivative instruments can be illiquid, may disproportionately increase losses and may have a potentially large negative impact on the portfolio’s performance. The use of leverage may increase volatility in the Portfolio. A currency forward is a hedging tool that does not involve any upfront payment. The use of leverage may increase volatility in the Portfolio. Diversification does not protect you against a loss in a particular market; however, it allows you to spread that risk across various asset classes.

Diesen Beitrag teilen: