AI Funding: The Bull and Bear Investment Cases

Is AI fueling a new productivity supercycle or facing structural limits in a rapidly evolving market? Eaton Vance’s equity teams explore both views in their “Bull vs. Bear” debate.

02.12.2025 | 05:22 Uhr

In recent months, concerns have intensified that the rapid growth in artificial intelligence (AI) investment is becoming a “bubble.” This has coincided with a flurry of massive deals among the largest U.S. technology companies. The proliferation and potential implications of these deals for investors prompted the Eaton Vance (EV) equity department to conduct a “Bull vs. Bear” debate over AI funding.

The collaborative discussion, with representation from all EV equity teams, exposed both the scale of ambition driving the AI revolution and the structural risks that could constrain it. Below, we summarize the two competing narratives that emerged.

The Bull Case: A Self-Funding Productivity Supercycle

The bullish view holds that AI build-out represents the next great

wave of global industrial investment—comparable to postwar manufacturing

or the1990s internet revolution. Its deployment across health care,

education, logistics and financial services could potentially unlock

immense productivity gains.

1. Scale justifies the spend

Global corporate profits of about $5 trillion in 2025, as reported by Forbes, imply enormous reinvestment capacity.1 A mere 1% to 2% uplift in profit margins resulting from AI productivity gains could generate $1 trillion in incremental earnings—enough to justify a $10 trillion AI investment base. Proponents argue that even a small allocation, say 1% of global financial assets, could mobilize $3 trillion toward AI infrastructure without dislocating capital markets.

2. Financing capacity exists

Hyperscalers2 remain at the center of this thesis. With

potential capital expenditures of $4 trillion through 2030, an

additional $1.2 trillion in free cash flow, and as much as $2.3 trillion

in balance-sheet leverage, the combined funding power of the six

dominant cloud players could exceed $7.5 trillion.3 Other

potential sources of funding include sovereign wealth funds and debt

markets via asset-backed securities. In October, Meta raised $27 billion

in debt, structured at a 6.6% fixed rate, illustrating the maturation

of AI infrastructure financing into a relatively low-risk, quasi-utility

asset class.

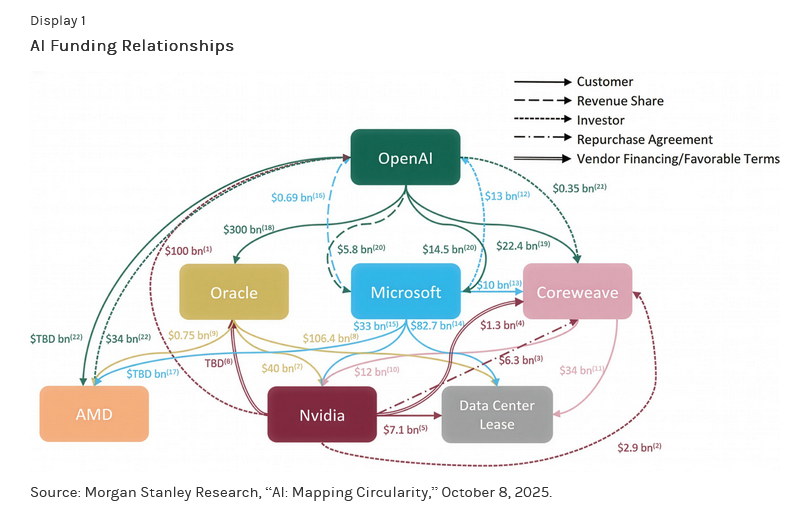

3. Circularity creates self-sustaining growth

While concerns have grown about the circularity of AI funding, as

illustrated in Display 1, the bullish view sees it as a strength:

industry leaders reinvesting profits into their ecosystems has

historically driven industrial maturity. Automotive and aerospace giants

once financed suppliers, built leasing arms, and took equity stakes in

strategic vendors. Applied to AI, this approach could mean NVIDIA or

Microsoft taking small stakes in chip foundries, data center operators

or model providers—seeding the next generation of capacity while

strengthening supply chain stability.

4. Technological and efficiency tailwinds

Finally, the bulls argue that concerns over power shortages and hardware

obsolescence will be mitigated by efficiency gains. NVIDIA reports a

40,000% improvement in their chips’ energy efficiency over time,

suggesting that compute density and performance per watt will continue

to outpace demand growth. Meanwhile, rapid improvements in model

performance may create deflationary effects, allowing AI to boost

productivity across the global economy faster than it consumes capital

or energy. In this view, AI spending becomes self-reinforcing:

productivity gains fund further investment, drawing more capital into

the ecosystem—a classic virtuous cycle.

The Bear Case: Unsustainable Leverage, Thin Revenues and Physical Limits

The bear case challenges the notion that AI’s financing machine can

run indefinitely without seeing sufficient revenues to justify the

investment. This view suggests that beneath the headline numbers, the

business models supporting the sector remain fragile, while physical and

regulatory bottlenecks loom large.

1. Fragile revenue foundations

OpenAI’s monetization dilemma is a central concern. Despite its vast

user base, only a small fraction of users pay directly, leaving revenue

concentrated in subscriptions and application programming interface

(API) fees. While some may assume adoption by businesses will close this

gap, the path to sustained free cash flow is quite uncertain. With

projections suggesting OpenAI may seek $1.6 trillion in new capital,

skeptics question whether such ambitions can coexist with a largely free

consumer model resulting in revenues of just $13 billion per year. The

risk is that a prolonged mismatch between spending and revenue could

erode balance sheets, triggering refinancing stress and equity

underperformance.

2. Leverage masks fragility

Heavy reliance on debt markets—especially structured finance—could

obscure true risk concentration. The Meta financing deal, cited by bulls

as a model of efficiency, could come to resemble the over-leveraged

telecom infrastructure of the early 2000s. If rates rise or utilization

lags, the yield advantage could quickly reverse, pressuring balance

sheets across the ecosystem.

3. Power as the hard constraint

Perhaps the most tangible risk lies in power infrastructure. Between

2028 and 2035, data centers could add a projected 15% to 20% strain on

global grids. Even with efficiency gains, power transmission,

transformer production and permitting timelines create bottlenecks that

financial engineering cannot solve. The result could be stranded

capital: data centers built faster than utilities can deliver power.

4. Governance and concentration risks

Finally, investors need to consider governance. The market’s

overreliance on visionary figures—OpenAI CEO Sam Altman foremost among

them—creates fragility in leadership and strategy. Meanwhile, the

distinction between “defensive” spending to protect existing

platforms—such as Google adding Gemini to protect its search

business—and “offensive” expansion, like Microsoft introducing and

charging more for Co-Pilot, remains blurred. This raises concerns that

much of today’s capital expenditures serve short-term competitive

positioning rather than long-term profitability.

Implications for Investors

Much of the U.S. equity market’s gains since ChatGPT’s launch in

late 2022 have been driven by companies at the center of the AI

ecosystem. As investors look to the future, a key question is whether

this powerful trend can continue or is vulnerable to a sharp pullback.

One of the key challenges is in identifying which companies can convert

AI infrastructure into recurring, high-margin revenue streams, and which

are merely relying on increasingly risky financing.

AI may indeed catalyze the next productivity supercycle. But as this debate made clear, the path from vision to value will depend less on the amount of capital that is raised—and more on how productively that capital is deployed.

Diesen Beitrag teilen: